💡 Big Banks Embrace Bitcoin

Issue 189

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The SAB-121 Victory (Brief Recap)

BlackRock’s In-Kind Revolution

The IBIT Institutional Surge

JPMorgan’s Collateral Confession

What This Means for Bitcoin

Inspirational Tweet:

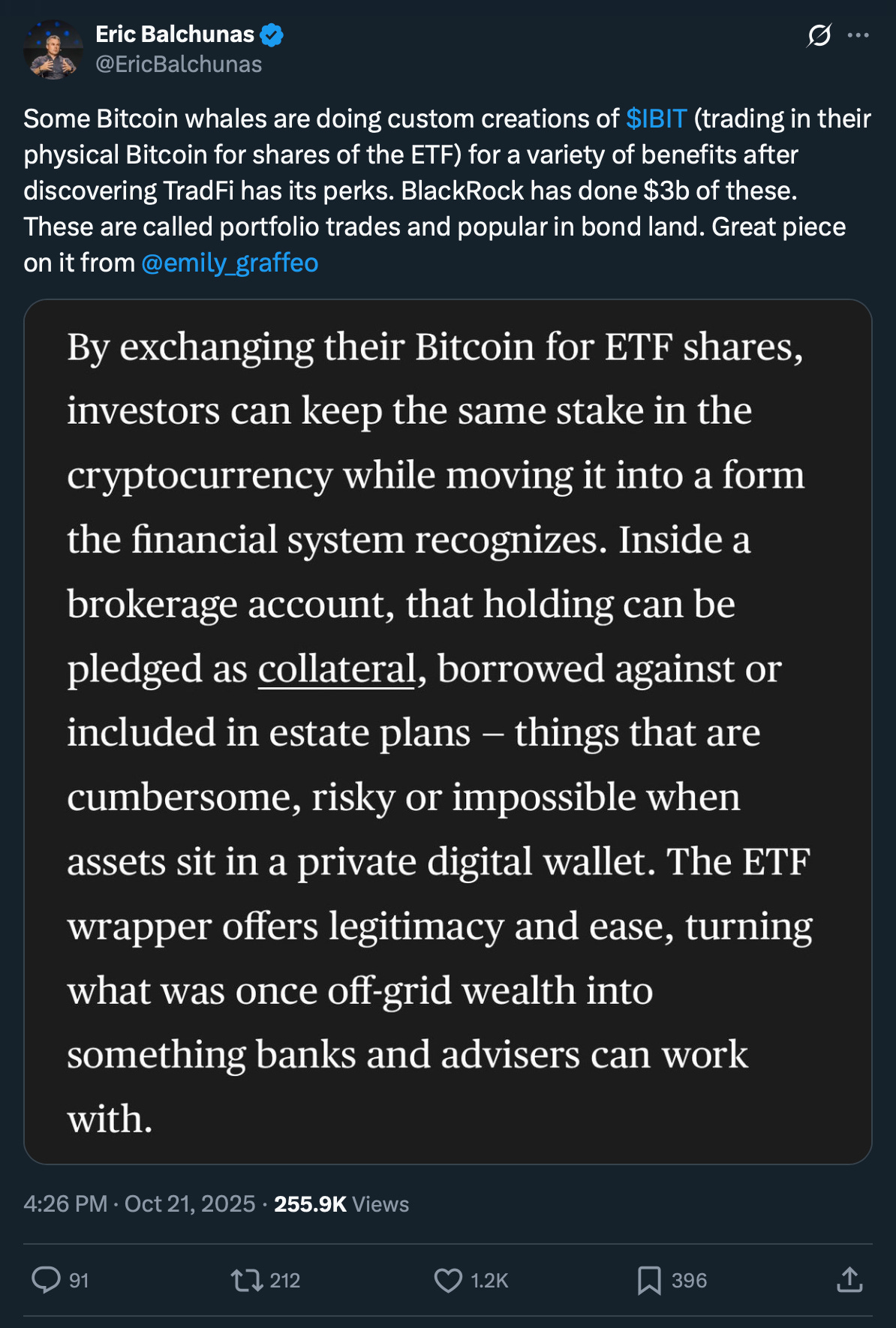

You read that right. Three billion dollars.

That’s how much Bitcoin has quietly moved from private wallets into BlackRock’s IBIT through in-kind contributions, all without a single taxable sale.

This means Bitcoin whales are discovering that traditional finance actually has some useful features.

