💡Informationist Alpha Newsletter

November 3, 2024

👊 Hey there Informationist Alpha, this is your monthly macro update. Unpolished and raw, these are the main macro themes and factors I'm taking into account for my own portfolios.

Let's get right to it!

ELECTION WEEK

It’s here. Finally.

And though the Presidential betting markets of Polymarket and Kalshi have suddenly collapsed into a dead-heat, after showing Trump pulling away in the odds, the financial markets have been saying something quite different, as of late.

In short, with the S&P 500 and NDX 100 marching to and then hovering around all-time highs, it has been a risk-on environment for weeks now.

And I believe the market is saying it expects a Trump win with a reasonable likelihood of a gridlock in Congress, keeping the deficits from ballooning—even further—out of control.

And no, Trump and Elon will not be able to cut enough fiscal spending to create a surplus. The Entitlement and interest expenses are just too big to get there.

But a Trump win would likely usher in some tax breaks, tariffs, and deregulation. And continued deficit spending, perhaps even more than current gaps.

Which would in turn cause? Inflation.

The bond market got this memo, though arguably before the stock market. Look at the long bond yields:

Just look at where rates have gone since the Fed cut in September. I’ve been talking about this in Twitter/X and in my Informationist newsletter, but for those who have not seen those posts, the premise is simple.

The 10-Year UST yields are up to 4.38%, up over .75% since the Fed cut, the 30-Year UST is now at 4.57%, up the same amount, and the average 30-Year Fixed Rate Mortgage is up to 7.28%.

This has some investors baffled, but you should not be, as we have been talking about this. Inflation is likely here to stay.

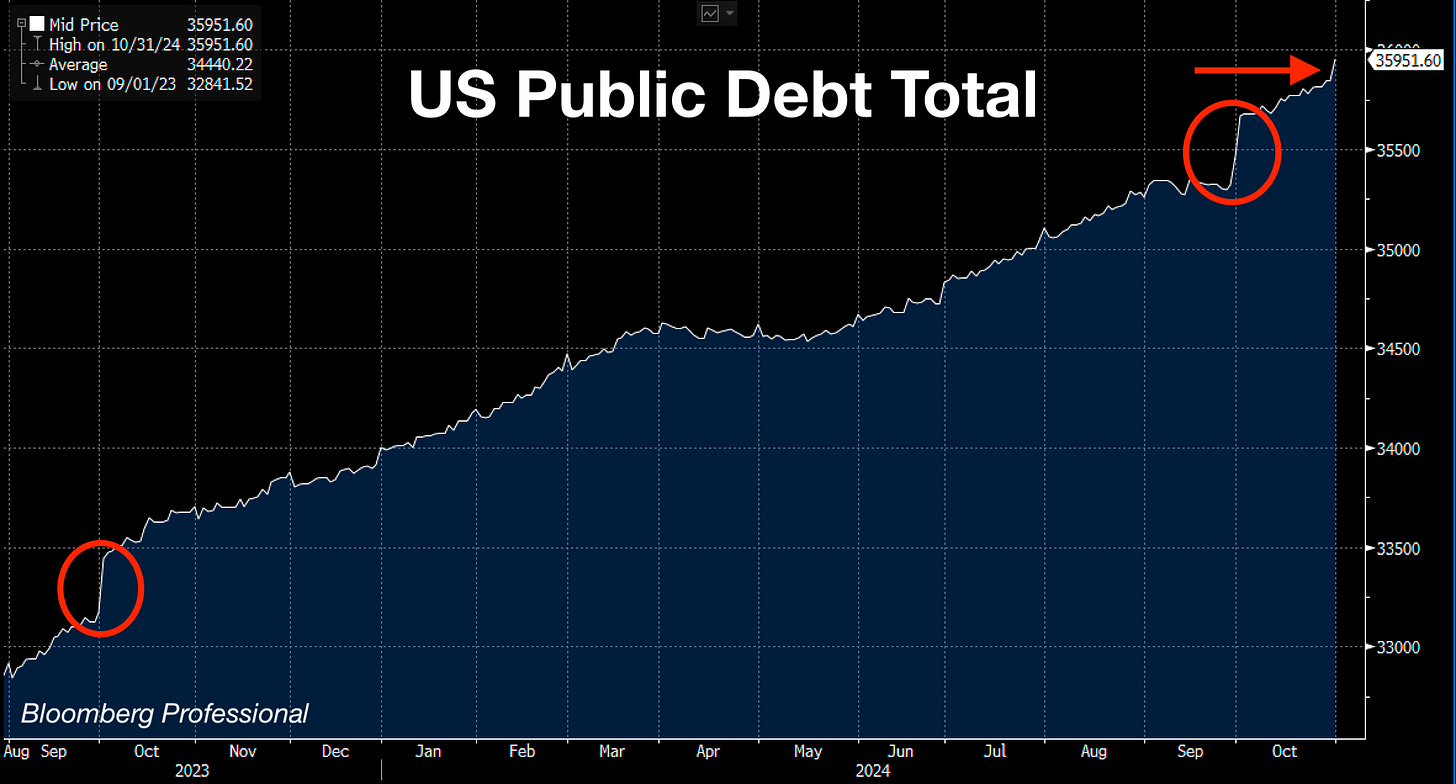

I mean, look at the spending coming out of DC:

