💡Informationist Alpha Newsletter

September, 2024

👊 Hey there Informationist Alpha, this is your monthly macro update. Unpolished and raw, these are the main macro themes and factors I'm taking into account for my own portfolios.

Let's get right to it!

If you feel yourself getting nervous, more uncertain, as the weeks roll toward the election, you are not alone.

With such diverging policies being floated by each candidate, we have completely different possibilities for tax and spending structures in the next four years.

This is not uncommon, of course, and it is typically reflected in the volatility of the markets.

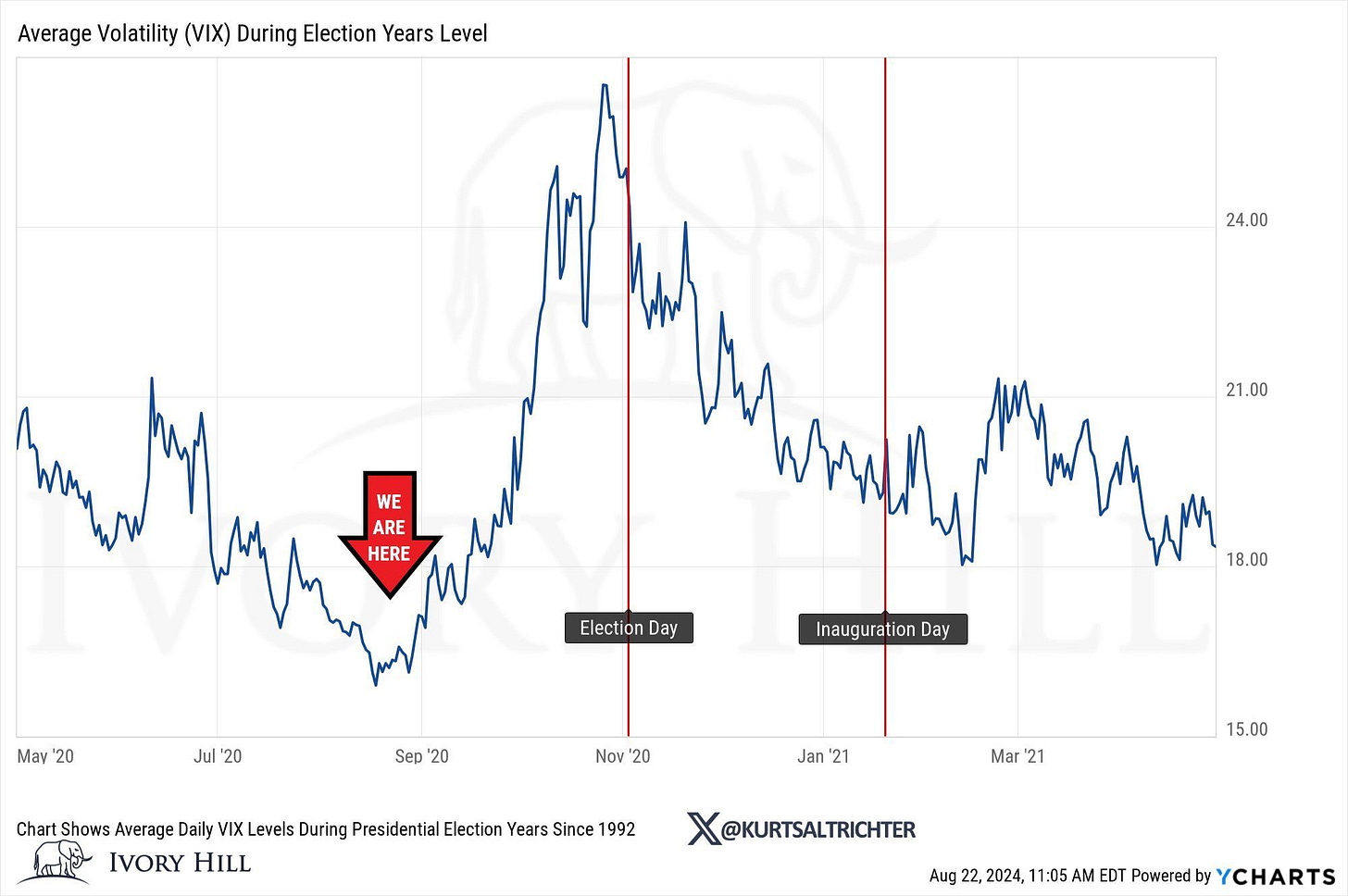

To that end, here’s what happens to the VIX in the months leading up to, and soon after, the election, on average:

Volatility really starts to pick up in the month of September, as the gap of policies widens and solidifies, while the outcome only becomes more uncertain.

Once the election occurs, however, the uncertainty dies down and the market re-adjusts to reflect the likely policies of the winner.

Typical.

