Informationist Real Talk: Inflation

Issue 78

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

CPI & Faulty Measures

Basics of Central Bank Goals

Wage Earners vs. Asset Owners

What To Do About It

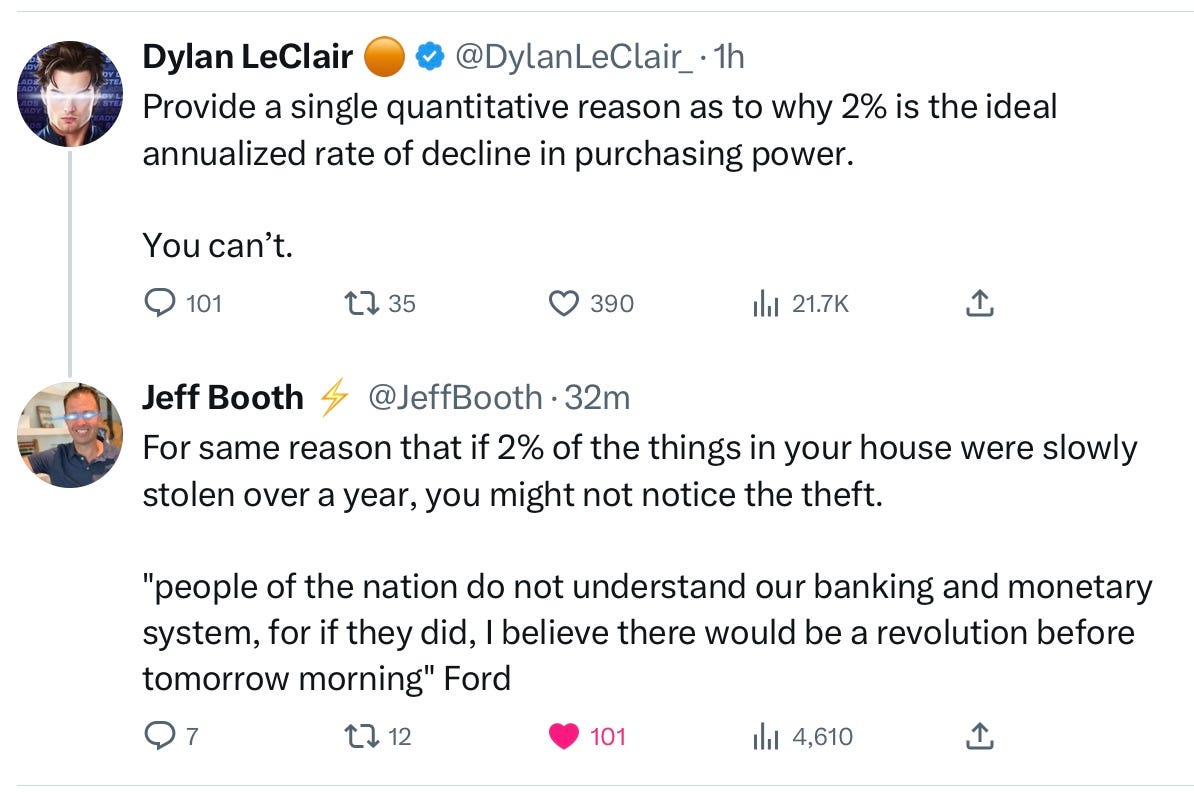

Inspirational Tweet:

Reality check. Inflation is here. Inflation is here to stay. The only questions that remain are: just how ‘bad’ has it been, and how ‘bad’ will they allow it to get?

After all, inflation does not affect everyone the same way.

Some people actually benefit from inflation.

Just reality, there really is no way to debate this.

Even so, we’re going to walk through inflation and its effects. And unlike the politicians and central bankers (and most investment bankers), we are going to have a real talk about inflation for once.

But don’t worry, we’ll keep it nice and simple, as always, today. So grab that coffee, saddle up and brace yourself for the bumpy inflation trail ahead, navigated with The Informationist.

Join the Informationist community for access to subscriber-only posts + the full archive, and ask questions and participate in the comments with other awesome 🧠subscribers!

Partner spot

Some of you have been asking recently what I read in the morning for fast, digestible news, and I’m happy to report that my new favorite source, hands down, is 1440.

