Informationist Alpha Newsletter

October 2024

👊 Hey there Informationist Alpha, this is your monthly macro update. Unpolished and raw, these are the main macro themes and factors I'm taking into account for my own portfolios.

Let's get right to it!

Fed Rate Path

So, Powell made one heck of a statement the last meeting, cutting rates by not just 25bps, but rather 50 bps. The market had priced in a significant chance of this with inflation moderating and a couple sketchy jobs reports, but the clincher, as Anna Wong the Chief Economist from Bloomberg astutely pointed out, was the dismal Beige Book Report.

I’ll likely write an Informationist newsletter digging into the Beige Book soon, but here’s a TL;DR:

The Beige Book is a snapshot of the economy based on anecdotal information from a survey of businesses, economists, and market experts across the 12 Fed Districts. It covers consumer spending, labor, manufacturing, and overall economic activity. It’s not data-heavy like some other reports but instead focuses on qualitative insights.

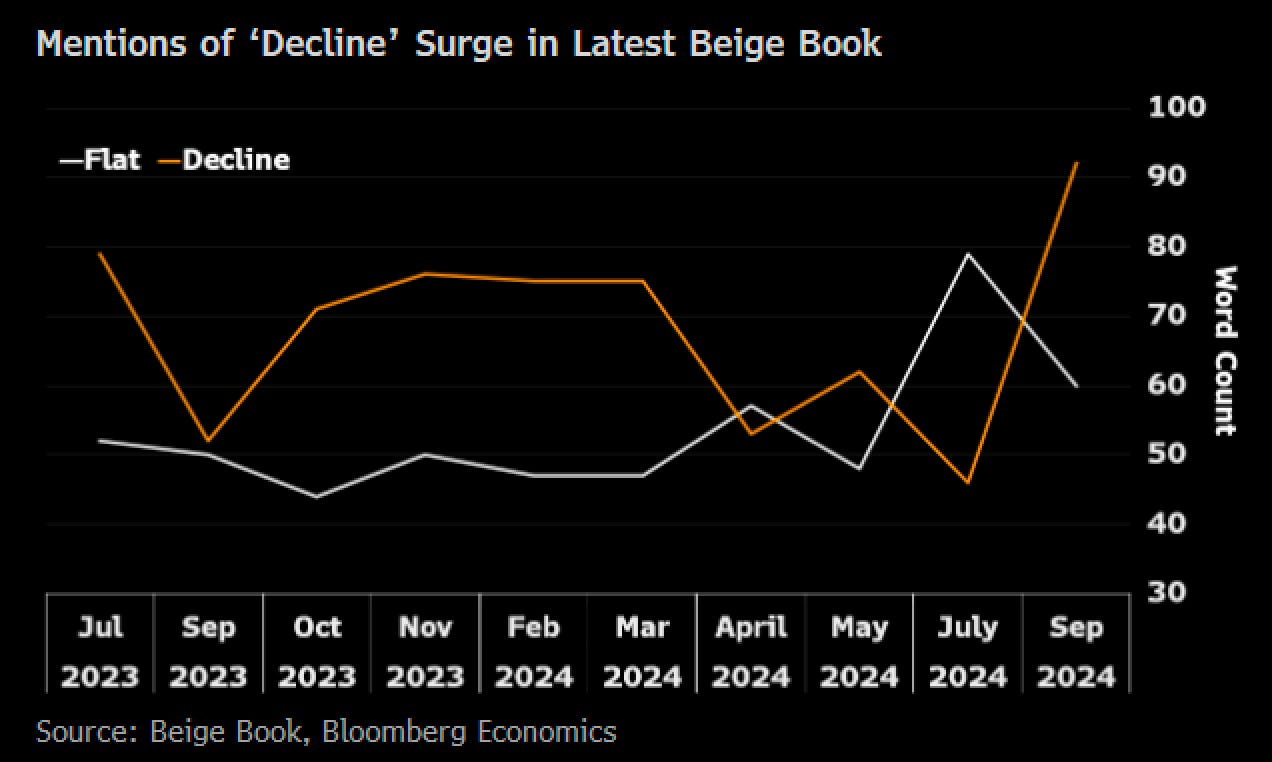

The latest read was pretty dismal, with 9 of 12 districts reporting flat or declining activity, plus overall weaker consumer spending and manufacturing activity. And word choices matter in this report. As such:

Essentially, this report gave Powell the necessary cover to deliver a 50bp cut.

