Bond Vigilantes: They're Back

Issue 85

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today's Bullets:

Who are the Bond Vigilantes

The Worst Bond Market in History

Inflation Concerns or Risk Premiums

Inspirational Tweet:

Bond yields have spiked recently and prices are way down. This has inarguably been the worst bond rout in history.

But what--or perhaps, rather, who--has caused all this pain and destruction?

If you have been paying close attention, you may have heard the term Bond Vigilanterecently. And how they have caused all this bond market pain.

Are the Bond Vigilantes to blame? And who are these so-called vigilantes, anyway?

Increasingly important questions, and ones we will answer, nice and easy as always, today.

So, grab your favorite cup of coffee, saddle up, and settle in for a short Sunday ride with The Informationist.

😡 Who are the Bond Vigilantes

If the term Vigilante stirs up images of Batman or Dirty Harry, then you're on the right track here.

Though the vigilantes in this story, Bond Vigilantes, may be more like John Wick in a V for Vendetta world, when it comes to their sheer tenaciousness and the type of justice they are seeking.

The term Bond Vigilante was originally coined by economist Ed Yardeni in the early 1980s. Some of you may remember that dismal economic period (we've been talking about it a lot here, lately, haven't we?)

In any case, that was a time where inflation was raging and rates were rising. But not quite enough, according to the vigilantes who were logging their protest towards easing monetary and irresponsible fiscal policies.

These large investors were selling bonds, driving up yields and, in turn, increasing the cost of borrowing for governments. Legend has it that they were doing this in retaliation of the growing power of the Federal Reserve.

The bond traders' actions were seen as a way to take the law into their own hands, since the Fed (the Sheriff here) was not adequately managing monetary policy itself.

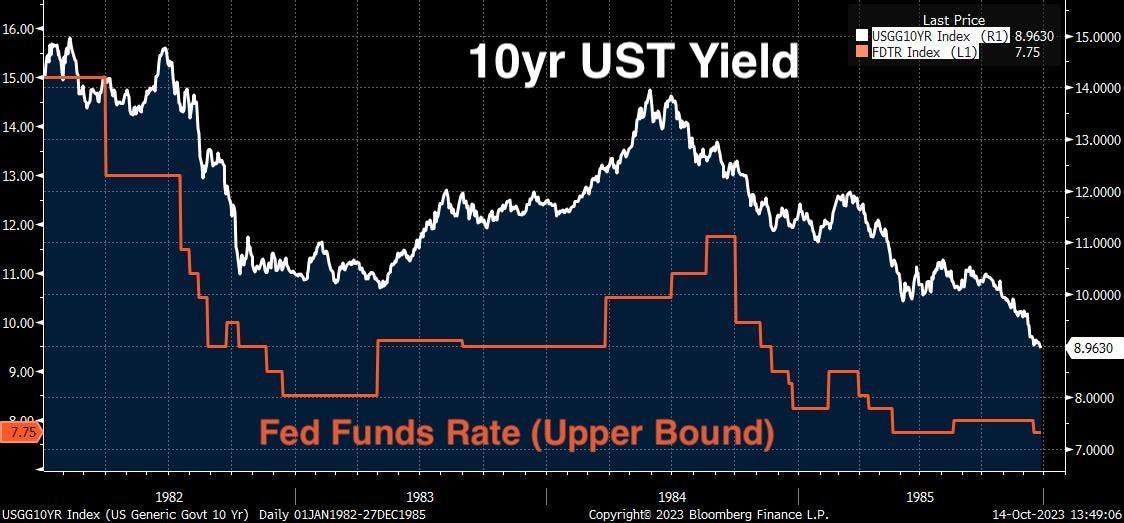

As you can see below, the 10yr UST yields drove higher and remained higher than the upper bound of the Fed Funds policy rate, eventually forcing the rates higher before they eased again.

Flash forward to the early 1990's, and the vigilantes were back at it again.

The Bond Vigilates were so relentless those years, that in 1993, Bill Clinton’s strategist and communications pal James Carville said, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.”

