💡Informationist Alpha Newsletter

June, 2024

👊 Hey there Informationist Alpha, this is your monthly macro update. Unpolished and raw, these are the main macro themes and factors I'm taking into account for my own portfolios.

Let's get right to it!

General Economic Indicators

First things first, we have had a slew of economic indicators recently, and plenty of charts to dig through this month. Some conflicting data, but on the whole it seems to suggest the economy is, in fact, beginning to slow.

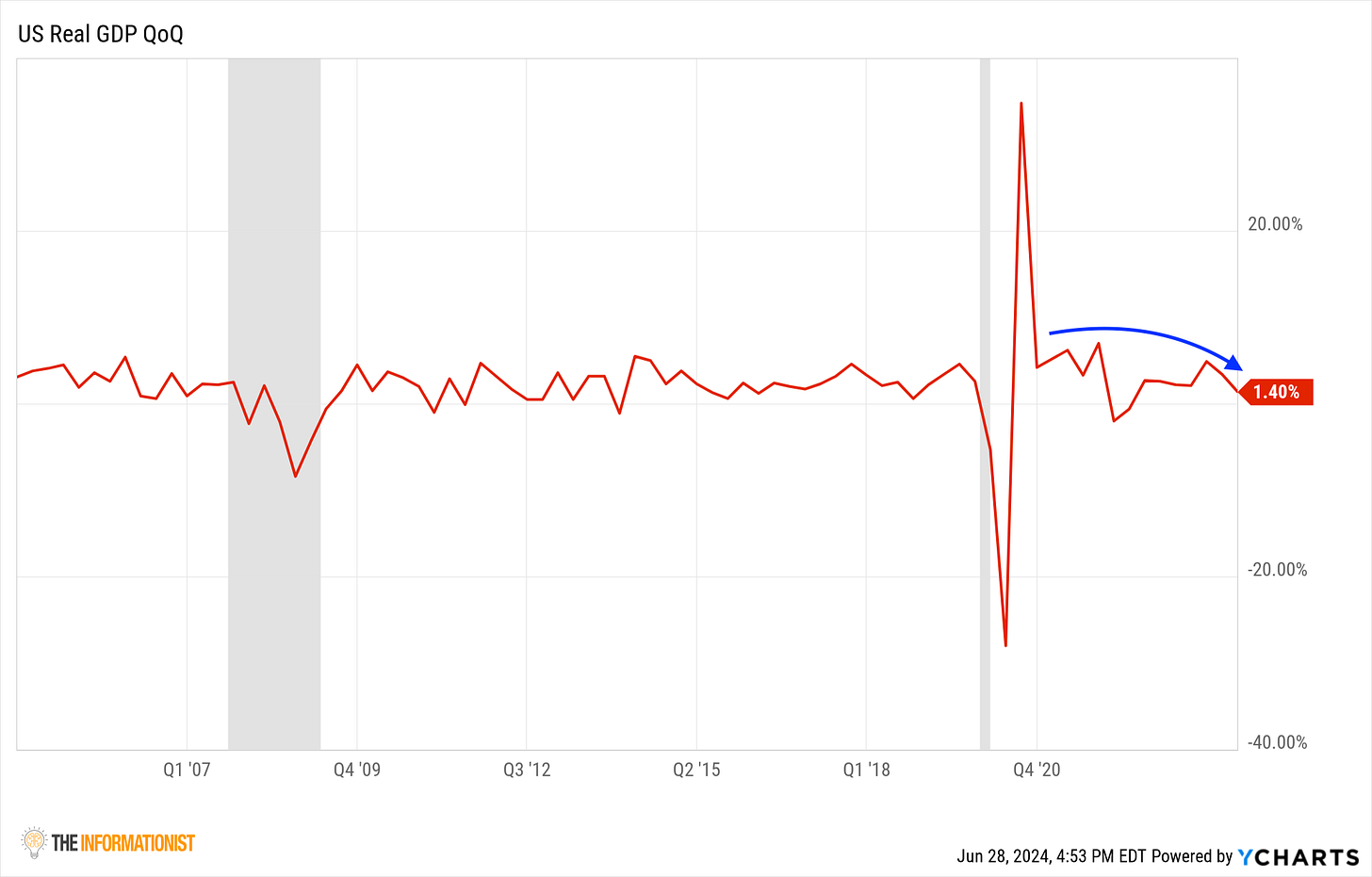

Here, the heavy lagging GDP reading from Q1 shows that real productivity has turned over and is gravitating back to below 1%. Not a contraction yet, but definitely easing.

