💡Dallas Fed Survey: Recession Red Flag?

Issue 118

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Surveys

The Importance

Current and Recent Conditions

The Comments

The Significance

Inspirational Tweet:

If you were not aware, the Bureau of Labor Services (BLS) and the Bureau of Economic Analysis (BEA) are not the only entities measuring the health of the economy.

You may have read a recent Informationist newsletter explaining the Michigan Consumer Sentiment survey, and how The Fed and investors look at this and various other measures when making decisions.

Of course, CPI, PCE and unemployment are the strongest and most important indicators for The Fed, but they in and of themselves do not—cannot—tell the whole story.

This is where the Regional Federal Reserve Banks come in (among other entities, like U Mich).

By measuring economic activity and sentiment in certain regions of the country, we can begin to see a more complete picture of the economy as a whole.

Now the question bears, what exactly is going on in some of these regions, and is the economy, as Zerohedge states above, the worst since the Great Recession?

And how important is the Dallas Fed’s data anyway?

If this has you intrigued or scratching your head, good news. Because we ‘re going to dive into Fed Surveys today.

But have no fear, we will keep it super simple, avoiding confusing macro-speak and acronyms, as always today.

So, grab your favorite cup of coffee and settle in for a peek into Dallas Fed Surveys with The Informationist.

🤓 The Surveys

There are a plethora of surveys conducted regularly that measure the health of the economy, and some of the most important ones are conducted by Regional Federal Reserve Banks themselves.

I mean, what better way to gauge the economy and its participants than asking the participants themselves how it is going?

For example, Manufacturing is measured by the Dallas Fed Manufacturing Index, Philadelphia Fed Manufacturing Business Outlook Survey, and Richmond Fed Manufacturing Index.

We also have other aspects of the economy measured by the Kansas City Fed's Agricultural Credit Survey, the Dallas Fed’s Energy Survey, the New York Fed's Small Business Credit Survey and Survey of Consumer Expectations, and others.

The point of all these surveys is to help The Federal Reserve set monetary policy according to actual economic conditions. Both regional and national.

Often what these Fed officials are looking for is early signals of economic shifts, such as recessions or recoveries, as well as an overall shift in sentiment within various areas of the economy

By focusing on specific regions, these surveys can often capture local economic nuances that national surveys might overlook, offering a more detailed and comprehensive economic picture.

One of the most important regions to tap into the pulse of the overall economy is none other than Texas.

Why?

Texas ranks as the second-largest economy among U.S. states with a GDP of $1.8 trillion, driven by a diverse economy including technology, energy, agriculture, and manufacturing sectors.

This is only second to California, with a GDP of $3.9 trillion, the fifth-largest economy in the world. But while California is the largest economy, its Federal Reserve Bank in San Francisco does not collect super meaningful economic data like the others.

And if you are wondering where DC fits in on this scale, it only generated $146B of GDP in 2023.

A big spender, but not a big producer. 🙄

In any case, today we are focused on the Texas surveys, particularly the Dallas Fed Manufacturing Index and the Dallas Fed Services Survey (which includes the Texas Retail Outlook Survey).

And within these three surveys, we get a wide range of data and sentiment.

The Manufacturing Survey measures everything from production to prices paid for materials versus prices received for finished goods to overall employment, etc.

The Services Survey measures revenue, input prices versus selling prices, wages, employment and general business sentiment.

And The Retail Survey also measures sales, input prices versus selling prices, wages, employment and general business sentiment.

So, how accurate are these surveys?

Do they actually help The Big Fed execute monetary policy any more effectively with the surveys as economic indicators?

🧐 The Importance

As you may expect, being the 2nd largest GDP in the nation, Texas gives some solid clues to any pending nationwide economic downturns or recessions.