And intimidate they did. Look at how the 10yr held above Fed Funds for years here, until the Fed finally (sort of) caught up in 1995.

By the way, guess who was appointed to join The Fed by President Clinton in 1994?

Would you believe Janet Yellen?

She's been in the sights of the vigilantes before.

No wonder she recently emphasized that she doesn’t “honestly think that that’s the case” today. Arguing instead that, "the bond market is reacting to strong consumer spending and a stabilizing housing market."

For real?

We'll come back to that one.

But for now, Yardeni says the Bond Vigilantes are"driving bond prices down and yields up, and sending a warning to Washington to rein in the deficit and inflation."

After all, have you seen the bond market lately?

Let's have a quick peek, shall we?

😱 The Worst Bond Market in History

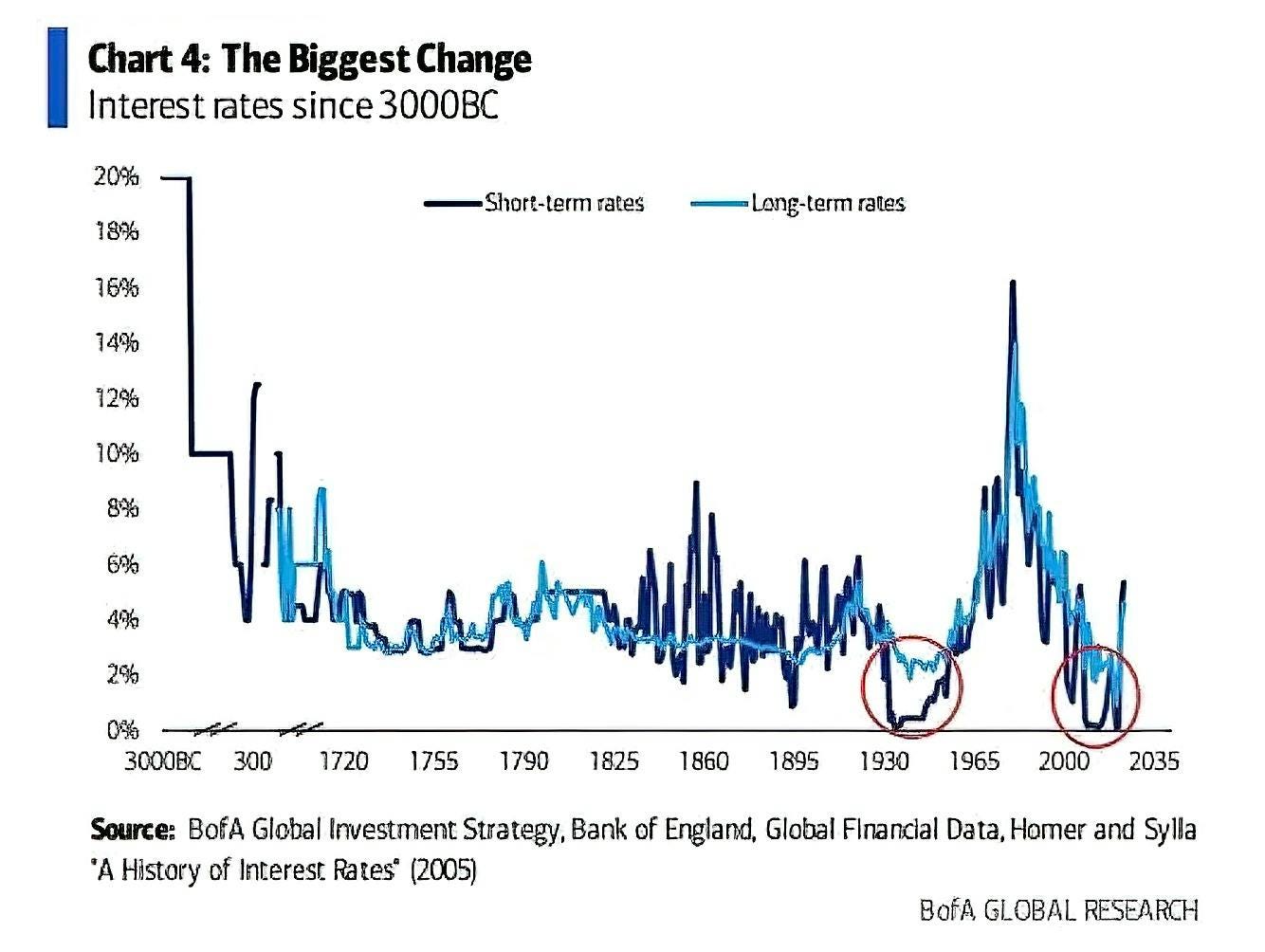

Let's first point out that bond yields in the years from 2008 to 2020 were not normal. In fact, there is nothing normal about ZIRP (Zero Interest Rate Policy), at all.

Recently, analysts at Bank of America somehow unearthed a key historical nugget which validates this point, showing how global long-term interest rates during 2008 to 2020 were the lowest in 5,000 years.

They even charted it out, and even though they left out a few thousand years, we will go with it:

Is it any wonder then, when the US printed trillions of dollars and inflation surged, the longer term interest rates followed higher with it?