Manufacturing data seems to support this (as does the purchasing manager commentary coming from surveys), but also suggests the economy has been sitting at something of a plateau and at a level of minor contraction (anything below a reading of 50 is contractionary). This hovering below 50 suggests an economy that is stagnating or perhaps turning over, but not crashing.

The elusive and (admittedly) heavily adjusted/manipulated CPI inflation rate has held above 3% for months now, also suggesting a plateau for the economy rather than a steep drop-off.

This also points to loose financial conditions in contrast to a high Fed Funds rate, as we have discussed re: fiscal deficits and spending coming out of DC and dominating the Fed’s restrictive stance.

No surprise in an election year and with a government that currently has no debt ceiling.

That said, we received the Fed-preferred PCE inflation numbers this week and the one Powell focuses on is the Core PCE, which excludes food and fuel, as these are often more volatile than the other components of the measure.

Looking at the numbers, it appears that Core PCE is headed int the ‘right direction’ for a Fed that is battling inflation and trying to land an economy that has been quite heated, at least in terms of price inflation.

That said, at the same time, consumer spending rose this month, along with inflation-adjusted disposable income, as you can see in the chart here:

Not welcome developments for Powell and the Fed, as this suggests that inflation could turn higher again in the near future. The dreaded Arthur Burns syndrome.

Another interesting data point we received was the U Michigan Consumer Confidence Survey. Higher consumer confidence with an overall drop in near-term inflation expectations is welcome for the Fed. However, there was a large skew in longer term inflation expectations.

What we see here is a major gap between the Mean (White Line) and the Median (Blue Line) expected level of inflation in the coming 5 - 10 years.

The Mean (or average) being much higher means there are likely a number of outliers who are extremely concerned about high inflation versus the average person. You can see the discrepancy is quite large here, and unless we have some sort of revision, it is pretty unprecedented, as the chart shows.

Any way you cut it, it points to uncertainty. The Fed will note this.

On that, we also got some confusing unemployment data that I wrote all about a couple of weeks ago. Jobs aplenty, many of them second and third jobs, and government hiring up the wazoo.

At the same time, full-time unemployment ticked up to 4%. What this means is that we are ticking closer and closer to a recession at least according to Claudia Sahm and the Sahm Rule. What we are looking for here is the average of the last three months to be more than .5% above the average of the lowest three month average of the past year. Right now we are .37% above.

That said, while unemployment is important, and it definitely jumps higher in a recession, that’s the problem with using it as an indicator. It is always terribly lagging as a data set and is not in and of itself useful as a predictor.

But the Sahm Rule is helpful in watching for an acceleration toward the overwhelming spike of unemployment that inevitably occurs in an actual recession.

On that, a good indicator of possible cracks in the economy is credit. Or more importantly, consumer defaults. And we’re seeing a spike in Credit Card delinquencies recently, pointing to consumer stress.

After all, it is way smarter to ignore CC bills than your mortgage or car. It’s a no-brainer to stop paying the Visa bill first. And what we see is a jump to levels that we have not seen since the GFC in 2008.

Not quite alarm bells yet, but a red flag for sure.

Hence, the markets are reacting to how they think the Fed will react.

And while the Fed continues its parade of officials insisting on the messaging of Higher for Longer and only one rate cut, if any this year, traders are expecting at least one and maybe two cuts in 2024.