Powell basically declared victory on the inflation front, saying he is now concerned about the employment side of the Fed mandate.

Along with the dovish prepared remarks and equally dovish press conference remarks, Powell also released the Fed Dots, showing the path of rates over the next few years. Here’s where it gets interesting.

Because, as you can see, the 2024 year-end target is pretty well clustered around 4.5%, give or take. But the 2025 rate targets are wider, and 2026 shows basically zero consensus.

Why this matters. Look at the previous meeting (blue line/dots), in comparison:

What we see is that the expected rates have dropped slightly for this year and 2025, along with the economic data we have recently seen. But then the longer term rate settles higher in the latest Plot.

Essentially, this means that the Fed officials believe that the Terminal Rate is 3% or so.

Janet may not love this, of course, as the US Treasury is already struggling to manage the interest costs, and this means one thing only: The Fed expects inflation to continue, and the terminal rate at 3% means the inflation rate is likely higher long-term.

Remember, negative real rates are essential to continue funding the US gov’t with deficits and debt.

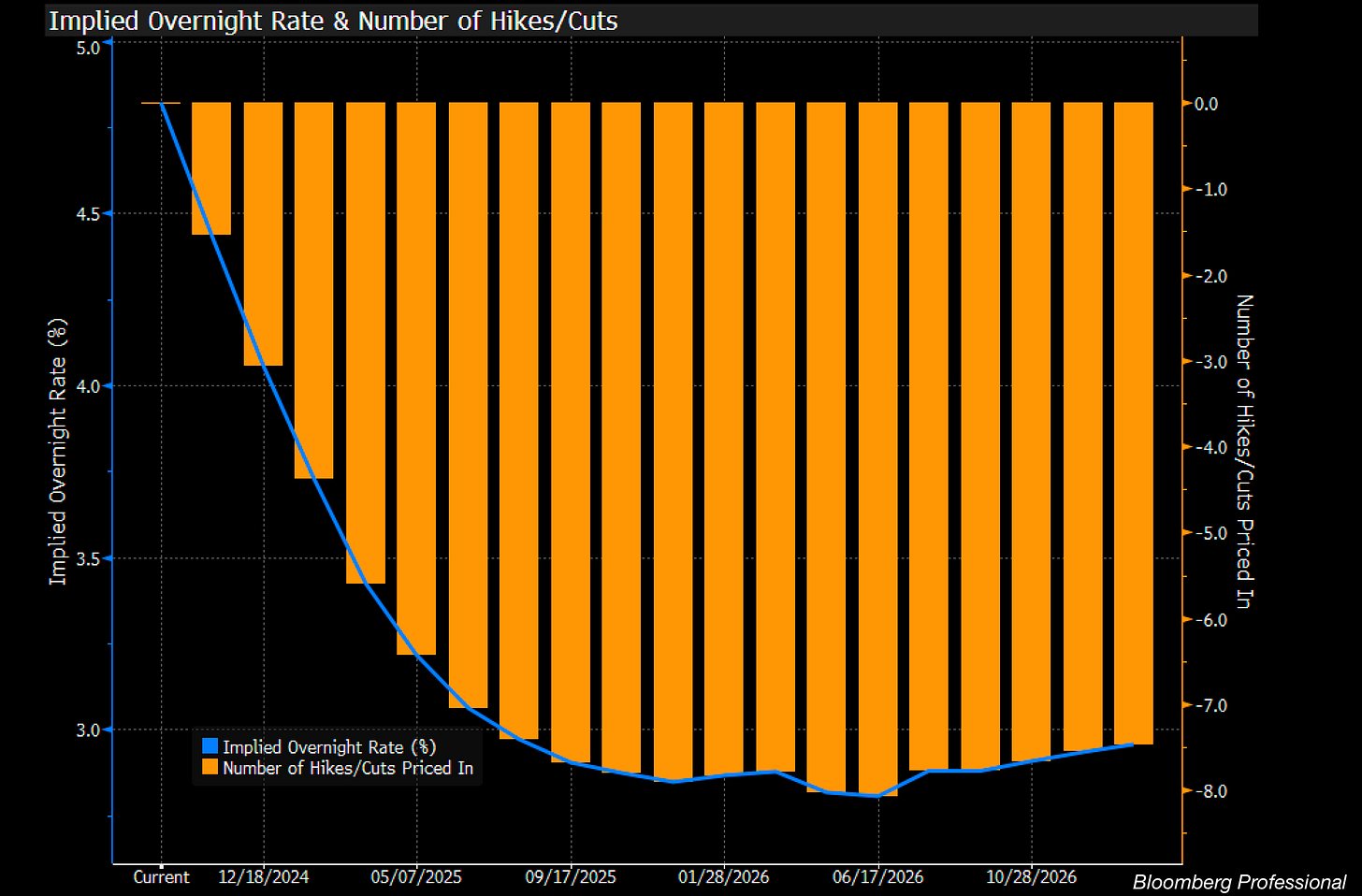

OK, so what does the market say/want?

Looking at the latest Fed Fund Futures, we see the market expects us to end 2024 a bit lower, at closer to 4%, or another 75bps of cuts.

Longer term, the market seems to agree that 3% is the Terminal Rate, as you can see above.

So, deeper and faster cuts up front, according to the market, but settling in at the same spot.

Translation: Market is fully expecting a soft landing, which means continued deficit spending, as this has been instrumental in the avoidance of a sharp drawdown here.

It is also expecting higher inflation than 2%, as this trajectory would make no sense otherwise, with long-bond yields likely a good amount higher than Fed Funds by the end of next year.

