How to Read (Between the Lines) of The Fed

Issue 101

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today's Bullets:

The Meeting

The Press Release

The Prepared Remarks

The Q & A

The Minutes

Ongoing Pressers

Inspirational Tweet:

If you're an investor, you've no doubt noticed that The Fed and their meetings have become increasingly important and impactful to both the bond and stock markets these days.

In fact, and as we will get to in a bit, they can cause downright and immediate volatility in them. This is no surprise, as interest rates and Fed policy have become a vital factor in market direction and asset valuations.

But what happens in these meetings, how is the information from them disseminated, and how can you better read what is going on for yourself?

Good questions, though it may seem super confusing, what with the press release, the press conference, the comments, the questions, etc.

But have no fear, we're going to break it down for you, nice and easy as always, here today.

So, grab a large cup of coffee, and sit back for simple (but longer than typical) primer on How to Read the Fed with The Informationist.

🤓 The Meeting

First things first, the meeting itself. If you already know this, feel free to skim/skip to the next section, where we get into the meat of things. But if it's all new too you, let's continue on...

The Fed Meeting: What is it, and who is there?

In short, the Federal Open Market Committee (FOMC), often affectionately referred to as just The Fed, is the governing body responsible for setting US monetary policy.

This committee, the FOMC, is made up of the seven members of the Board of Governors, the President of the Federal Reserve Bank of New York, and four of the remaining 11 Reserve Bank presidents, who serve on a rotating basis.

The Voting Members.

If you want to understand more about how the Fed, the Reserve Banks, and the FOMC are structured, I wrote a full thread all about that, you can find here:

The FOMC holds eight scheduled meetings each year. The regular meetings. But they sometimes meet in-between these meetings. These are unscheduled or emergency meetings.

Recent emergency meetings include one in September 1998 (LTCM implosion), 2X in 2001 (Tech Bubble Burst and 9/11), three in 2007/8 (the Great Financial Crisis), and two emergency meetings in March, 2020 (Covid Meltdown).

Fed emergency meetings mean one thing and one thing only: monetary easing.

Aka, fire up the money printer. 🔥

But what about the rest of the meetings? The regularly scheduled ones? What's the purpose and and how do we get a read on those?

Other than listening to Fed pundits like Nik Timiraos and FinTwit, that is...

Well, during these regularly scheduled meetings, the FOMC gathers to discuss the economy and its role in either stimulating or restricting access to money, credit, etc. for institutions and individuals.

Monetary Policy.

One note, these meetings last for two days, typically Tuesday and Wednesday, culminating with a press release announcing policy decisions and then a press conference, featuring the Fed Chairman, currently Jerome Powell.

More detail on that in a moment.

First, what is going on in those meetings for two days? What are they talking about?

Well, as you can imagine, they're discussing everything from economic indicators and data to financial markets to the overall economic outlook. All the participants (the full Board of Governors and all 12 Reserve Bank Presidents) give their opinions on the economic environment and the overall data.

At times, as we have seen, it may be more of an exercise like reading tea leaves.

This is because economic indicators are (Fed-admitted) lagging, and also (Fed-complained) highly imperfect.

Even so, it's what they have to go with, and this is what ultimately then drives monetary policy.

Other topics may include bank and/or financial stability, economic projections, or maybe the repo and reverse repo markets, as well as special programs like the BTFP and its effects on bank reserves, etc.

Remember, the Fed has two stated goals:

1) Price Stability

2) Maximum Employment

In other words, control inflation without imploding the jobs market.

Once all the deliberation and tea-leaf reading is finished, only the 12 designated FOMC Members vote on actual policy decisions.

Raise, lower, or keep rates steady. And start, continue, or stop open market operations (QE or QT).

OK, so once this meeting ends and they've made their collective decision(s) on monetary policy(ies), then what?

🧐 The Press Release

First comes the official Fed Press Release, detailing the policy decision and some of the reasoning behind it. This is released at 2pm ET, after the meeting has ended.

The whole financial world seems to be waiting, poised on pins and needles, for the Fed Meeting Press Release.

And yes, the press release in and of itself is the first vital dose of information.