This flies directly in the face of the Fed Dot Plot, which only estimates that one cut the Fed officials keep re-iterating.

Meanwhile the market insists, “Sure, Jane.”

So, where does this leave us?

As economist Mohamed El-Erian, the president of Queens’ College, Cambridge and a Bloomberg commentator who I quite respect said this week (paraphrased): “The Fed is at risk of keeping rates “too high for too long, and…the more likely error right now is that the Fed will not start cutting early enough, and eventually wind up having to cut rates more than they should.”

Translated: the Fed needs to pivot soon before they commit yet another policy error. This time on the side of being too restrictive, pushing the economy into a recession.

If this does happen, I believe the reaction from the Fed and Treasury would be swift and powerful.

Cowbell, aka The Fed Put.

It is for this reason that I maintain my belief that even though overall rates would come down as a trade, in the long run, the risk of long-term rates remaining higher due to inflation and traders’ demand of rate premiums is too great.

I see three outcomes for the economy (in order of likelihood):

The government continues to spend like mad, allowing for fiscal policy to dominate the Fed, especially in an election year. Cannot, will not, have a recession on the Biden watch. Even if it means more spending, higher deficits, more debt. Aka, the Soft Landing. Or No Landing, really.

Outcome: the everything bubble just keeps expanding, more inflation, more debt, higher interest rates on the long end of the curve, driven by rate premiums, and all assets (real estate, stocks, gold, silver, and Bitcoin) march on to new highs.

We have a relatively short-lived economic downturn, the Fed wins vs The government (yay) and all assets grind lower for a limited period. Just long enough for the Treasury to get nervous (which is not very long, mind you), and the Fed drops rates back to ZIRP and teams up with the Treasury to add liquidity back into the system.

Outcome: a drawdown in the markets that takes weeks or months and a healthy correction in those assets that have gotten ahead of themselves.

Exhibit A:

This of course just delays the inevitable outcome: Higher recession-driven deficits, more debt, more money printing and liquidity added to the market in the form of QE, and of course, more inflation. Assets recover and march back toward all-time highs.

We have some sort of surprise that rocks the markets. The dreaded Black Swan. What this can be is anyone’s guess, that's why it is unexpected. Possibilities include our current proxy wars turning into a hot war with Russia, Iran and/or others. China and Taiwan—you get the point. Maybe an October surprise in the election that happens this summer instead (July surprise?). The market is now handicapping Biden dropping out, so that’s not it. Something else unexpected there. Or maybe even an attack on US soil. Who knows.

Whatever it could be, it would mean sharp and extreme volatility in markets with a drastic drawdown. Because this would immediately affect the Treasury market, the response would be equally extreme, with the kind of money printing that would literally make you gasp.

Outcome: All assets correlate to 1. Draw down. And then recover with equal enthusiasm. A fresh and powerful bout of inflation that takes assets like real estate, gold and Bitcoin to eye-watering all-time highs.

Bottom Line

Any way I see it, the Treasury simply cannot have a massive correction. They have painted themselves into a money printing corner, as the demand for borrowing at the federal level will supersede all other needs or demands.

It will continue to supersede all rational thought (as if there ever were any) out of DC, and require immediate and powerful attention.

The alternative is financial destruction for the Treasury and the rest of the financial world. What the Treasury needs is negative real rates forever. This means high inflation and low yields. In perpetuity.

We had ten years of ZIRP with negative real rates, but this will be more like ZIRP on steroids. I am talking about high, structural, perpetual inflation.

Because of this belief and what I consider to be the harsh reality of the Treasury’s predicament, I continue to remain widely diversified in asset class exposures:

Cash-equivalent T-Bills only, no long-term bonds

Gold, silver, and select commodities

Bitcoin

Equities with sector rotation exposures

As such, I continue to feel comfortable with my exposures and there are no changes to this month’s portfolios, which can be found here:

->> LINK TO PORTFOLIOS <<-

That's it.

If you have questions or ideas, you can find me in the Informationist Alpha community!

Talk soon,

James✌️