We get more economic data soon to either confirm or unseat these expectations. Here’s the packed schedule for just this week:

We’ll be watching these closely, especially the jobs report, to see if we should expect a 50bp cut in November or even an emergency 25bp cut in Oct.

China

A big development from this past week has been the PBoC announcement of stimulus in China, which included a 20bp cut to 7-day reverse repo rate (equivalent of Fed Funds for China) and a 50bp cut in mortgages.

The overall cuts were not dramatic, but they unexpectedly came all at once. This has been a big boost in reversing negative market sentiment in China. Remember, China has a 5% GDP target. So, this is trillions of yuan (Hundreds of billions of USD) of stimulus in the world’s second largest economy to prevent deflation.

Signpost.

Global Liquidity

On that, it looks like global liquidity growth has begun to re-accelerate. According to Michael Howe of Crossborder Capital, the recent 3mo avg is 11% versus the YoY 5.1% rate. Acceleration indeed.

This is important, because as we know, global liquidity drives markets. The more liquidity, the more stocks and hard assets like real estate and hard monies like gold, silver and Bitcoin rise.

And while gold appears to be anticipating this additional liquidity, Bitcoin is lagging. I expect it will catch up, however, as Bitcoin has followed gold on a three-month lag closely the last number of years.

A nifty recent chart by Capriole demonstrates this:

And here is gold vs. US M2 money supply, a solid benchmark for overall global liquidity, but still a fraction of the total.

OK, so rates are falling and liquidity is rising. What about the unexpected, things that could be priced in as risks to the markets?

Election

We seemingly can’t turn anywhere without noise from the election coming across the transom, can we?

Of course it matters, unless it doesn’t.