It tells us:

Rate decisions

Open market operations decisions

and some reasoning behind the decisions

But often what really matters to investors is the next level of detail.

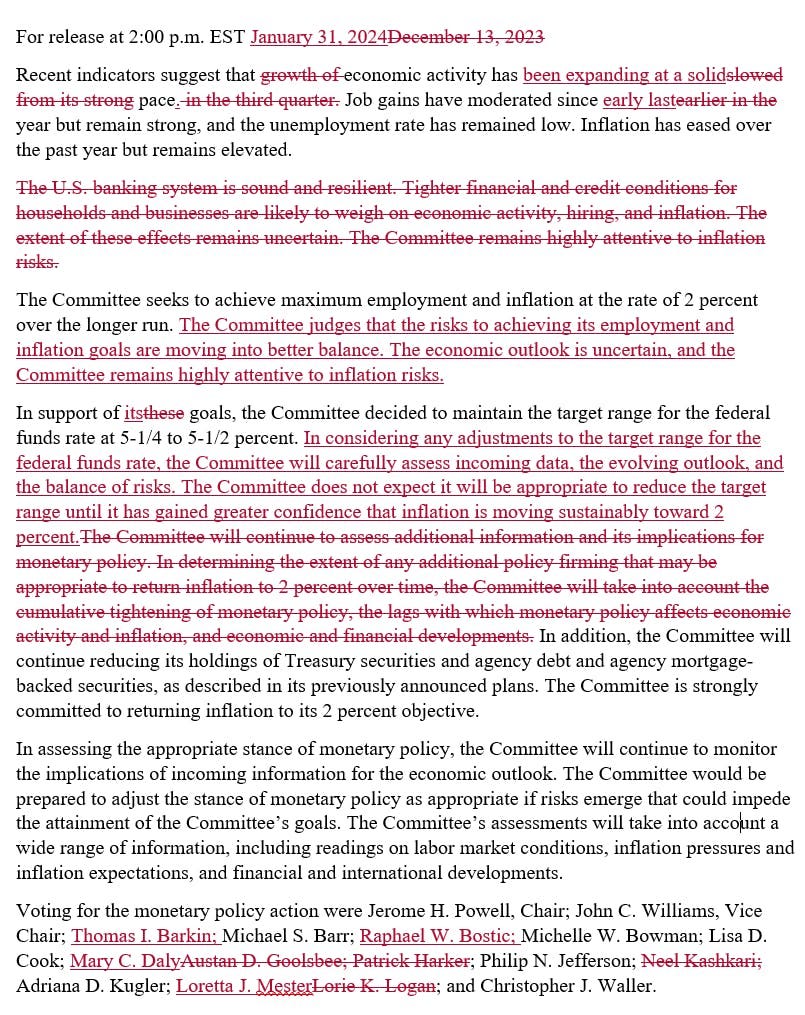

The Press Release Redline.

If you're an attorney or work with documents, you know exactly what I am talking about here. If not, let me explain.

See, the redline version of a document is exactly what it sounds like: a document that highlights all the changes that were made from the previous document, in red text and crossouts.

In this case, we are comparing the current meeting's press release with the last meeting's press release, and detailing all the changes in RED.

Like so:

And so, what we are looking for here is not just what the decision on rates was, but the language around the reason for that decision. And how that language may have changed.

This can sometimes give us important clues to the Fed's thinking, whether they are deepening their current stance (entrenching) or beginning to change their views (pivoting).

Looking at the latest redlined press release, we see a few things:

language has turned more hawkish (i.e., worried about further or a flare-up of inflation)

a strong reiteration of 2% inflation goal (mentioned 3 times + this redline adjustment)

no redline to QT policy language

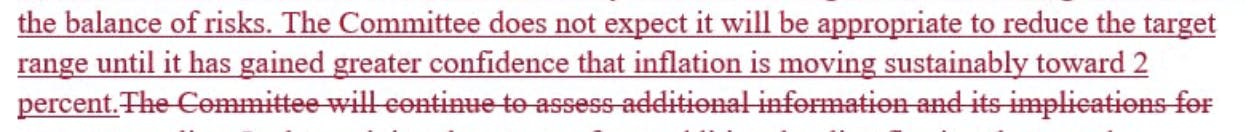

and an interesting removal of one important paragraph

Now, some people are speculating that the Fed removed this paragraph because of the impairment of New York Community Bancorp just the day before. I.e., The Fed feels it cannot keep that sentence in the press release if it believes the system is not strong and resilient as of today.