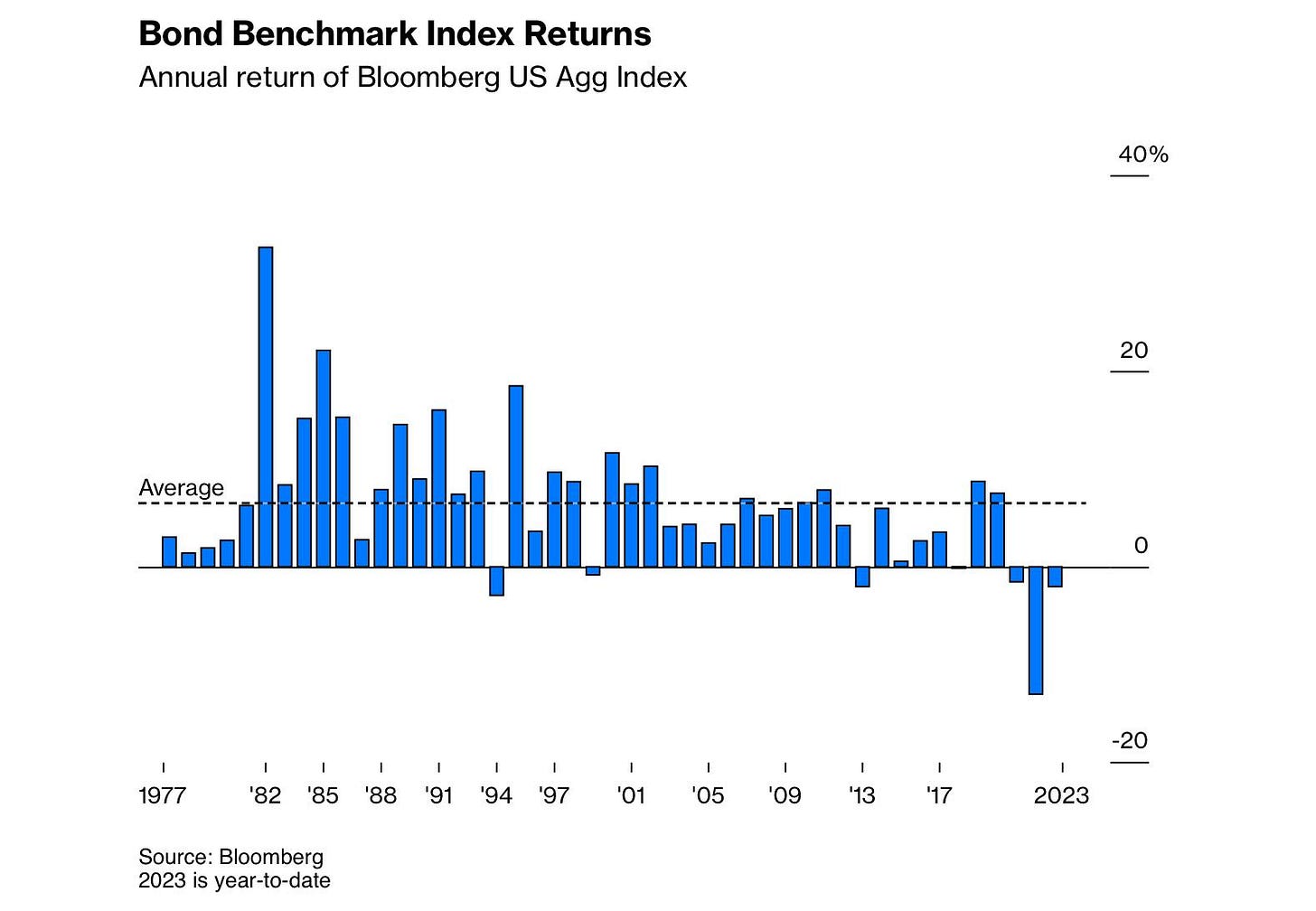

Looking at the aggregate bond market performance:

And the TLT 20yr Bond ETF, down an eye-watering 49% from its highs in 2020:

Pretty bad for the long duration segment of the Treasury market.

