💡Informationist Alpha Newsletter

December 1, 2024

👊 Hey there Informationist Alpha, this is your monthly macro update. Unpolished and raw, these are the main macro themes and factors I'm taking into account for my own portfolios. Let's get right to it!

Trump Trade - Policies

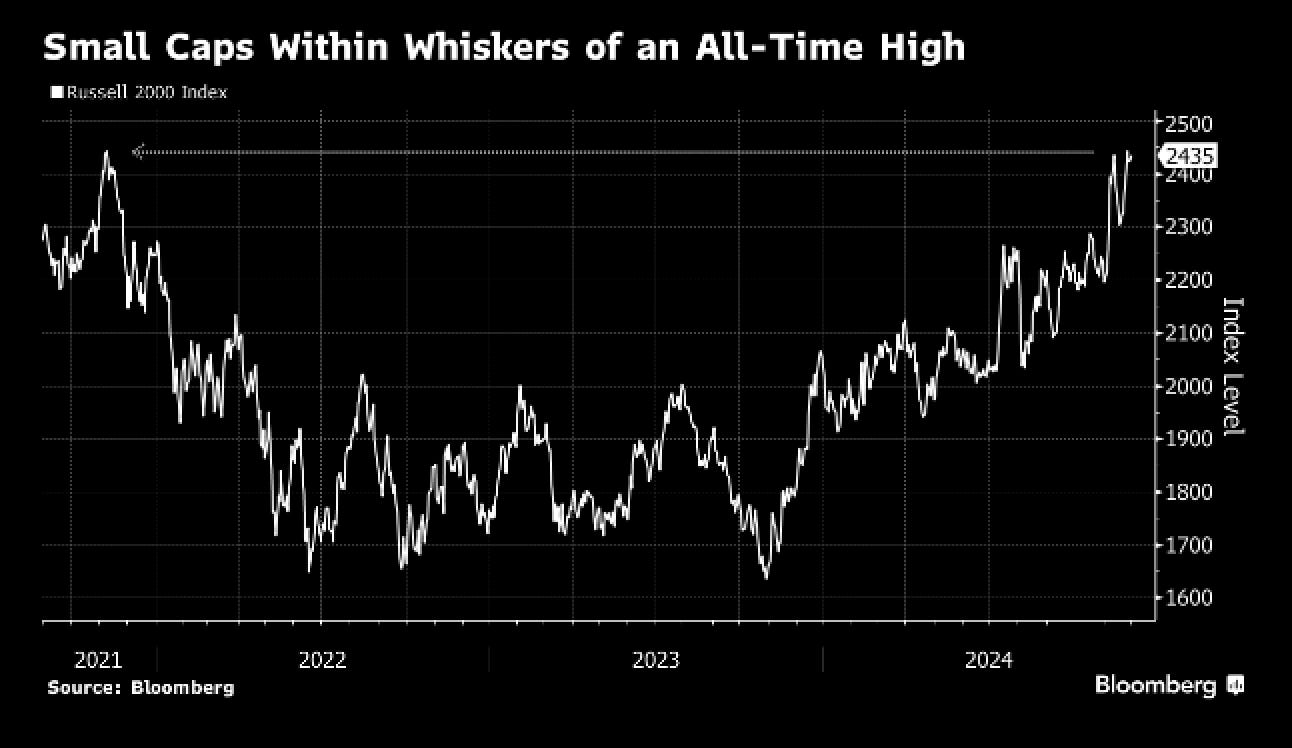

Trump won, and in the last two weeks we’ve heard mainstream media worries about mass deportations and a global trade war, as well as fears of a new spike in inflation. Even so, the S&P 500 ripped to a new record high and small caps was up 2X vs the S&P in the same period, also about to hit a new high—the first since 2021.

Meanwhile, the VIX all but collapsed back to serene levels, indicating no worries about downside volatility. Put it all together, and you get a near-euphoria appetite for risk.

That begs the question: can it continue? Or is all this an obvious contrarian indicator?

Well, when you factor in deregulation, lower corporate taxes, easier stance on antitrust policy (monopoly merger policy), and Drill, baby, drill (cheaper energy), investors believe that corporate revenues will rise, particularly for smaller companies, and margins will expand.

So, put simply: yes, it could continue.