Except this year, we have a few other uncertainties brewing around the economy itself, so much so, that Powell all but conceded the Fed will be cutting rates by at least 25bps this month.

If you read this week’s Informationist, you know all about the pending Fed pivot and the timing around both ending QT and starting QE back up again.

A few key data points for us today.

First, we know the jobs creation number was revised significantly lower from the original estimate. 28% lower, in fact, as BLS confessed to overestimating the number by 818K, or about 68K fewer jobs created each month this past year.

The critical component, and the one the BLS so poorly gauged, was the birth/death model showing the creation and dissolution of jobs due to companies started vs. companies closing (BLS estimates this for the jobs numbers).

To confirm the BLS estimation blunder, here’s a chart showing the number of companies declaring bankruptcy, rising steadily for well over a year now.

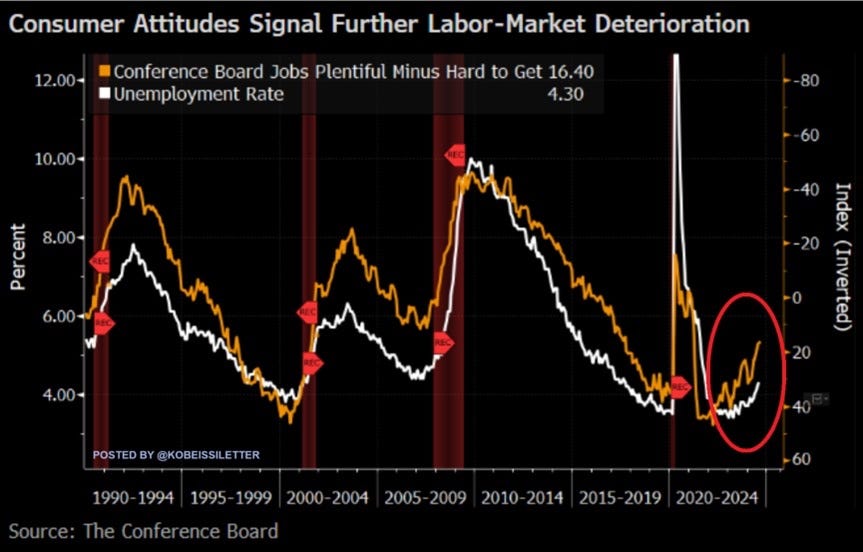

This may explain the jump in unemployment, and the difficulty some workers are finding when trying to land a job:

We’ve talked quite a bit about how hard it is the slow down the rise in unemployment once the steamroller starts heading downhill.

The consumer weakens, and in a service economy like the US, this just winds up snowballing into a spike of layoffs and, of course, further weakness, which leads us into recession.

No surprise then that the consumer credit report released by the NY Fed this past week shows a spike in credit card delinquencies to almost 11%.

It makes sense, with many Student Loans still paused, people will typically pay their mortgages and home equity lines, as well as car payments first, and if they do not have enough left over after expenses like food and gas, they will skip the payments on credit cards.

This is one side of the tale of the economy, however.

The other side is demonstrating quite a bit of resilience still.

This would be the older and/or more affluent demographic, those who are either: heavily invested in the market, have a ton of cash sitting in high-interest earning money market or savings accounts, or are sitting in homes that have appreciated significantly in the past few years.

As such, they are not only not feeling a cash crunch, but likely feel wealthier than before the lockdowns.

Here’s how the wealthiest 1% and wealthiest 2 to 10% have done with inflation:

The bottom 50%, of course does not have many assets, if any, and are struggling just to keep up with the payments, as noted above.

Look at the housing prices versus wages:

This dynamic of wealth creation through asset appreciation due to massive inflation is in essence creating two totally different economies within the US.

While most people are struggling to keep up with inflation and their income is eaten up by the rise in prices, those sitting on large piles of stocks, bonds, or big houses feel rich, as their wages are doing fine, but the appreciation of their assets has far outpaced the price of their *needs*.

Hence the stock market at all-time highs, yet overall consumer sentiment in the dumpster:

Digging deeper, we see the demographic issue:

And so, while the top third is starting to feel it a little, the bottom third sentiment is headed back to historic lows.

So does this mean we are, in fact, headed for recession? Is the Fed too late in its pivot again?

If you look at the UST 10yr-2yr spread, it is all the way back to about 0 from being inverted for over two years. When this happens, it usually means we are heading straight into a recession. Or it is too late.

But now we must step back and look at the entire market from a standpoint of liquidity. Fact is, total liquidity has been moving sideways, at best, not contracting:

and M2 money supply has actually starting to trend higher again:

This may explain why we are bumping right up against all-time highs again in the markets. It also shows how the market is not the economy.

And because liquidity is actually moving sideways to slightly higher, and the Fed knows this, Powell will not make a move on QT again unless something drastic happens in the credit markets.