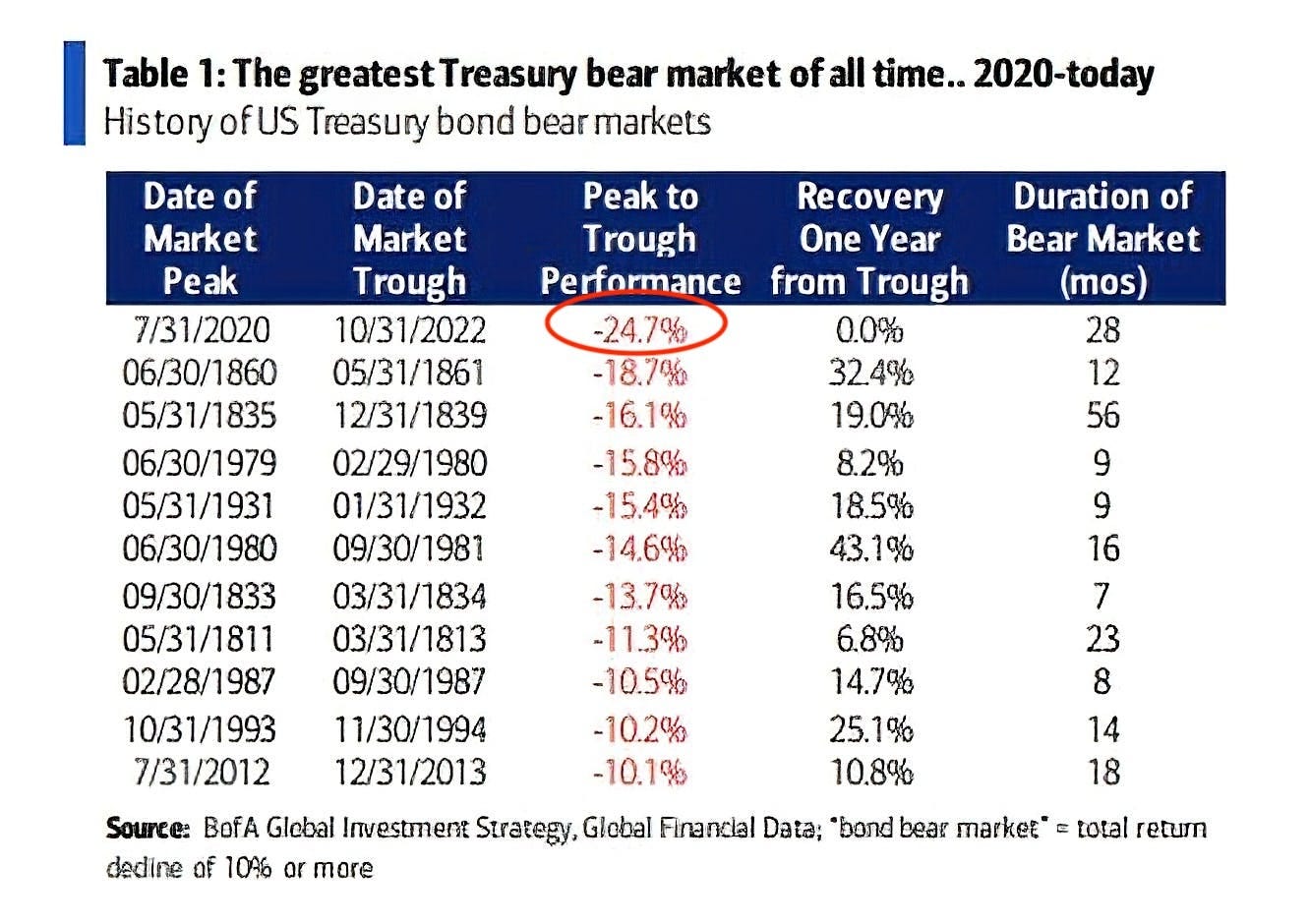

And so, is it the worst performance drawdown for overall Treasuries in history?

From the BofA Team again, going back to the early 1800s:

Ouch.

Question is: is it actually due to the fact that rates were artificially low for a long time, and now we have sticky inflation that is causing expectations of the Fed pushing rates higher, which is causing all this pain?

Or is it something else?

Is it the Bond Vigilantes moving the markets?

Are they, in fact, back, with Janet Yellen in their sights again?

🤨 Inflation Concerns or Risk Premiums

There are clues that the surge in yields of the 10yr and longer duration US Treasuries has much more to do with concerns about fiscal policy (Congress spending) than monetary policy (the Fed taming inflation).

First of all, there are plenty of conflicting signals coming from the economy right now, suggesting uncertainty with inflation and the eventuality of a recession. These are lagging, mind you, so the direction of the data is more important than the absolutes right now.