The folks at 1440 scour over 100 sources every morning so you don't have to. You'll save time and start your day smarter. What more could you ask for?

Sign up for 1440 now and get your first issue, immediately. It's completely free—no catches, no nonsense, and absolutely no BS. I wouldn’t recommend it, if I wasn’t sure you’d love it, too.

Join 1440 for free today.

🤔 CPI & Faulty Measures

First of all, inflation is on everyone’s minds. It has been on their minds for years now, eating away at the dollar and people’s ability to pay for necessities. And politicians and bankers know this, so they keep addressing it.

We’re constantly hearing about how inflation is coming down, it’s falling. ‘Decreasing rapidly’ even.

Sounds great, right?

The White House even created the Inflation Reduction Act, which quite honestly is all about green energy subsidies and has little to nothing to do with inflation. But we won’t get into that today.

What we do care about is reality.

So, is true? Is inflation really plummeting?

First, let’s define ‘plummeting’.

When inflation decreases, it means the rate at which it is running falls. However, this does not mean prices are falling, too.

It just means they are increasing at a slower rate.

I.e., a gallon of milk is never going back to 50c.

Ever.

For instance, if inflation is running at 10%, then a loaf of bread that costs $4 today will cost $4.40 next year. And if inflation falls, decreases, plummets to 3% the next year, then that loaf of bread now costs $4.53.

See how that works?

Prices are still rising and the purchasing power of the dollar is falling, along with your ability to purchase those goods.

If you’ve been watching the markets and listening to the pundits, then you’ve likely heard all about a measure of inflation called the Consumer Price Index, or CPI as it is commonly known.

And CPI supposedly tracks the prices we are all paying for goods and services here in the US. It is the measure (along with a few others) that The Fed points to when discussing its fight against inflation.

However, sometimes it seems a bit off. The estimates just don’t seem to add up.

I mean, if inflation is only 3.2%, then why is my grocery bill a good 10 to 20% higher than last year?

What gives?

Well, it’s clear that the CPI measure is faulty at best.

We talked all about this in a recent Informationist newsletter recently, and if you want more context and understanding of the actual workings of CPI, you can find that here:

TL;DR: The CPI methodology is constantly changing. Goods are added to or removed from the measurement (the basket of goods), according to consumer ‘behavior’.

But here’s the thing, the measurement of inflation according to the CPI always seems to skew low. Like it’s actually not capturing all of the inflation, just some of it.

But why? Why would the Bureau of Labor Services underestimate inflation?

And is it purposeful or just an imperfect approach, one that is just too complicated to ensure a correct reading?

Well, it seems there’s good reason for this measure to be perpetually underestimated.

Actually a few of them.

Let’s look.

🤨 Basics of Central Bank Goals

See, we have two things we must look at here. On one hand, we have actual inflation, the reality of the decrease in purchasing power of every single dollar.

On the other hand, we have the perception of inflation. What everybody thinks and is being told about the strength of the dollar.

*By the way, we’re focused on the US Dollar here today, but make no mistake, this is happening in just about every currency that is fiat based (i.e., sovereign backed).

The Federal Reserve (like other central banks) is the quarterback of the whole US Dollar perception game. They are in charge of instilling confidence in the US Dollar.

This way, the US Treasury can continue to borrow against the strength of the US Dollar.

See how it works?

And so, the goal of the Fed (regardless of what they SAY) is not to extinguish the inflation fire, but rather let it burn forever. Quietly.

Right under the noses of the US citizens, USD owners and users, at a rate that they accept, that they swallow.

Stealth theft.

Because if the citizens begin to balk, then it draws attention to the rate of inflation. It alerts others, particularly investors and foreign buyers of US Treasuries.

After all, if inflation is hot, then investors’ bonds become worth less when they receive their principle back.

And there’s the rub.

The US Treasury needs inflation to run as hot as it can, without setting off the fire alarms.

And so, The Fed is like a team of arsonists who are also the appointed government-non-government fire battalion. They are standing at the ready with their hoses, watching this fire burn. If it sparks up a bit too much, they sprinkle some water. If it flares, they pour water. And if it rages, they flood the fire, snuff it out. Let it soak a bit (recession).

Because they know they have a bottomless well of gasoline to just spark it back up again.

They fire up the money printer (expand M2), re-start QE (buy bonds and stocks and whatever), and lower rates back to ZIPR (Zero Interest Rate Policy) levels.