Like borrowing against your assets without selling them. Like estate planning that doesn’t require explaining seed phrases to your heirs. Like integration into the same wealth preservation strategies the super wealthy use with stocks and bonds.

It’s not just BlackRock. JPMorgan will now accept Bitcoin as collateral for loans. And other massive investment banks hold millions of dollars of Blackrock’s Bitcoin ETF, IBIT. And lastly, we are seeing sovereign wealth funds dip into IBIT, too.

We are going to get into all of that and the importance of some of these recent developments here today.

But have no fear, we will do it nice and easy, as always.

So, pour yourself a big ol’ cup of coffee, and settle into your favorite chair for a look into how Wall Street is quickly changing their tune about Bitcoin with this Sunday’s Informationist.

Partner spot

Is the fiat retirement system sinking? With markets uncertain, layoffs on the rise, and monetary policy shifting, it might be time to rethink how you protect your long-term savings.

On October 28 at 12 PM CT, Mark Moss and Unchained’s Jeff Vandrew will cover:

Why the “illusion of wealth” hides the true weakness of fiat-based retirement accounts

Why bitcoin’s scarcity and growth curve make it the cheat code for retirement planning

How rolling an old 401(k) into a bitcoin IRA could offer tax advantages and help build generational wealth

Learn how bitcoin can protect your purchasing power, strengthen your retirement plan, and offer a level of sovereignty no other retirement asset can.

WHEN: Tuesday, Oct 28 at 12:00 PM CT — online, free to attend.

🤓 The SAB-121 Victory (Brief Recap)

First things first, let’s have a quick breakdown of SAB-121.

I wrote all about it earlier this year, and if you haven’t seen that or want a refresh on it, you can find that issue right here:

But for the TL;DR crowd, here’s the essential background you need to understand what’s happening now.

The Regulatory Chokehold

Staff Accounting Bulletin 121, aka SAB-121, was issued by the SEC in March 2022 under Bitcoin antagonist Gary Gensler.

On the surface, it looked like a simple accounting guideline. In reality, it was a regulatory weapon designed to scare banks away from touching Bitcoin and cryptocurrency.

Here’s how it worked. SAB-121 required any company safeguarding crypto assets for customers to report those holdings as both assets and liabilities on their balance sheets. That means if a bank held one billion dollars in Bitcoin for clients, it had to show one billion on the asset side and one billion on the liability side.

You may now be asking, Why does this matter?

Because under banking regulations, liabilities require capital reserves. So that same bank would need to set aside hundreds of millions of dollars in capital just to custody Bitcoin for customers—capital that could otherwise be deployed for lending, trading, or other profitable activities.

But that’s not the worst of it.

See, the bulletin also imposed onerous risk disclosures, compliance requirements, and operational burdens. Banks would need new systems, new controls, new compliance frameworks, and new audit procedures. The regulatory uncertainty alone was enough to make general counsels stonewall innovation into the space altogether.

Wouldn’t touch it with a ten-foot pole kinda stuff.

Because in practice, ignoring the SEC guidance is like asking to be audited with a microscope. The SEC expects companies to comply, and non-compliance leads to enforcement actions, fines, and regulatory scrutiny that can cost millions.

The Bypass Play

Here’s where Gary and Co. got really sneaky. Instead of pursuing SAB-121 through normal rulemaking, which requires public comment periods, cost-benefit analysis, and Congressional oversight…the SEC just issued it unilaterally.

See, SAB-121 was issued as a “staff accounting bulletin,” which is technically just guidance on how the SEC interprets existing accounting standards.

Gensler and Co. did an end-zone run around Congress entirely.

Makes one want to see the email trails and phone records of one Gary Gensler and one Elizabeth Warren.

In any case, banks that had been exploring digital asset services stopped post haste. Those who had already started programs began winding them down. The regulatory message was clear: touch Bitcoin and crypto at your own risk.

But it didn’t stop there.

SAB-121 was part of a broader coordinated effort that came to be known as “Operation Chokepoint 2.0”—a systematic campaign by multiple regulatory agencies to cut off banking services to crypto companies.

The FDIC, OCC, and Federal Reserve all issued guidance discouraging banks from working with digital asset firms. Bitcoin and crypto associated companies found their bank accounts suddenly closed, wire transfers mysteriously canceled, and new banking relationships nearly impossible to establish.