I don't agree with this thinking.

I actually believe it was already planned to be removed, as it was added back in March, 2023 after the Silicon Valley Bank implosion and they've kept in every release since. It makes sense in this new year that they'd want to remove it.

The Fed likely wants to convey the message that this is no longer needed to be included, as it is now a forgone conclusion that we have regained strength and resilience in the banking system.

SVB is long behind us...

I, of course, do not believe it is a foregone conclusion, but this is what I think their intention was in its removal.

It would have helped if Nik or any other reporter had actually asked about it in the subsequent press conference, but hey, some of this is a game of dress-up, and nobody wants to be un-invited to the next Fed party by asking the host in front of everyone why the dip smells off.

But on that, the next step in reading the tea leaves of the Fed tea-reading exercise.

The Fed press conference, aka the Powell Presser.

🤨 The Prepared Remarks

The press conference begins at 2:30pm ET, thirty minutes after the policy decision press release is published, giving everyone a few minutes to study the redlines and draw conclusions on language changes and/or additions.

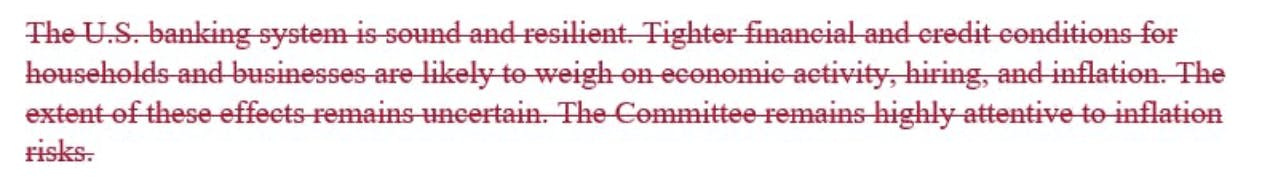

The Fed Chairman, Jerome Powell, first reads prepared remarks that are meant to reinforce the language and stance of the press release, and perhaps add some nuance for the commensurate Q&A session.

BTW, if you've never seen one of these pressers, they can be fascinating. Like watching a ping-pong language match, seeing how calm and collected or unnerved, frustrated The Chairman gets (always the return player, never the server).

The latest presser can be seen here:

In the latest press conference, Powell used the prepared remarks to reinforce certain things and guide others.

A few observations:

First, he mentioned the 2 percent inflation target 6 times

As usual, he referenced certain data to back up the decision of the FOMC, such as GDP numbers, unemployment rates, housing, mortgages, business investment, as well as labor force participation, PCE, and other data

He said, "We believe that our policy rate is likely at its peak for this tightening cycle."

But also, "We are prepared to maintain the current target range for the federal funds rate for longer..."

And, "Restoring price stability is essential to set the stage for achieving maximum employment and stable prices over the longer run."

These last referenced statements seem directed right at Wall Street and investors who have been speculating and almost clamoring for lower rates, and some politicians, like Lizzy Warren have already begun to demand lower rates.

The nerve.

Look at the Fed Futures expectations before the Fed Meeting and Press Conference:

That's right, the markets were still estimating an almost 50% probability of a rate cut in March. With markets and assets ripping higher and interest rates tanking lower on this speculation, this does not help The Fed's goal of reducing inflation to 2%.

But then, after the press conference and Q&A:

The probability was cut down to 37%:

Perhaps they are starting to believe the higher for longer narrative after Powell's mention of 2 percent inflation target in the press release 3 times and 6 more times in the prepared remarks.

Still optimistic IMO, but hey, that's Wall Street for you. They are conditioned to receive help from the Fed.

I mean, can you blame them, really?

OK, so we have the Meeting, the Press Release, the Prepared Remarks.

Next up?

An old fashioned Q & A session.

