Informationist Update & Midweek Macro Bonus

✌️First, I want to just thank all of the incredible feedback and support for The Informationist this past week.

🙌 Second, the $99 for a year deal will continue for a bit longer, more on that below.

🧠 Third, a little mid-week macro bonus, as a thank you.

Let’s keep this short, get right into it.

Seriously, thank you for all the kind words and awesome feedback on The Informationist. I truly appreciate each and every Tweet, DM, and email that you have written. I am working on responding to each as I can.

Onward to the deal.

So, even though I immediately initiated refunds to all of the subscribers of The Signal, I have learned that it may take up to two weeks for Substack and Stripe to process the funds back to you.

Ugh.

This is a function of the dysfunctional legacy banking system. One that we are so intent on fixing with a better system (the fix rhymes with -itcoin).

Anyway, because of this, and because I realize a number of you may want/need that reimbursement before being able to commit to upgrading your subscription to The Informationist, I am keeping the early subscriber deal pricing in place for a little longer.

So.

🙏 Early supporters who subscribe in the next two weeks get 33% off for the first year — just $100, or $10/month ✌️

After next Sunday, only paid subscribers will get this newsletter weekly. Also, paid subscriber questions will take priority, and they’ll occasionally get a few other cool benefits that I am working on, such as the macro bonus below. Going forward, free subscribers will receive this newsletter only once a month.

Like I said, whether you are a doctor, an accountant, a sports trainer, or an aspiring investor, think of this newsletter as the finance education you were never given in school. It’s like having your own Wall Street translator, all for the cost of a couple of coffees a month.

Onto the bonus.