Remember, Trump is obsessed with the stock market as a gauge of his success. Question is, will his strong stance on trade and tariffs negatively impact the USD and, hence, the stock market in turn?

Trump & Tariffs / BRICS

Just yesterday, Trump threatened BRICS nations with a 100% tariff if they moved to create a new currency as an alternative to the USD.

Let’s unpack that.

First, the BRICS nations may have rumbled about a new currency and there has been plenty of (unfounded) speculation that the BRICS nations would join together and create a USD-competing currency. This would be nothing short of miraculous IMO.

The BRICS nations are littered with dictators, after all, so how would that even work? Who would trust who and who would ultimately be in charge of any newly formed BRICS central bank in this scenario?

Also, Trump has been known for his tariff bluster in the past and has mostly used them as a threat in order to ‘negotiate’ for favorable terms between the US and other nations. Look at Mexico suddenly wanting to help with the border crisis, for instance.

In any case, nobody should be concerned that BRICS are suddenly going to emerge with a new dominant currency. What they want (and quite honestly need) is to move away from having to hold USTs in order to have USDs for cross border trade.

Treasuries can be seized, after all, as Biden showed them (idiotically, I may add) two years ago. Who wants to hold those if they are not a strong ally of the US?

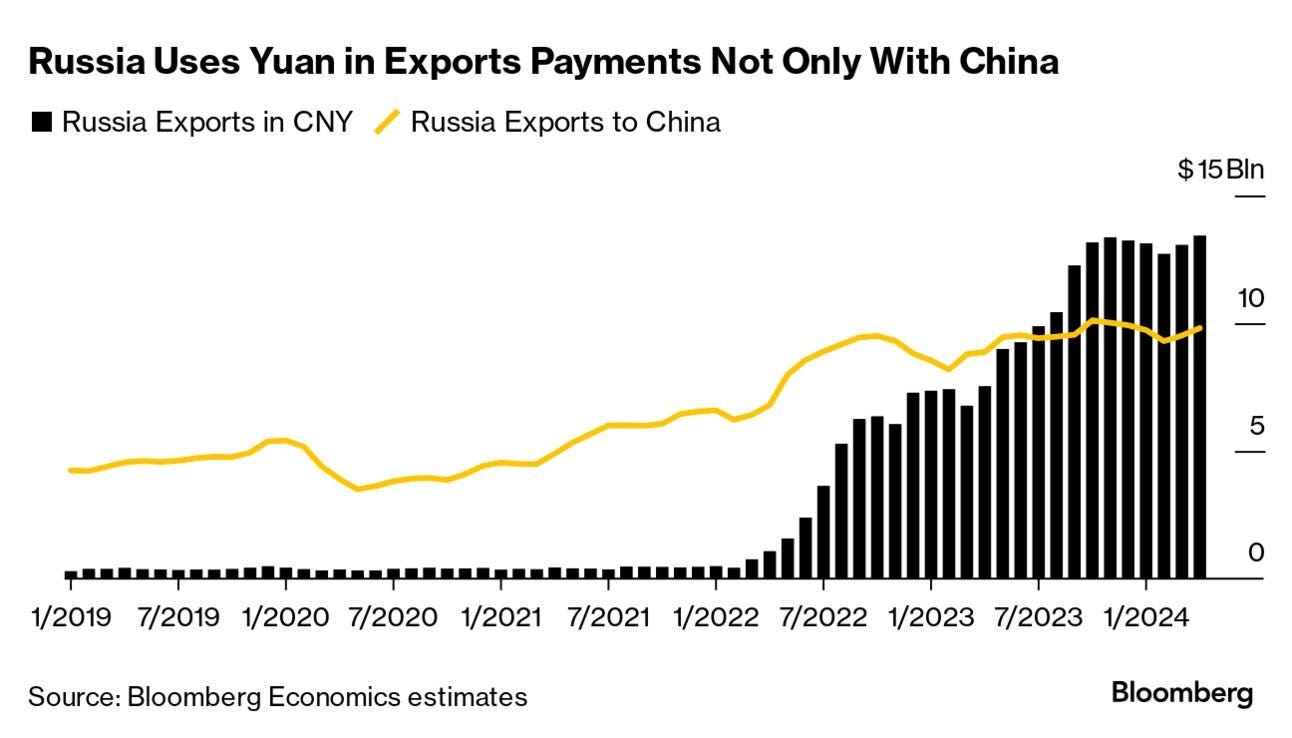

But de-dollarization is far different than creating a competing currency. They’ve mostly just been using more and more yuan, for instance.