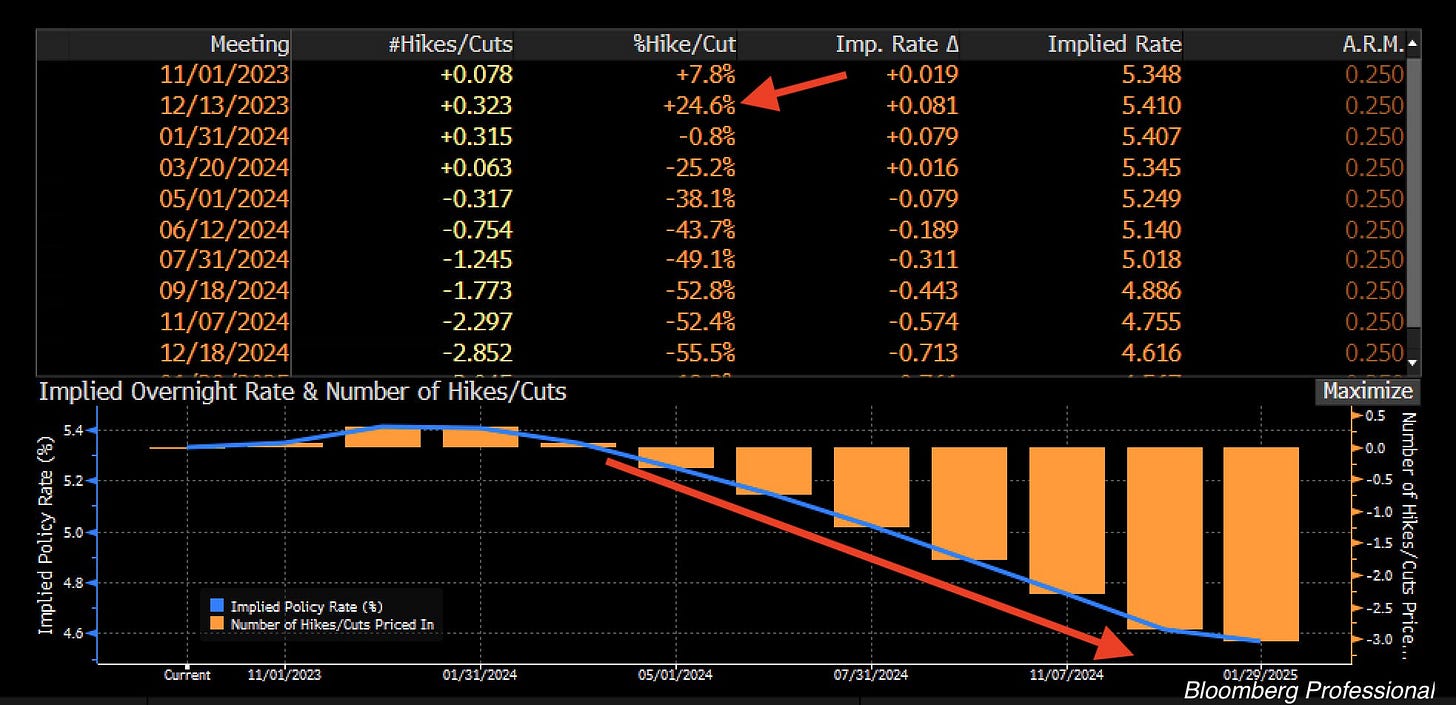

Even so, after some key economic data was released this week, Fed Funds futures have priced in the probability of another rate raise before the end of the year being just 24.6%.

Futures are also pricing in 3 rate cuts before the end of next year, taking rates back down under 5%.

So, why on earth would long term yields be rising in the market?

