✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

What is BRICS?

BRICS → BRIICSS

BRIICS+ and the Prisoner’s Dilemma

Could BRIICS+ lead to hyperbitcoinization?

Inspirational Tweet:

https://twitter.com/LynAldenContact/status/1645825098937450496?s=20

Lyn knows how to drive right to the heart of it, doesn’t she? And Jesse makes an important observation re: the BRICS nations seeking to escape the grip of US hegemony, i.e., being forced to hold US Treasuries and use USDs for global transactions.

But what exactly, or should I say, who exactly are the BRICS, and why is this development so important to the US and the USD?

Super important questions, growing ever-more important daily. Ones that we’re going to tackle today.

But don’t worry, it’ll be like my bulldog tackling a cupcake. Quick, easy, painless.

Tasty, even.

So, grab a cup of coffee and settle in for this week’s Informationist.

Join the 🧠Informationist community and get access to every single post + the entire archive of articles, all for a fraction of the cost of a college finance course.

You’ll learn a whole lot more, faster and easier. That’s my guarantee.

Partner spot

Some of you have been asking recently what I read in the morning for fast, digestible news, and I’m happy to report that my new favorite source, hands down, is 1440.

The folks at 1440 scour over 100 sources every morning so you don't have to. You'll save time and start your day smarter. What more could you ask for?

Sign up for 1440 now and get your first issue, immediately. It's completely free—no catches, no nonsense, and absolutely no BS. I wouldn’t recommend it, if I wasn’t sure you’d love it, too.

Join 1440 for free today.

🧐 What is BRICS?

First things first, BRICS is just an acronym for a group of countries seeking to form their own economic cooperation.

A non-Western-centric bloc, you might say.

These countries are currently, Brazil, Russia, India, China, and South Africa.

BRICS.

The name was originally coined by Goldman Sachs economist Jim O’Neill back in 2001, and since South Africa had yet to join, it was just BRIC. They entered in 2010, making it BRICS.

Getting right to the essence of it, BRICS is seeking to break away from the need to hold and transact in USD. They are looking to do this for various reasons, but two are the clear standouts:

By continuing to use USDs as the primary medium of exchange, these countries continue to feed the economic engine of the US, likely at the expense of their own economic growth

In needing USDs for transactions, this forces these countries to hold reserves of USD and US Treasuries as reserve assets, and there are two reasons they’re looking to opt out of USTs:

When the US sanctioned Russia last year, freezing their US Treasury holdings and shutting them out from SWIFT (the worldwide money transfer system), the US demonstrated authoritarian control over any USD denominated asset held in foreign treasuries.

The US Treasury has repeatedly printed USD to buy its own debt during times of crisis, and this has expanded the money supply and induced perpetual inflation. Put simply, the USD is worth less every single year — and anyone holding USTs or USD loses purchasing power.

Pretty good reasons to opt out of the USD, actually.

Instead, the BRICS alliance would like to either agree to transact in their own currencies or adopt a European-style model, where one currency (like the Chinese yuan) is the primary medium of exchange between all of them.

And so now, we are hearing increased rumblings, like this:

But how exactly can BRICS accomplish this?

Simple, really: they all migrate away from holding US Treasuries and turn to other assets, like each others’ currencies, gold, or Bitcoin.

And begin convincing others to, as well.

Evidence of this already occurring came last week when we saw the United Arab Emirates (UAE) settle a large LNG (natural gas) trade with China, which was done in…wait for it…Chinese yuan.

Well, well.

Sounds ominous for the USD, when also considering the chart above. These countries combined represent a massive amount of global GDP.

Question then is, could they cause the USD to lose status as the global reserve currency?

But to answer that we must first ask, can the BRICS unseat the US Treasury as the global reserve asset?

🤩BRICS → BRIICSS

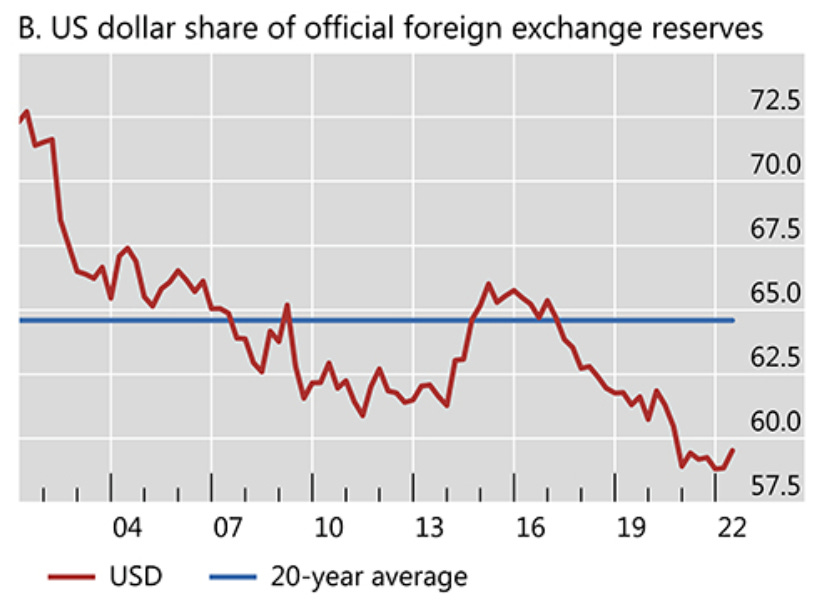

Let’s be honest here, the US Treasury’s dominance as global reserve asset, while not exactly on the ropes, is in decline.