And they have been buying gold. Maybe with the intention of using it in some large settlements, but more likely to protect against needing future fiat and looking for a place to protect the current value of their holdings. I would guess they have been buying Bitcoin, too, for that matter.

No, I would be more concerned about inflation, honestly. And with the stock market ripping to new highs, this not only affects asset inflation, but according to some experts, the market accounts for more than 1/3rd of core services inflation.

Meaning that the stock market likely needs to correct if we are going to see the Fed continue with their cuts to Fed Funds.

On that, Powell last week said, “The economy is not sending any signals that we need to be in a hurry to lower rates…the strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.”

Sounds like the Fed is about to hit the pause button. Powell is likely concerned about the expansionary policies of Trump and how that could spark renewed inflation. The last CPI reading confirms that inflation has stalled YoY and MoM.

Question is, have we entered a period of stagflation, instead?

Economic Indicators & Jobs

Jobs data showed a terrible reading last month, but economists are blaming it all on storms and seasonal fluctuations (anomalies). They expect a robust bounce back this month of 200K jobs added. That data is to be released this week.

This may be the Goldilocks scenario that the markets want and need, where inflation eases just enough and jobs contract just enough, leaving the unemployment rate just high enough that the market doesn’t crash with fears of a recession, but the Fed continues easing rates, creating looser credit.

After all, initial Black Friday readings show that retail sales grew by 3.4%, with online sales jumping 14.6% YoY. Though, that suggests issues that retailers face with in-person sales, and how CRE may have more problems than just in Office Space.

We will come back to that, but first, here are all the data that is set to be released this week. Plenty to chew on and assess ahead of the next Fed Meeting on Dec 18th.

Fed Funds & 10 Year

As for the Fed and rates, the PCE numbers came out last week, and they also remained stubborn. The proclaimed preferred Fed measure of inflation, Core PCE actually rose to 2.8% YoY. (Oops)

So where does that leave us?