🤔 The Q & A

What we are looking for—listening for—here, is the nuance in Powell's words and the inflections of his voice.

A few observations from this month's Fed Q & A session:

First, overall, he just seemed more timid and defensive than the last press conference, less confident, perhaps

Second, Powell made a point over and over to say that while the Fed has certainly made progress on inflation they are not done yet: "We feel like inflation is coming down....we're trying to...identify a place where we're really confident about inflation getting back down to 2 percent so that we can then begin the process of dialing back the restrictive level." and "we're wanting to see, you know, more data.", etc...

He expects to lower rates this year, but not sure when: "...almost everyone on the Committee is in favor of moving rates down this year. But the timing of that is going to be linked to our gaining confidence that inflation is on a sustainable path down to 2 percent."

There was zero chance of a cut this month: "There was no proposal to cut rates."

Re: soft-landing narrative: "No, I wouldn't say we've achieved that. And I think we have a ways to go. Inflation is still, you know, core inflation is still well above target on a 12-month basis."

And perhaps the most telling statement of all:

"I think that that is a risk, the risk that inflation would reaccelerate. I think the greater risk is that it would stabilize at a level meaningfully above 2 percent."

Ah, there it is. The nugget of hope. The liquid glimmer of the punch bowl.

Cowbell.

Powell knows it will be extremely damaging to have a recession. And he knows that inflation is a necessary component of the current and ongoing financial system.

Without inflation, the mountain of federal debt will simply bury us.

And hence, him.

Requiring another round of massive money printing.

The market, of course, knows this, too, and has chosen to anticipate cuts ahead of a recession.

Call it a soft landing, a no-landing, a continued fiscal deficit driven expansion.

They're all the same.

And the market hangs on...Every. Single. Word.

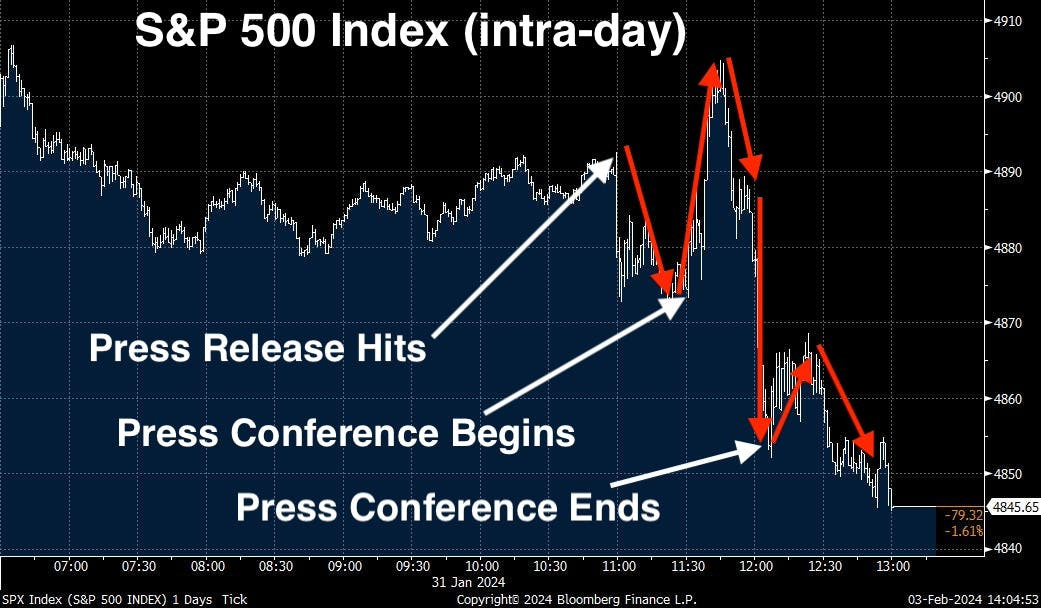

Just look at the price action of the S&P 500 Index during the Powell Presser last week:

*Note, these are all in Pacific Time, as that's where I reside

Like a bouncing super ball.