I mean, the reality is that the markets are already pricing in either a Trump victory or an uncontested Harris victory with a split Congress.

In other words, more of the same financially for the US, or better. If Harris is somehow elected, her stated policies could create wreckage in the markets, but it is highly unlikely at this point that she would be able to get any of her outrageous ideas (like unrealized capital gains taxes, etc.) pushed through a divided Congress.

And if Trump is elected, we will likely get a bunch of tax cuts and regulation relief. This would be a boon for small companies and markets.

And either way, both candidates would continue with deficit spending. There’s really no way that Trump could even cut back to a balanced budget, for all his claims. We know this because mandatory line items plus military plus interest on debt outweigh all tax receipts already.

The debt ceiling will be raised in Jan or soon thereafter, with or without all the drama and theatrics. And spending will continue, almost unabated, IMO.

Could we have a contested election? Sure, obviously. Especially with all the election and polling site nonsense that the Democrats are creating with litigation and other tactics, including adding illegal immigrants on voter rolls. So, who knows.

As we get closer, some of this uncertainty could be priced in, and this would temporarily de-rail the markets march higher from liquidity.

But then the result would only be The Fed and global central banks executing money-bazooka policies of monetary expansion through QE, etc.

And we are back to markets in a V-recovery and upwards again.

I honestly do not see another path for the Treasury or Fed at this point. If this changes, I will certainly be writing about it here and on Twitter.

So, stay tuned.

Port Strike

Another unknown is the looming Longshoremen's Association battle with docks on the East and Gulf Coasts. A strike could happen this week, and impact 14 major ports.

Pharma and Ag imports, along with clothing would likely be affected and could snarl supply chains through year-end. A shutdown would cost the economy $5 to 7B per week. But this would eventually be made up in a reversal of the dispute, so reports of potential catastrophic impacts are overblown IMO.

->> LINK TO NEW PORTFOLIOS <<-

Portfolio Commentary

Considering all of the above, I think we have mostly graduated to a higher risk of a liquidity pump into the markets than a sharp downturn from any credit crisis.

To be clear: this does not mean that there is not any chance of one. With massive leverage all the way from sovereigns to companies to individuals, the system is heavily reliant on debt and the expansion of that debt.

And an expansion of the money supply.

And so, could there be short-term pain? Absolutely. Especially with some sort of October election surprise which sends credit and equity markets reeling. But again, this would be temporary IMO, as the Fed and Treasury would have little choice but to step in and splash liquidity into the markets.

But still, the best approach to these types of markets and cycles are in a multi-pillar portfolio strategy, as we have already constructed.

Cash-equivalent T-Bills or money market

Gold, silver and commodities

Bitcoin

Equities with select sector exposures

Portfolio Adjustments:

With the decreased risk of a credit fallout from high rates forcing indebted companies to default on debt, I am removing the SJB High Yield Bond Short position. The risk/reward on this has played out, IMO. I was wrong, but hey, we did well staying long elsewhere.

The equal weighted equity exposure lagged earlier in the year but has performed well this past few months, and I expect this to continue with the uncertainty in here.

Similarly, exposure to defensive sectors like Utilities and Consumer Staples has worked well in the last few months, outpacing overall markets and I think this will also continue through the election.

And finally, I am adding a small position of long China equity exposure through the FXI I-Shares China ETF to both the Tactical and the 10-year portfolios, as the 10-year International exposure ETF of EMXC is X-China, so this will add exposure back to China in that portfolio.

That's it.

If you have questions or ideas, you can find me in the Informationist Alpha community!

Talk soon,

James✌️

James, I can't seem to log in either. There for a while I was getting notifications that my auto-renewal was going to take affect and now I'm not getting anything. Are you no longer offering the subscription? Let me know. Mark

Hi James - I can’t seem to log into Mighty Networks anymore to view your portfolio weightings. Just asking whether I’m still listed as one of your paid subscribers? If I recall, I thought I was - thank you