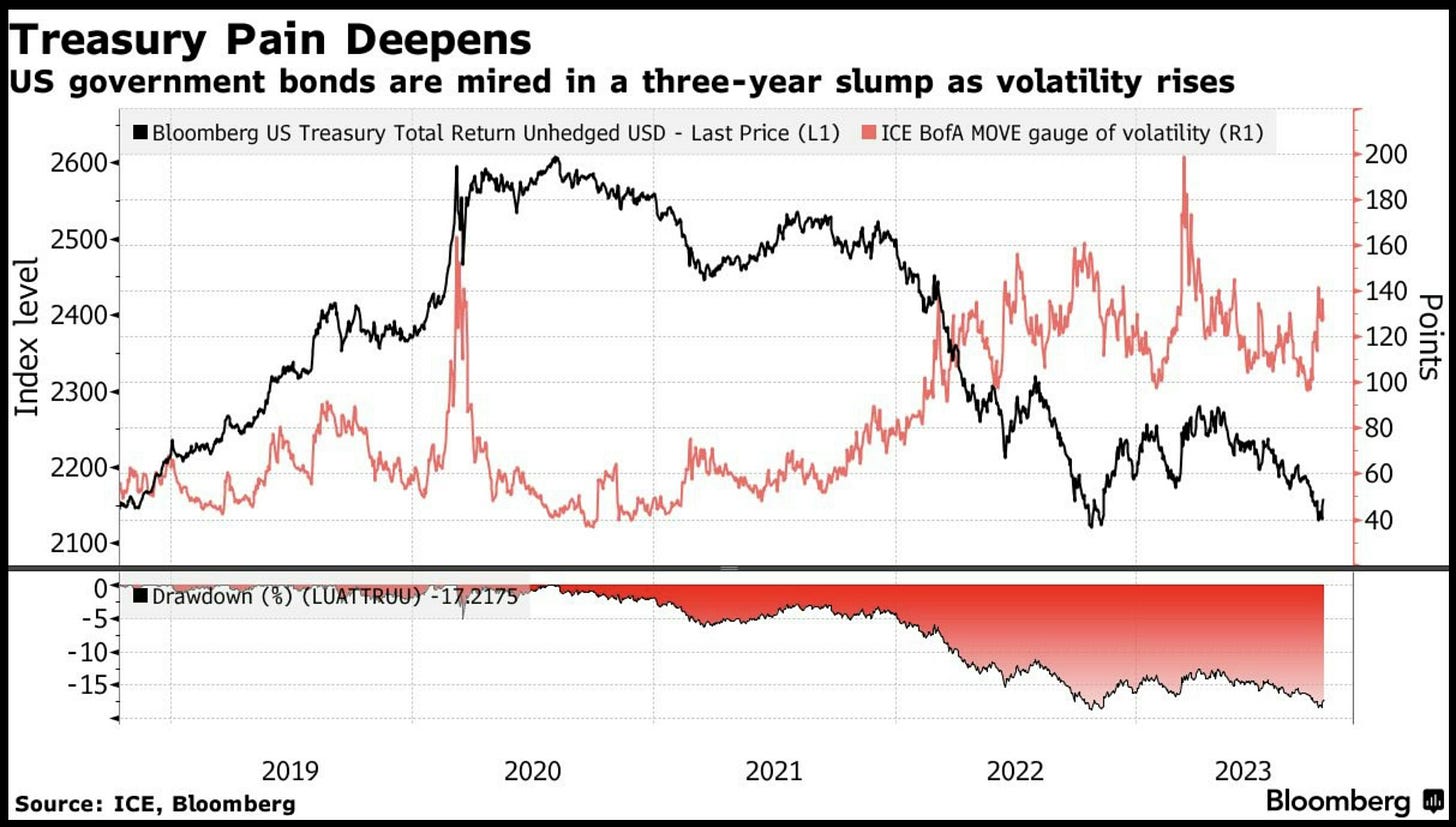

One clue can be found in the MOVE Index, a bond volatility measure that suggests as uncertainty grows, US Treasury total returns have fallen recently.

Which is likely due to this:

Term Premium.

This measure shows how much yield (above short term rates) that investors are demanding to buy a bond. Looking at the 10yr UST Term Premiums above, we can see that investors now want to be compensated for uncertainty in yields ahead.

So, even though Fed Funds futures are showing lower rates next year, the 10yr has been rising.

Why?

Well, when you factor in this:

And this:

You see that federal deficits are now running over 7%, and growing.

That's right.

US deficits are growing so rapidly, that we've already added another $2T of federal debt to the pile that now stands at over $33.5T total.

And over $500B was added in just the last two weeks. 😱

Good. God.

And this is not slowing down, evidenced by the US Treasury recently expanding the size of Treasury auctions, across the board.

To be clear, the bond market is not worried about the US defaulting on its obligations.

No. The sincere concern is that the US government is running such massive deficits that the Treasury will have no choice but to dump a mountain, a virtual Tsunami, of debt onto the market.

Trillions and trillions and trillions of it.

This means that not only will the Treasury soak up every available USD for investment, but investors will demand a higher return for the purchases.

Why?

Because they know that the only way the Fed and Treasury can keep the charade going is by either printing more money and monetizing the debt (like the Bank of Japan is doing) or allowing inflation to run high in order to create larger nominal GDP and paying down that debt through taxing cheaper future dollars.

Either way, it means higher inflation and lower REAL return on those bonds.

Enter the Bond Vigilantes.