All to re-ignite inflation.

Burn, baby, burn.

But why?

The issue here is that government operates in a perpetual deficit. We spend far more than we make as a country.

Thus far this year, we are spending $1.6T more than we are making—and that’s just in in the first ten months.

Oops?

So, to keep it all going, the big debt charade, we have to borrow more and more and more.

And more.

I’ve talked a whole lot about this on Twitter and in my newsletters, and if you have not yet read about the Debt Spiral, I strongly urge you to go back and check out those threads and articles, starting with this one:

Bottom line, inflation allows for the US Dollar to debase, become worth less. In other words, it’s easier to make one dollar in profit if there are more of them to go around.

If total US profits (GDP) increase, then the taxes that the Treasury collects also increase, and this allows them to pay back the mountain of debt it owes a lot easier.

Fed goal: allow inflation to run as hot as it possibly can, while only admitting to it running at a certain rate.

That generally accepted rate?

2%.

This arbitrary number apparently originated in 1989 in New Zealand, when the government passed a law making their Central Bank independent and included a target inflation rate of 2%.

Nifty.

This is why Powell and other Fed and CB’s have no strong answer as to why we allow for 2% inflation or where the number even comes from.

They know all too well that is is arbitrary, at best.

Under oath and during testimony to Congress, they say things like, “Well, it’s just the generally accepted target used by most central banks around the world, and it has been for a long time.”

I don’t know about you, but that answer gives me serious ‘because that’s the way it’s always been done’ vibes. Empty.

But the Big Bad Fed Talk on fighting, solving, conquering inflation will continue, as will the underestimated CPI numbers.

Because this instills confidence around the world that the US Dollar is still strong and trustworthy and retains its value.

Lower (admitted) inflation also prevents the government from having to adjust mandatory payments from Social Security, Medicare, etc. too much higher. The Cost of Living Adjustment was just 5.9% in 2022 and 8.7% in 2023, even though the CPI inflation for these periods touched 7% and 9.1% in those years.

And that was what they admitted to.

We all know that actual inflation—the inflation of the goods and services we need—was much much higher.

And finally, if CPI is lower than actual inflation, then the so-called Treasury Inflation Protected Securities (TIPS) will also receive a lower increase, thereby saving the US Treasury money there, too.

What a deal.

Wrote all about TIPS recently, too. If you want to check that out, you can find it here:

TL;DR: They’re not an optimal investment, IMO.

Getting back to center here, what is the reality of inflation?

We keep hearing it is bad, bad, bad.

But is that 100% true?

Well, that all has to do with a person’s velocity of earnings.

Let me explain.

🤯 Wage Earners vs. Asset Owners

See, if you are an average wage earner in the US today, you make $59,428 per year.

And your average take home pay is then $48,379.

Next, the average savings rate is 4.6%.

If we use a simple extraction of this data, we can assume the average person saves roughly $2,225.

Now, if inflation is 2% (and assuming your wages lag and don’t catch up right away—i.e., your velocity of earnings does not keep pace with the expansion of M2), then the numbers for the next year go like this:

Earnings: $59,428

Take Home: $48,379

Expenses: $47,077

Savings: $1,302

See where I’m going with this?

Let’s say next year’s inflation is 5% (wages still have not caught up…they often don’t).

The numbers become:

Earnings: $59,428

Take Home: $48,379

Expenses: $48,461

Savings: -$82

Investments (including last year’s savings): $1,302 * 5% - $82 = $1,367

Man, it will take forever to save a year of salary this way, won’t it?

But what if your velocity of earnings is higher, much much higher? What if you make multiplies of what you spend each year? What if your savings rate is over 50%?

Let’s make it extreme, shall we? Let’s look at a CEO who takes home a multi-million dollar package each year, like $10 million, of which he socks most of it away in non-taxed company stock.

Earnings: $1 million cash +$9 million stock

Take Home: $666K

Expenses: $500K

Savings: $9,166,000

If inflation then hits 5%, this is what happens to this guy:

Earnings: $1 million cash +$9 million stock

Take Home: $666K (no pun)

Expenses: $525K

Savings: $9,141,000

Investments (assuming they have kept up with M2 expansion, which they typically do): $9,166,000 * 5% + $9,141,000 = $18,765,300

Wow.