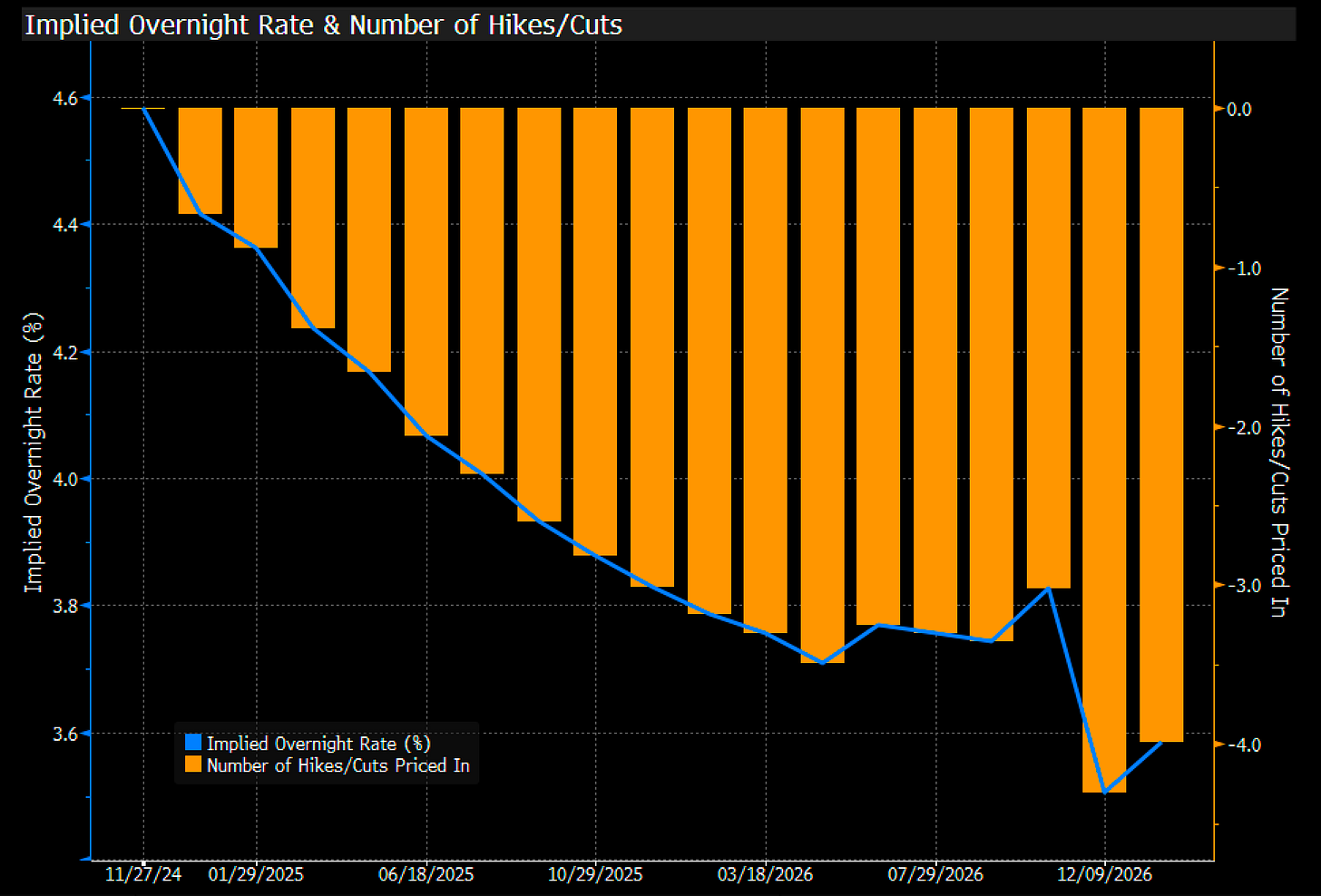

Well, the market is now pricing in a 66% chance of a 25bp cut in December and pricing the terminal rate (where the Fed stops lowering this cycle) at ~3.75%.

Interestingly, as I have noted before, the 10-YR UST yields have jumped since the Fed began lowering rates, going in the opposite direction that the Fed had expected.

I place the high expectations of future inflation as the reason for this move.

Though, as you see, the spike eased this week with some encouraging data, namely a non-Core PCE reading of 2.3%, hovering right above the Fed’s stated 2% target.

Perhaps the Fed will keep cutting, worried that the job market weakens while inflation is low enough to not be too concerned about a resurgence yet.

The final piece on many peoples’ minds is of course the housing market.

Real Estate & Mortgages

One negative about the 10-YR UST spiking after rate cuts was that the 30-YR UST and 30-YR Fixed Rate Mortgage rates followed suit, with mortgages jumping up to 7.3% on the 30-YR Fixed Rate.

This, too, has eased along with the 10-YR yields, but antsy homeowners looking to sell and those looking to buy are still largely priced out of the market. After all, who wants to sell a sub 3% mortgage only to have to take out a 7% rate on a home of lower value?

Until we see rates come down a bit further, it is going to be difficult to tell just how overpriced homes are at this point. So, this may cause some asset deflation and in turn softness in markets. Remains to be seen.

What is likely to cause some softness, however is the CRE market, as we have been saying for a while now.

A red flag of sorts this week, with the delinquency rate on US commercial mortgage-backed securities (CMBS) for offices jumping to the highest rate in 11 years at 10.4%.

This is just offices, though, remember. The overall CMBS default rate is at 6.4%, which is high but not catastrophic by any means. And regional banks have been all over this for years. Plus, it gives Powell another reason to lower rates and loosen liquidity/policy. Which of course is my base case and has been all along, regardless of a downturn in the markets. The only question is how loose and how fast, IMO.

And with that, it leaves my portfolios almost unchanged going into year-end here.

My only change is to remove the China ETF (FXI), as this was a momentum play that just didn’t work in the time frame I set for it. I would rather own the US S&P Equal Weight (RSP) instead long-term.

The rest remains unchanged.

My three pillars of high-yielding money market/T-Bill cash, gold/silver/Bitcoin, and broad-based plus defensive stocks allow me to weather uncertainty but not give up long-term gains, while allowing for liquidity to take advantage of any sharp market drawdowns.

I will do this if we see a drawdown—especially a sharp one—as I expect Powell and Co. to break out the money bazooka to keep markets nice and liquid and avoid any softness in the US Treasury market, in particular.

That's it. If you have questions or ideas, you can find me in the Informationist Alpha community!

Talk soon,

James✌️