What we see here is a jump in Treasury borrowing on the first day of fiscal 2024 (one year ago, on Oct 1, 2023) and then again on the first day of fiscal 2025 (first day of October, 2024).

And you see that red arrow pointing to that last jump in the chart? That equates to over $100B of spending on the last day of October this year.

This fiscal spending has likely impacted jobs numbers (lots of gov’t hiring), as we have seen some conflicting reports lately, along with +GDP numbers and sticky inflation readings, and the spending doesn’t appear to be slowing down.

Bond investors, as a result, are demanding more yield in longer duration USTs, like the 10-Year and 30-Year USTs over the last month. I.e.,rate premiums to protect against a resurgence of inflation in the future.

Adding some fuel to the fire, we have seen the Reverse Repo Facility draining down to almost zero (see yesterday’s Informationist for more on that, please).

This, coupled with the Treasury refunding announcement has only exacerbated the UST yield situation for long bonds.

TREASURY QUARTERLY REFUNDING

Last Wednesday, Janet Yellen gave the update on near-future funding needs for the US Treasury.

The Quarterly Refunding Announcement or QRA.

What we learned:

Over the next quarter, the Treasury plans to:

spend $186 billion from the TGA (Treasury checking account)

issue $546 billion more USTs

And in Q1 of 2025, the Treasury plans to:

fill the TGA back up to $850 billion (by adding $150 billion back)

borrow an additional $823 billion

Assuming no debt crisis, that’s $1.4 trillion of borrowing over the next six months.

Here’s the rub, though. The Treasury will heavily weight that Q1 2025 borrowing to the short end of the curve, relying on T-Bills to continue to float the spending gap and draining the rest of the RRF.

The bond markets are saying that this is effectively kicking the can down the road and cannot last forever (only $155B left in RRF).

But why is Janet doing this?

Simple. To avoid locking in high borrowing rates in long-term debt and waiting for the Fed to cut rates instead.

A game of rate-chicken, you may say.

About that.

FED WEEK

This is also Fed week in that Powell and company will be announcing rate policy on Thursday, after meeting for two days.

You may have noticed this is coming a day later than the usual Wednesday announcement and you’re right. The Fed is waiting until after the election to meet and announce rate policy this month.

Regardless, traders are expecting another cut of .25%, assigning a 97% chance in Fed Funds Futures:

As you can see, they are also assigning an 85% chance of an additional cut of .25% in December, and a continued path of rate cuts until reaching a terminal rate of approximately 3.5%.

The recent surge in 10-Year yields suggests that bond investors are demanding a full 1% or more of rate premiums for long-term bonds.

Again, this is because they want to be protected against a surge in inflation and the interest rate risk associated with it.

And if the neutral rate ends up being closer to 4 or even 4.5%, then the long bonds would likely go right back up to 5% or higher.

Putting it all together

Buckle in for a period of uncertainty and likely volatility over the coming weeks. Things that could produce large market movements:

A clean sweep of Presidency and Congress → this could cause confusion and a selloff and then a resumption toward ATHs

An outright Harris win → this produces policy uncertainty around taxes and onerous regulations and pricing control measures for companies

No results for weeks or highly contested results → this would be awful and markets hate uncertainty

Unexpected Fed hawkishness → while this may help the long end of the bond market, stocks would suffer from the punchbowl being put away

And so, I am satisfied with my positioning going into the election and ensuing weeks afterward.

Having the three main pillars of short-term cash equivalent bonds, gold + Bitcoin, and a mix of equities with some defensive sectors layered in enables the portfolios to weather this probable uncertainty.

Cash acts as a ballast and can be used opportunistically to take advantage of large drawdowns in equities, gold, and Bitcoin

Gold acts as a flight to safety and can be relied on in times of global unrest

Equities will capture economic expansion and inflation expectations, as will gold and Bitcoin

As such, I do not have any changes and feel well-positioned with the current mix of investments this month.

Because people have had issues logging into the Mighty Networks site, here is the portfolio snapshot and excel model for reference:

That's it.

If you have questions or ideas, you can find me in the Informationist Alpha community!

Talk soon,

James✌️