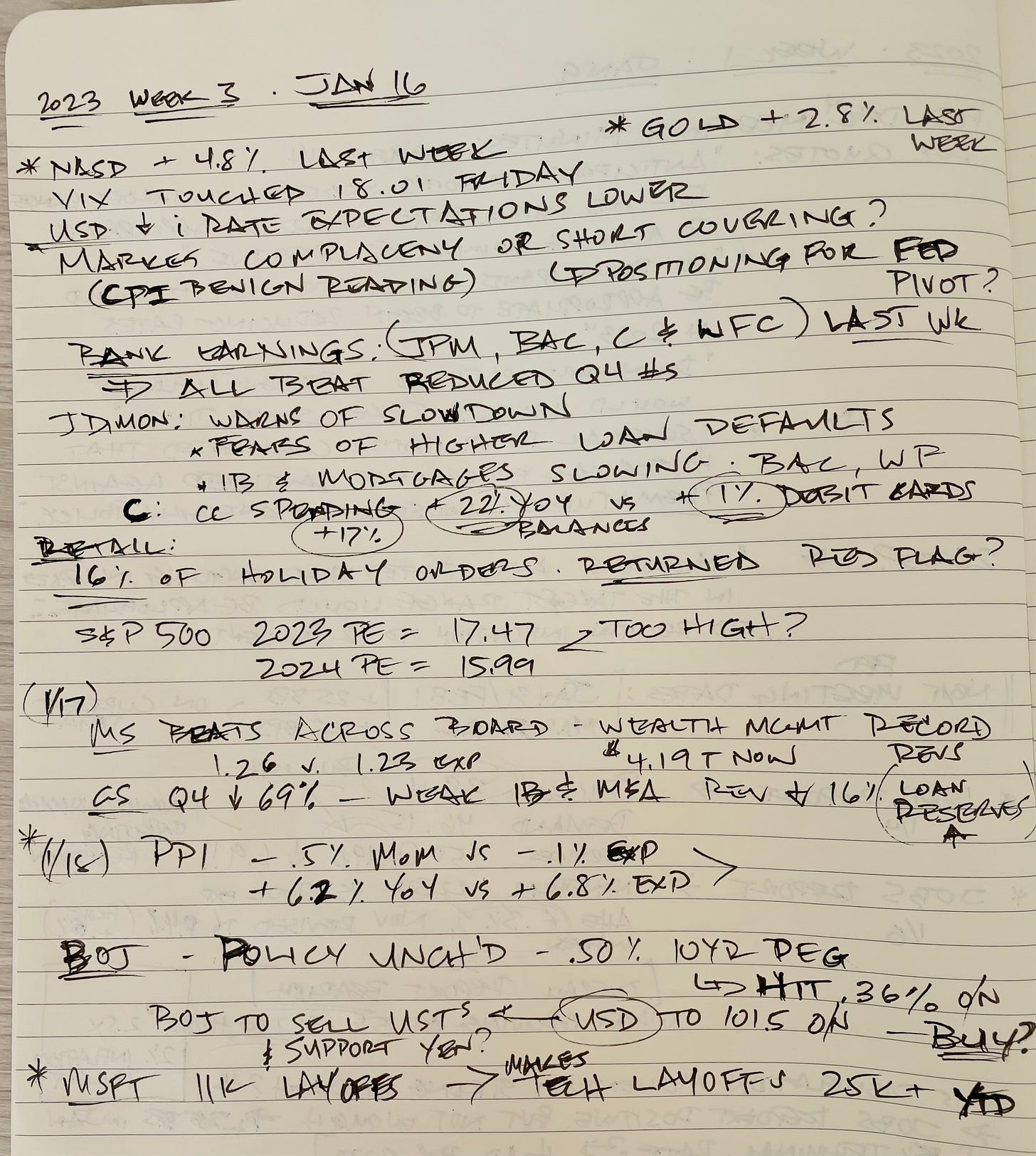

I’m sitting here scribbling market related notes, and this is what has jumped out at me during this already volatile week. 🤯 Check out this screenshot of my notebook:

🔥 To distill some of this, here’re the raw thoughts going through my head:

We have a lot of speculation surrounding the latest CPI and the next Fed meeting. With the CPI coming in right on the screws at +6.5% YoY, and -.1% MoM, a lot of traders are making the bet that the Fed is close to capitulating and will halt rate hikes after one more of 25bps on Feb 1, and maybe another 25bps in March.

The focus on this as a risk asset reprieve is a mistake.

The fury of tech stock and risk asset buying last week in hopes/expectations/or fears (short covering) of a pivot are erroneous, IMO.

I see the Fed continuing on the path to raising rates to at or above 5% as a terminal point, and then…and only then…do they pause. This means they will take the economy right to the edge.

Remember, Powell wants to be Volcker, not Arthur Burns. He can’t let inflation flame out of control. He wants to snuff out all the embers, pour cold water on all the smoking coals, step back, and watch for a while.

And in the meantime, we are seeing the PPI come down this week, banks warning of lower profits, credit card balances up 22% with usage up 17% vs debit card spending up only 1% (i.e., bank accounts are drained, people are turning to cc’s to meet the spending needs margin)—not to mention the reports of 16% of all purchases during holidays have been returned—Red Flag or non-event? Then add in tech layoffs of over 25K in just the first few weeks this year.

See all of this noted in my book above.

What does this point to other than a recession?

So, people are focused on the wrong event. The Pivot. While they should be watching all these red flags and paying attention as we blow through stop signs along the way to the impending recession. Look at the 10yr/2yr spread, inverted to 70bps.

The market is getting ahead of itself here. I see the USD recovering from the recent selloff and risk assets sinking with the realization of the negative impact this deflation will have on corporate earnings and spending. Revenues decline, margins compress, multiples compress. Earnings get revised lower, equities get re-priced.

The market sells off.

See the chart above? Recessions occur after the inversion, well after sometimes. But we are getting close. And even though the BoJ reiterated their commitment to YCC last night, the peg on the 10yr JGBs continues to be tested. At some point, this breaks, at some point, the era of free money disappears completely.

And so, to repeat: with every single basis point the Fed raises rates as we head into a recession, the probability of a credit event (major default with cascading contagion events) rises exponentially.

The CDS market has sniffed it out.

h/t Gregg Foss:

So I remain net short the equities market (risk asset off trade), short junk bonds (credit event trade), long the USD (flight to safety trade), and am accumulating hard monies like gold, silver, and Bitcoin opportunistically (flight to safety and eventual pivot trade). Please note that while sharing my thoughts, I understand each person has a different risk profile and appetite. Revisit the disclaimer below, and consult your personal advisor to make appropriate allocations for yourself.

I hope this helps, and now back to the regularly scheduled programming.

James✌️

To upgrade at the early sub price, hit the button below!

Disclaimer

The information in this newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. We strongly advise you to discuss your investment options with your financial adviser prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in this newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.