Pretty clear to me what the effects are, yet we still hear economist mind-vomit, like this nonsense:

Really Paul?

Must be really difficult to see Main Street from all the way up there.

🤓 What To Do About It

OK, so we understand that inflation is a force that we must contend with, fight against, protect ourselves from.

But how?

Let’s face it, not many of us are going to just get a $10 million pay package any time soon.

I know I’m not. So, I’ll tell you what I do, and maybe this will help.

One thing is clear, we must not waste income. Now, I don’t mean to stop getting Starbucks or never go out to dinner with your family.

I mean focus on the big things here, like buying the amount of house you need and not getting a new car annually—and maybe not betting ten grand on a long-shot horse to win the Kentucky Derby.

But a big one for me: negotiating rates and prices and fees relentlessly (everything is up for negotiation, IMO). Not just cars and houses, but car and home maintenance, tuitions and medical bills, dental bills and…you get the point.

Then use your extra income (the discretionary part) to accumulate assets sensibly.

This for me is a mix of attractive yield earning fully FDIC-protected cash and short-term(!) Treasuries, hard monies like gold, silver, and Bitcoin, plus a sector-focused mix of stocks, according to macro cycles and sector-rotation exposures.

I also own real estate (with a reasonably low interest rate mortgage), plus private equity and venture capital, among other illiquid investments and assets.

The point here is that I remain highly diversified across many asset classes.

There’s that word again. Asset.

Because investment assets inflate, as we see in the example above, and are essential to keeping up with and, better yet, outpacing inflation (when choosing the right ones).

Also, I remain highly diversified. I do this because I do not know where the next Black Swan lands, severely disrupting any one or multiple asset classes.

But, once it happens, my diversification (and dry powder in the form of cash and short-term USTs) allows me to take advantage of those drastic drawdowns.

Then I re-allocate opportunistically.

The key here is to accumulate assets and then allocate intelligently to growth and yield with proper risk/reward while watching for market disruptions.

The most important part, though, is to start accumulating. It doesn’t matter if it is just $100 per month. Any amount is a good starting point.

The goal is to accumulate enough assets that they become worth more than your annual earnings (and spending).

Your choice: you can try to keep outrunning the flames of inflation, or harness them, like a hot-air balloon operator, to carry you up and forward without very much effort at all.

That’s it. I hope you feel a little bit smarter knowing about inflation and how you can use it to your benefit. Before leaving, feel free to respond to this newsletter with questions or future topics of interest.

And if you are a paid subscriber, don’t forget to leave a comment or answer a comment in our awesome 🧠 Informationist community below!

Talk soon,

James✌️

Thanks for the article....and helping me realize TODAY is Sunday...not yesterday 🤓.

The funny thing is... on https://fiscaldata.treasury.gov/americas-finance-guide they have a quote from Thomas Jefferson, "We might hope to see the finances of the Union as clear and intelligible as a merchant’s books, so that every member of Congress, and every person of any mind in the Union should be able to comprehend them, to investigate abuses, and consequently to control them."

1) Finances are not clear and intelligible, including that of CPI

2) 99% of the Union do not comprehend them, never mind investigate abuses (as I'll show below) to help control them.

Also embedded on that site, they show the Revenue, Spending, Deficit, and Debt. For Spending, they state "The U.S. government has spent $5.30 trillion in fiscal year 2023 to ensure the well-being of the people of the United States." - ("well-being"....what a flipping joke)

And they justify the Debt by stating, "The national debt enables the federal government to pay for important programs and services for the American public." - soooo...let's go into debt to pay for important programs and services. If I ran my household budget this way, I'd be in jail.

They also admit the recurrence of a deficit: "As the federal government experiences reoccurring deficits, which is common, the national debt grows." - 🤯

Lastly, they point to saying 'it's ok...the sky isn't falling' by showing the Debt-to-GDP ratio and how we've been able to manage it over time. With current average interest rates at 2.07%, the monetary policy stance of higher for longer, is just going to blow things out of proportion (and they've published this, as you've talked about). One more black swan and that published 124% Debt to GDP will go to 150%...then 200%...then 300% overnight.

Thanks for discussing inflation. I think it would be interesting for you do flesh out how the FED and Treasury have diddled with the basket of consumer items over the years. It is is another way they hide the stealing going.