💡 Do Price Controls Work?

Issue 129

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

US Pricing Reality

Theory of Price Controls

Real World Examples

Portfolio Positioning

Inspirational Tweet:

By now you have likely heard and seen an absolute barrage of soundbites and headlines regarding the presidential candidates’ potential policies and proposals for once they get back in (or ascend) to the Oval Office.

But none of them have gotten quite as much attention as the banger that the Harris campaign (Kamala herself, actually) hit the street with this past week.

In short, Harris said she would institute a federal price-fixing plan for corporations, as president, to stop "big corporations" from taking advantage of consumers.

AKA, price controls.

She has been campaigning and repeating that prices are too high, especially for groceries, and she is going to force companies to bring them down.

The idea and plan has been widely criticized and panned across the board by everyone from Fox to CNN to even the far-left leaning Washington Post.

Regardless of your politics, it’s time to put on our critical thinking hats today.

First, what has been going on with grocers and food manufactures and are they, in fact, participating in what Harris describes as ‘price gouging’ their customers.

Second, if she does ascend to the Presidency and enacts some sort of Soviet-style price control structure, what is the theoretical outcome, and what has history taught us about these policies?

And finally, I’ll give you my thoughts on what is really going on here (hint: it’s political).

A lot to chew on here, though, and we will do it as cleanly and simply as possible, as always.

So, grab your favorite mug of coffee and settle into a nice comfortable seat for some Sunday fun Econ 101 with The Informationist.

🧐 US Pricing Reality

First things first. Have prices been going up astronomically because of ‘price gouging’, as Harris suggested, or is it something else?

Well, if you have been following me, you know that I strongly believe (and we have solid evidence that) the cause of inflation—across the board—is most tightly correlated to the expansion of the money supply.

Inflation occurs when there are more units of a currency chasing a slower growing (or contracting) set of goods.

To simplify even further, more dollars equals higher prices.

That said, this type of rapid expansion in the money supply, like we witnessed after lockdowns and Fed QE + stimulus checks sent directly to consumers, can produce inefficiencies and noise.

This could in turn produce opportunity for large companies to take advantage of consumers when selling necessities like food.

So, have they been gouging consumers on food prices, as Harris suggests?

If we look at the data from the USDA and producers, reports show significant increases in input costs, including labor, transportation, and raw materials since 2020.

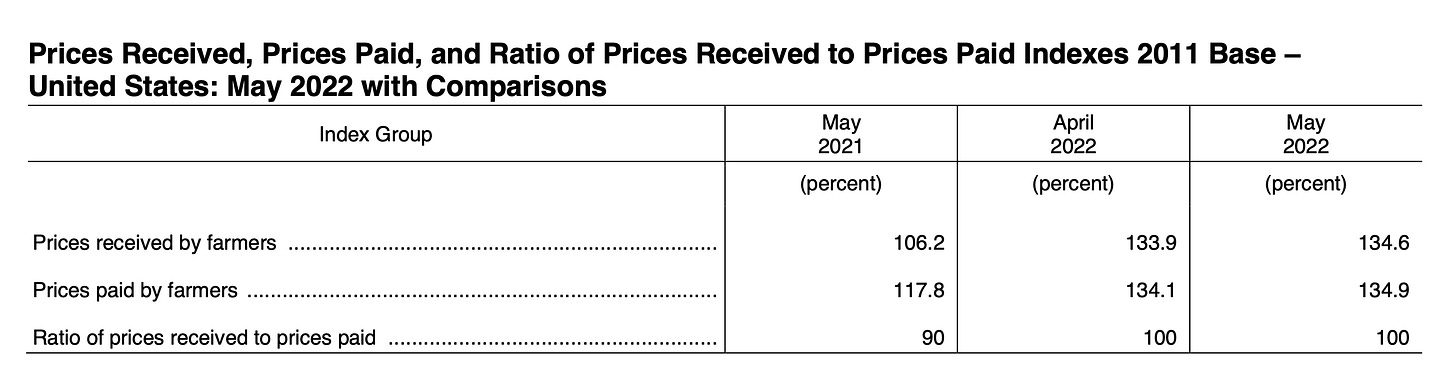

As evidenced by the Producer Price Indices shown below.

What we see here is that the prices for farm-related commodities and shipping costs both spiked in 2021 to 2023. Labor also increased.

However, the overall consumer prices for food (at home) rose less than the costs to create that food.

To simplify, this means that producers and/or retailers (grocery stores) profit margins were lower.

So, the grocery stores were passing along some of the increases, but not all of them. They were not only not price gouging, but they were profiting less than before 2021.

This is verified by the USDA in a recent report:

Agricultural commodity prices rose by around 12-15% between 2021 and 2023

Labor costs in food production and retail increased by approximately 5-7% during the same period, driven by rising wages and a tight labor market

Transportation costs surged, driven by fuel prices and ongoing supply chain disruptions

The ultimate result?

Grocers increased prices for consumers at a slower rate than what they paid for the goods themselves:

The gap you see here between the PPI and CPI suggests that retailers are absorbing some cost pressures, resulting in tighter margins.

Hardly price gouging.

But let’s pretend that the above data is not perfectly accurate and that there is still room for so-called price controls.

What does that mean, and what would—in theory—be the ultimate result?

🤓 Theory of Price Controls

The proposal suggests that the government would determine the appropriate prices for goods by instituting a limit on the prices that producers and/or grocers could charge.

While this may seem a good idea to some, especially those who are struggling to make ends meet in this constant inflationary environment, the intended consequences likely will not match up with reality.