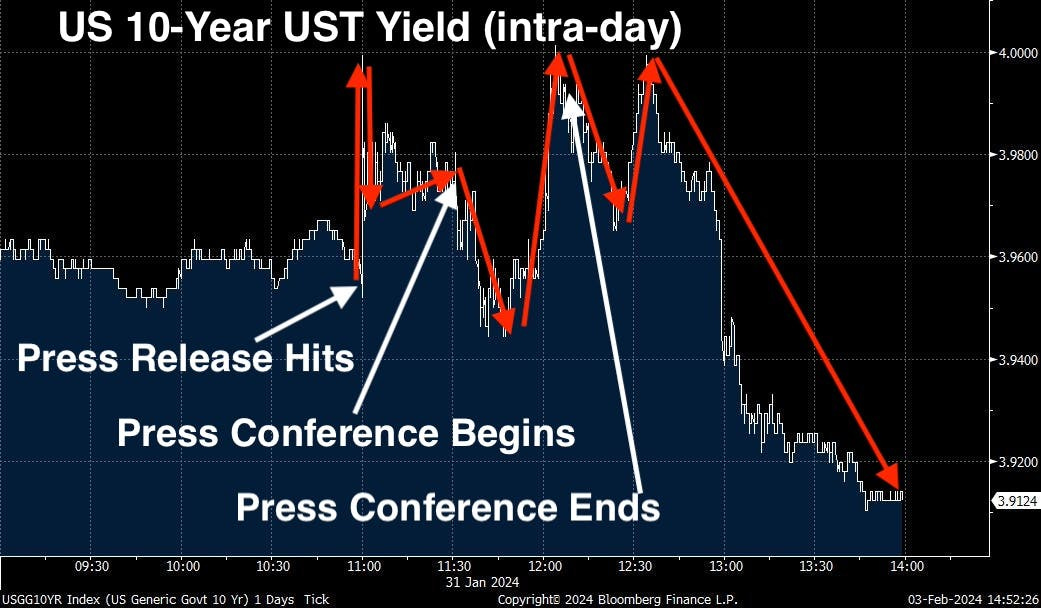

And look at the 10-Year UST, the benchmark security of the world:

Good Lord.

Powell whips the markets around these days, doesn't he?

OK, so now we've had the Q & A (and there's much much more in there, if you want to go have a peek yourself), what is the last piece of a Fed Meeting communication? Or, sort of last...

The Fed Meeting Minutes.

😐 The Minutes

Once we have been through the Press Release, the Prepared Remarks, and the Q&A, there's one final set of words that maaaay just include a nugget or gem for us to focus on, as investors.

The Meeting Minutes.

Yep, just like any board meeting, the Fed also keeps a (so-called) accurate record of the discussions during each official FOMC meeting.

And they are released three weeks after the meeting.

Every once in a while, there is something in there that wasn't detailed in the Press Release or Prepared Remarks and was not touched on in the Q & A.

Not often, but on occasion.

For instance the last set of minutes from the December meeting pretty much confirmed what The Fed had communicated on the day of the press conference.

OK, if nothing there, then what? Where else can we get more information from, about The Fed?

What if the Press Release, the Prepared Comments, the Presser, and the Q & A Session are not enough???

What if we want MOAR?

😵💫 The Ongoing Pressers

If all this Fed Speak is just not enough, have no fear.

There's always more from The Fed.

After all, Fed Members love nothing more than to get up on stage or at a podium, or heck, even just give an off-the-cuff remark regularly.

It seems we have a different Fed official spouting off something almost daily now.

Often, multiple times a day.

Look at this week's schedule:

Nine speakers just this week! And a 2x Collins package. Lucky us!

Perhaps they're all feeling a little left out and a need for the spotlight after The Powell HourPresser last week...

Fun fact: when Fed officials speak off the cuff, they often contradict one another.

One may say that inflation looks tamed or beat, while another just an hour later says inflation is nowhere near beat.

Ah, the fun and games they play at the Fed.

But any way you cut it, they are here to stay for now, and they continue to impact markets one way or another. So, understanding why and how can help your investing.

That’s it. I hope you feel a little bit smarter knowing about the Fed and their meetings and how you can read into the various commentary yourself.

If you enjoyed this newsletter and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️