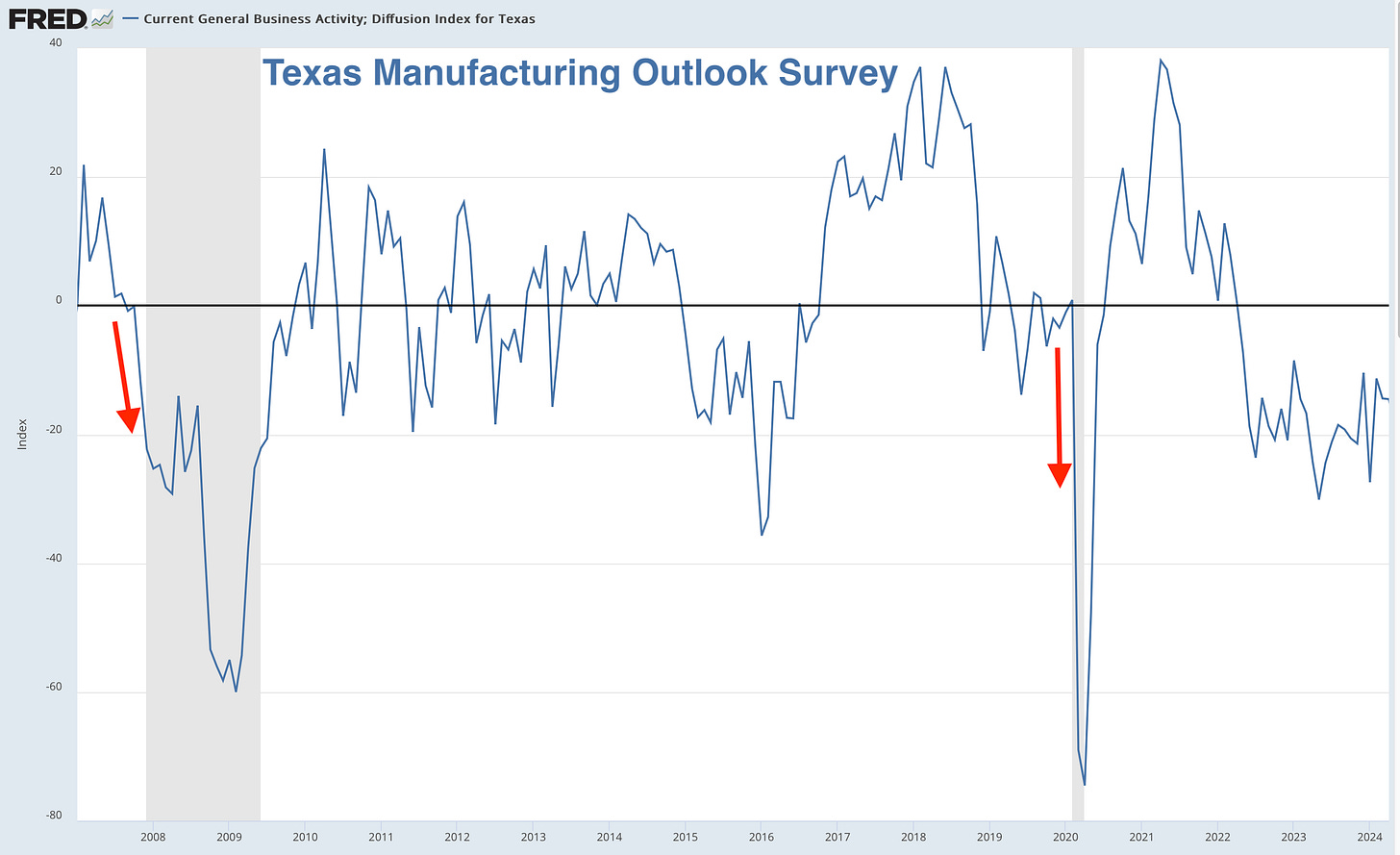

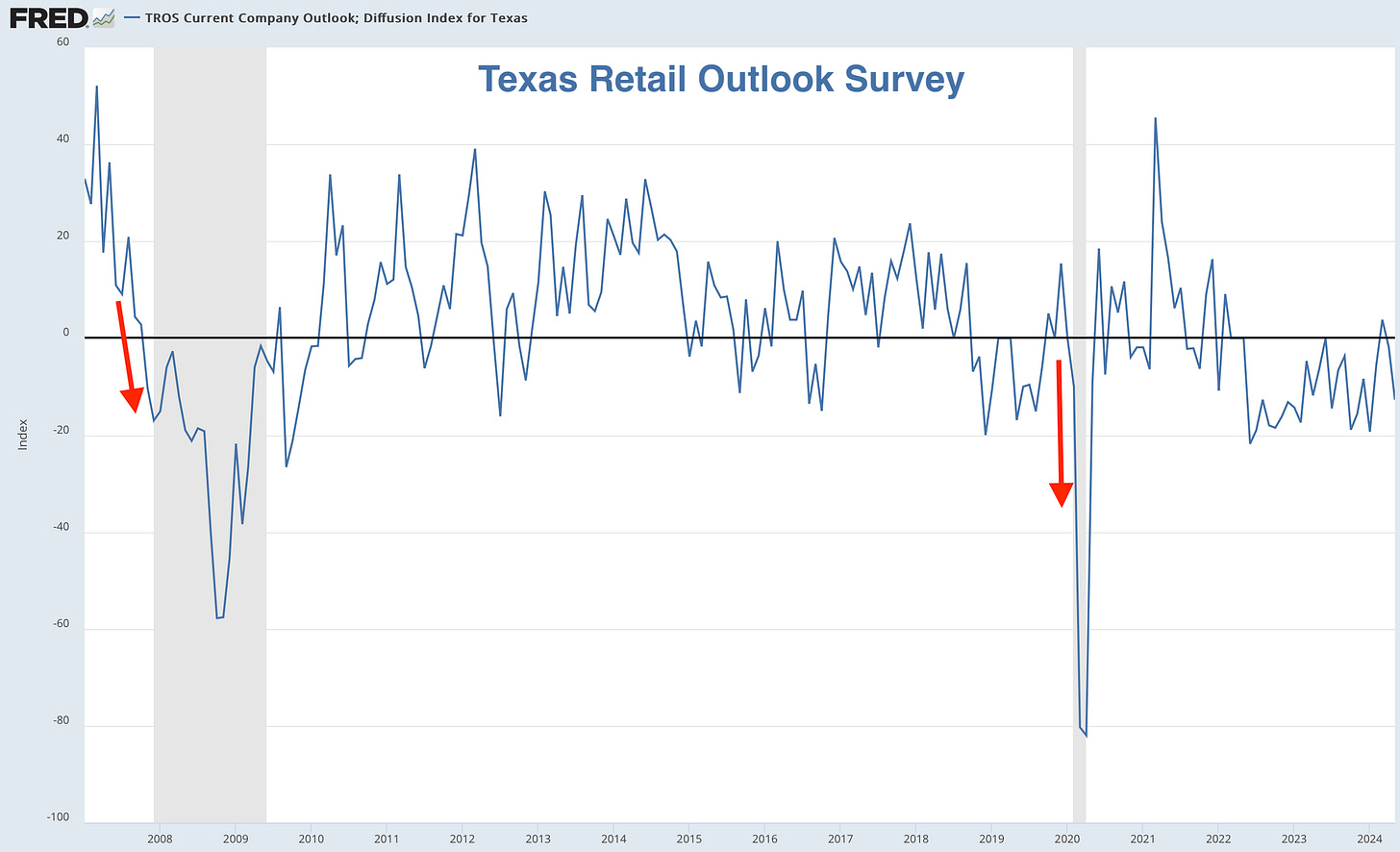

No surprise, all three surveys showed a clear shift in sentiment prior to the 2008 Great Financial Crisis, and of course the 2020 Covid debacle.

Manufacturing:

Services:

Retail:

Almost perfectly dovetailing with the nationwide ISM Purchasing Managers Index, a monthly survey of supply chain managers measuring the activity level of purchasing managers in the manufacturing sector.

In fact, the Texas surveys seemed to do a slightly better job at predicting the GFC than the ISM PMI surveys, as sentiment shifted lower in the Dallas Fed surveys before the ISM PMI survey.

OK, so that’s all well and good. But what is the latest Dallas Fed survey showing us? Where does the Texas economy, a bell-weather for the rest of the nation, stand now, and are the numbers the ‘worst since the Great Recession’?

🫣 Current and Recent Conditions

Let’s just say, they‘re not good.