There are many reasons for this, but this past few years has not been kind to the US Treasury. After all, in response to US sanctions, Russia sold their USTs, China has been unwinding theirs, Japan has been forced to reduce theirs to stabilize their own currency, and so on…

As a result, foreign ownership of USTs has decreased significantly as a percentage of total holders over the last decade:

And no surprise, the USD is headed in the same direction.

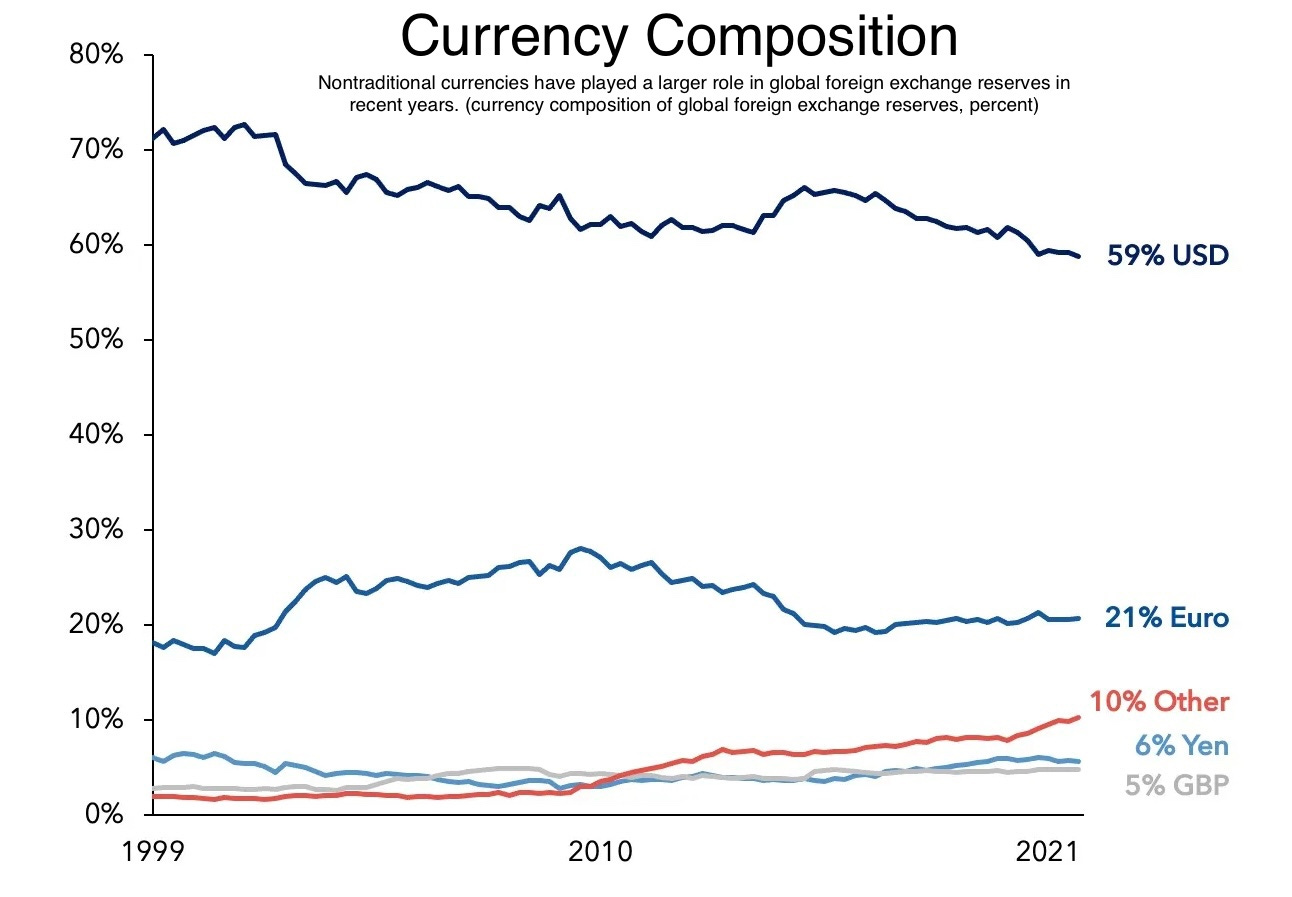

And to put this in context, the lost share is not going to the euro, the British pound, or the yen. It is going to ‘other currencies’, which includes the Chinese yuan.

First, let’s be clear. Take another peek at the above chart. There are hundreds of currencies in the world, and the USD is still by far the dominant medium of exchange.

Nothing is even close.

But.

This very dominance is causing certain countries to seek a way to be less dependent on the USD and the UST. To extract themselves from the whims and needs of a central bank that lives a world away from their own economy.

Yet still finds a way to dominate it.

And so as more countries seek to escape this grip, we find other countries applying for ‘membership’ to the BRICS alliance. The two most recent inquiries came from Iran and Saudi Arabia.

Iran is no surprise.

But wait, you say, the same Saudi Arabia that agreed to settle virtually all their oil trades in USD since we left the gold standard in the early 70’s?

Yes, one and the same.

The resulting cooperative would be dubbed BRIICSS.

Problem is, they have no single currency they can all rely on (read: trust) for denominating an asset in, i.e., a US Treasury. But unlike the Treasury (which is like a mega yacht with a leak in the hull), they must find a way to protect the value of their reserves, to denominate in something that will hold its value, regardless of the currency a nation may need to transact in.

The obvious and overwhelmingly popular choice today?

You got it.

Gold (and Bitcoin?)

Let’s look what’s been recently happening there, next.

Keep reading with a 7-day free trial

Subscribe to The Informationist to keep reading this post and get 7 days of free access to the full post archives.