I experienced this firsthand with my hedge fund, the Bitcoin Opportunity Fund. Wires would be canceled without explanation. Traditional banks would refuse service once they learned we invested in Bitcoin. Heck, they refused to send money to our Delaware based fund just because it had ‘Bitcoin’ in the name. It was a massive operational headache that we eventually overcame, but not without significant time, cost, and frustration.

In any case, the ultimate result of SAB-121 for the industry?

Throughout 2024, even as Bitcoin ETFs launched and absorbed over one hundred billion dollars in assets from retail investors, the banks themselves stayed on the regulatory sidelines.

Retail investors could buy IBIT through their Fidelity or Schwab accounts, but the banks couldn’t custody Bitcoin directly, couldn’t offer it as a product to wealth management clients, and certainly couldn’t use it as collateral for loans.

An important piece to today’s discussion.

I bet some felt like they were watching the California Gold Rush of 1849 from behind a tall fence. The gold was there, the miners were getting rich, but banks were forbidden from participating.

The Congressional Rebellion

Before Trump even took office, Congress had already had enough. In May 2024, the House of Representatives passed a resolution to overturn SAB-121. The vote was 228-182, with twenty-one Democrats joining Republicans to strike down the bulletin. The message from the House was clear: the SEC had overstepped its authority.

Then in late May, the Senate followed suit with a 60-38 vote to overturn SAB-121. This was remarkable—getting sixty votes in the Senate meant significant Democratic support for repealing an accounting bulletin that their own party’s SEC Chairman had championed.

Congress basically slapped down Gensler and told him that SAB-121 represented massive regulatory overreach. They used the Congressional Review Act—a rarely deployed tool that allows Congress to overturn federal regulations—to strike down the bulletin entirely.

But then President Biden, presumably under pressure from Senator Elizabeth Warren and her self-described “anti-crypto army,” vetoed the Congressional resolution. With that veto, SAB-121 snapped right back into force.

The regulatory handcuffs were back on.

Banks stayed away. Institutional adoption stalled.

The Executive Order

Fast forward to January 2025. One of Trump’s very first executive orders repealed SAB-121 by overturning Biden’s veto.

Just like that, with the stroke of a (non-auto) pen, the regulatory handcuffs came off.

The message to Wall Street was clear: the war on Bitcoin and crypto is over. The new administration wants digital asset innovation. Banks are free to offer services, custody assets, and build products without fear of regulatory retaliation.

And Wall Street wasted absolutely zero time responding.

Within weeks, we started seeing announcements. Banks exploring custody services. Wealth management arms considering Bitcoin allocations. And then the big one—BlackRock announcing in-kind creation and redemption for IBIT.

Which brings us to the acceleration of adoption that is happening right now.

🤑 BlackRock’s In-Kind Revolution

Here’s where things get really interesting.

With the SAB-121 drama in the rear-view, in late July 2025, the SEC approved a significant rule change that had been quietly working through the regulatory process. This wasn’t headline news. There were no press conferences. But for Bitcoin’s institutional adoption, it was arguably as important as the ETF approvals themselves.

The SEC authorized the use of in-kind creation and redemption mechanisms for crypto ETFs.

Translated: Institutional investors and Bitcoin whales can now trade their actual Bitcoin directly for ETF shares without ever converting to cash. No sale. No taxable event. Just a direct swap of Bitcoin for IBIT.

How It Actually Works

Let’s walk through the mechanics of how this clever tactic works.

Under the old system that all Bitcoin ETFs used through July 2025, here’s what happened when someone wanted to convert their Bitcoin into the IBIT ETF:

You sell your Bitcoin on an exchange for cash

You use that cash to buy IBIT shares through your broker

The ETF issuer (BlackRock) uses your cash to buy Bitcoin in the spot market

BlackRock holds that Bitcoin in custody to back the ETF shares

Simple enough. But notice the problem?

Step one is a taxable sale. If you bought Bitcoin years ago for five thousand dollars and it’s now worth one hundred thousand, you just triggered a massive capital gains tax bill.

Here’s the new way with in-kind creation:

You deliver your Bitcoin directly to BlackRock (through an authorized participant)

BlackRock issues you IBIT shares representing that exact same Bitcoin

No cash changes hands

No sale occurs

No taxable event

The Bitcoin you owned is now the Bitcoin backing your IBIT shares. You maintain the same economic exposure to Bitcoin’s price. But now it’s wrapped in an ETF structure that the entire traditional financial system recognizes and can work with.