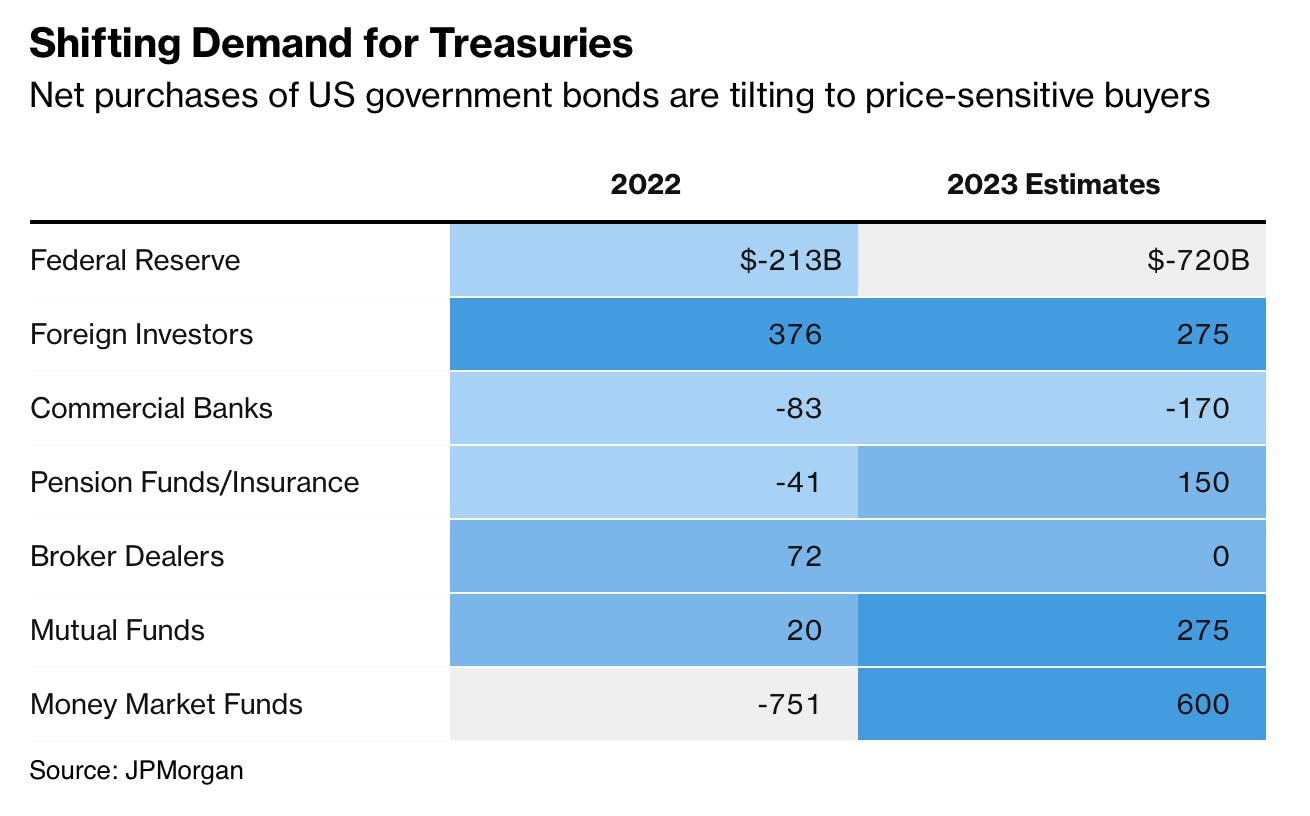

You can see here how the buying base for USTs has shifted to the players in the market who are actually price sensitive (i.e., Pension, Mutual, and Money Market Funds):

What we see here is the Fed competing with the Treasury by trying to peel some of those $8T of USTs off their own balance sheet from massive QE purchases in 2020 and 2021. Also, foreign demand is dropping with two of our largest buyers, China and Japan, now net sellers as they use USTs and USDs to shore up their own currencies and financial situations.

Commercial banks have massive losses from USTs on their balance sheets, evidenced by Silcon Valley Bank and others. They aren't buying more.

Bottom line, whether you like it or not, it appears the Bond Vigilantes are back.

And they mean business.

They may end up doing Powell and the Fed's job for them, driving rates higher and higher, until something in fact, breaks. Or Congress somehow gets their act together and cuts back on ridiculous spending.

I have my money on something breaking first.

Because the Bond Vigilantes are "not only saddled up," as Yardeni said just last week, "but they are on the move."

That’s it. I hope you feel a little bit smarter knowing about bond vigilantes and are ready to start incorporating some of this information into your own investing and portfolios.

And if you enjoyed this newsletter and found it helpful, please share it with someone who you think will love it, too.

Talk soon,

James✌️