Again, if you read The Informationist newsletter this weekend, you know where the RRP and Bank Reserves stand, and they would need to move much lower for the Fed to start getting nervous, like under $3T, after the RRP of ~$400B is drained.

This means there’s still almost $1T of cushion in the bank kitty.

So, let’s bring all these data points together.

We can see that the consumer is beginning to struggle, broadly. Jobs are not as plentiful as they were two years ago. The lower demographic always starts to feel it first, and there is strong evidence that they are, considering the credit card delinquencies and consumer sentiment of the lower 1/3rd of earners.

There is little question that a part of the economy is slowing down.

Question is, will the Fed lower rates fast enough to get ahead of any avalanche in job losses?

And when they do lower rates, will housing prices actually fall, as rates are lower and some of the owners look to lock in their gains and head to smaller houses with reasonable mortgage rates?

I think this is a fair probability.

In other words, does it all snowball and drive the economy into a recession?

I think this is also a fair probability.

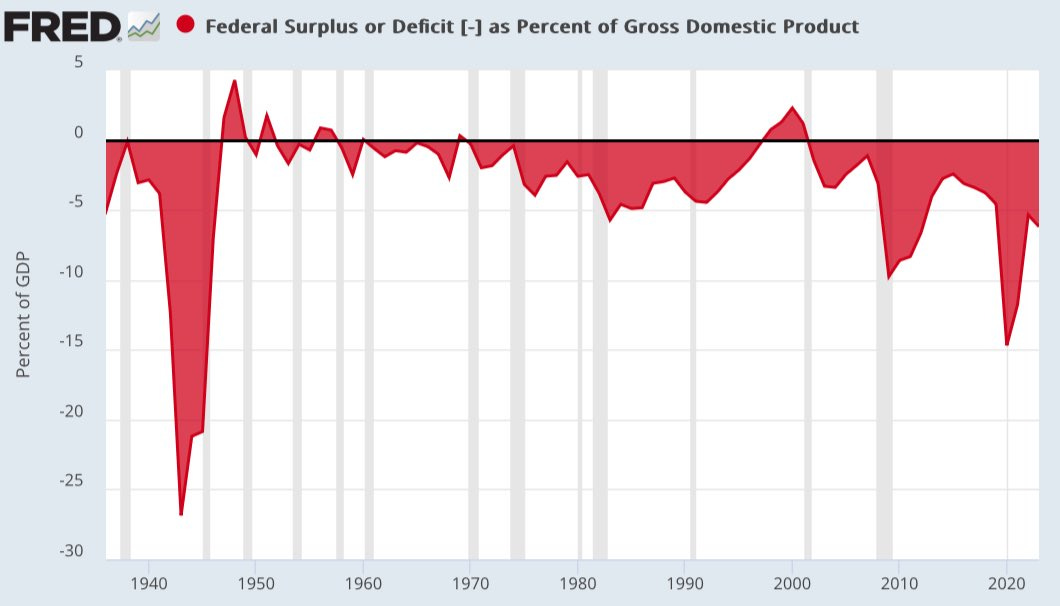

Here’s the thing, though. The Treasury cannot withstand a long drawn out recession. I needs high GDP nominally to keep up with the debt load it is growing with the massive deficits the government is running.

And guess what? The deficit is growing versus GDP, meaning it takes more and more spending to drive every dollar of productivity.

Knowing this, the Fed and Treasury will do whatever they can to avoid an economic meltdown, IMO. And any shock will be short lived, like March 2020.

I keep reiterating that I am most comfortable owning assets, but with the market at all-time highs here, I hold a large allocation to hard monies that will be defensive in the face of any market shocks (who knows what happens in this election or overseas).

Assets like gold can and should be defensive with any geopolitical or domestically political unrest. It will also do well in the case of massive money printing.

As will Bitcoin.

And so, I continue to hold my ballast of high yielding cash (T-Bills) with a pillar of hard monies and commodities, as well as Bitcoin. I also maintain a reasonable exposure to defensive and broad-based equities in the case that we just continue to melt up in a crack-up boom.

But this diversification should protect me from substantial losses in many scenarios.

Of course, there is no guarantee, but I can sleep at night with this type of diversification.

Having made a number of changes just before the recent market drawdown, I have no changes to make this month. But I will be watching the election cycles and Fed movements closely. If there is a mid-month change that is warranted, I will be sure to let you all know.

->> LINK TO NEW PORTFOLIOS <<-

Portfolio Adjustments:

Overall, I remain widely diversified in asset class exposures:

Cash-equivalent T-Bills

Gold, silver and commodities

Bitcoin

Equities with select sector exposures

That's it.

If you have questions or ideas, you can find me in the Informationist Alpha community!

Talk soon,

James✌️