Bank Deposits are Disappearing. Why?

Issue 80

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

The Big Drain

The Big Gain

Some Perspective

Portfolio Positioning

Inspirational Tweet:

Dramatic chart, yes? As Kobeissi points out, a massive amount of deposits have been leaving the banks. Rushing right out the door, like spooked cattle through an open gate.

But why are deposits leaving, where are they going, and what are the implications?

Lots to clear up here, but we’re going to get you all sorted out, nice and easy as always, today.

So, grab that mug of coffee and saddle up for a short ride down the banking path with The Informationist.

😰 The Big Drain

First things first, let’s define what a deposit is, according to the Fed itself:

‘Deposits are funds that customers place with a bank and that the bank is obligated to repay on demand…[and] are the primary funding source for most banks and, as a result, have a significant effect on a bank's liquidity.’

OK, great. Pretty simple and it makes sense.

I have one problem though. Specifically with the word ‘obligated’.

Yes, yes, the bank promises to give your money back. In reality, a deposit is a loan you are giving the bank with expectation that the bank gives it back when you want it.

Though, sometimes banks can seize your deposits to save their own arses.

If this sounds too surreal and fantastical to you, I wrote all about it back in February, when news of Silicon Valley Bank was sweeping the street. If you have not yet read it, I strongly suggest you check this article out for your own investing intelligence:

TL;DR: There’re plenty of ways that banks can get over their ski-tips and upside down, and default or renege on their obligation to give your money back. And unless that money is FDIC-insured, you're pretty much out of luck.

Is this why the flood gates have opened and cash is pouring out of banks this year?

A massive drop, for sure. But are people scared of banks failing? Pulling their money out and stuffing it into mattresses to keep it safe from incompetent bankers?

And if not, then where is it all going?

🤑 The Big Gain

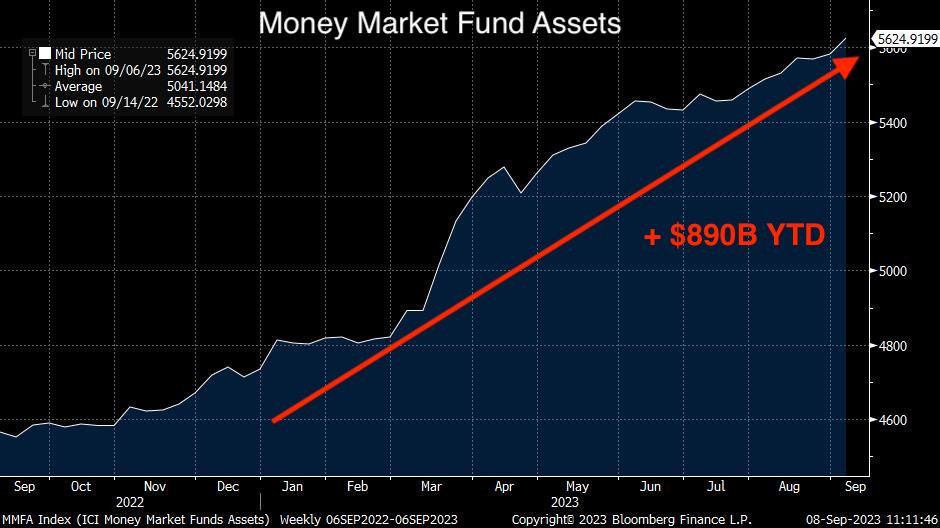

Turning our attention to cash equivalents, we see that a segment of investor holdings, namely money market accounts, is soaring in assets this year:

Money markets, remember, are mostly made up of US T-Bills and other short-term debt securities that are extremely safe (though nothing is risk-free, mind you).

In any case, this is why they are called cash equivalents.

They are highly liquid, easy to move in and out of, and are more or less backed by the US government by effect of the underlying holdings (US Treasuries).

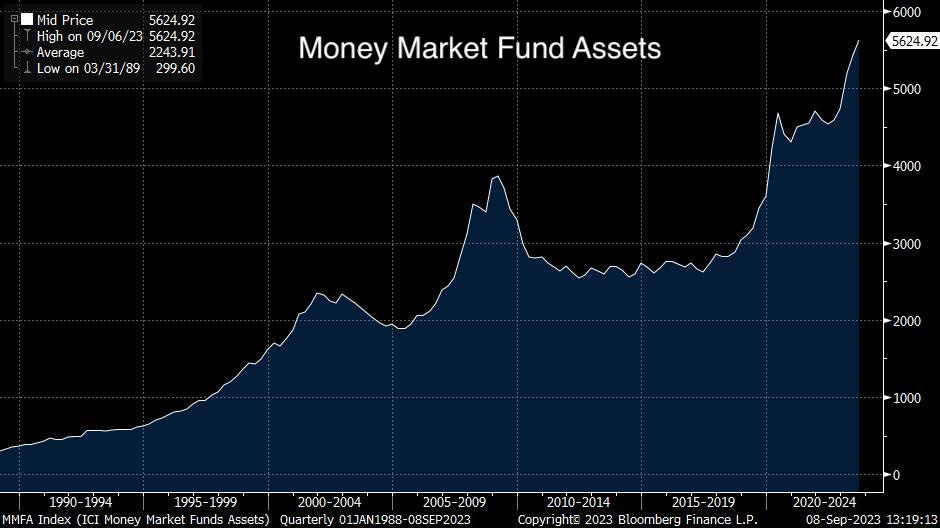

It’s no wonder they’ve grown by over $5T during the last 50 years. But as you see in the chart, they’ve soared ~$1T (or 20% of that) in just the last year.

This tells us a few things, not the least of which is a reminder of just how much money has been created recently.

Money that is looking for a home. A home away from bank deposits.

But just how bad it is? Are banks on the verge of collapse here?

Are we already in one?

🧐 Some Perspective

Before we panic, let’s pull our vantage back a bit and look at the longer term picture. Here are the deposits of all commercial banks since 2008:

We can look at this one of two ways:

We could say that deposits have dropped significantly in absolute dollar terms, down over $873B from the peak of $18.214T.

We can also look at it in percentage terms, calculating a total drawdown of just 4.8%, meaning we could still have a long way to go.

As high rates persist, deposits will continue to drain from banks, and as more and more problems pop up for regional banks, this could produce a snowball effect.

If one bank experiences another run on deposits (a la Silicon Valley Bank) there is a high likelihood of additional bank failures.

Unless, of course, the Fed and Treasury step back in with fancy-termed QE-not QE help (a la another BTFP program).

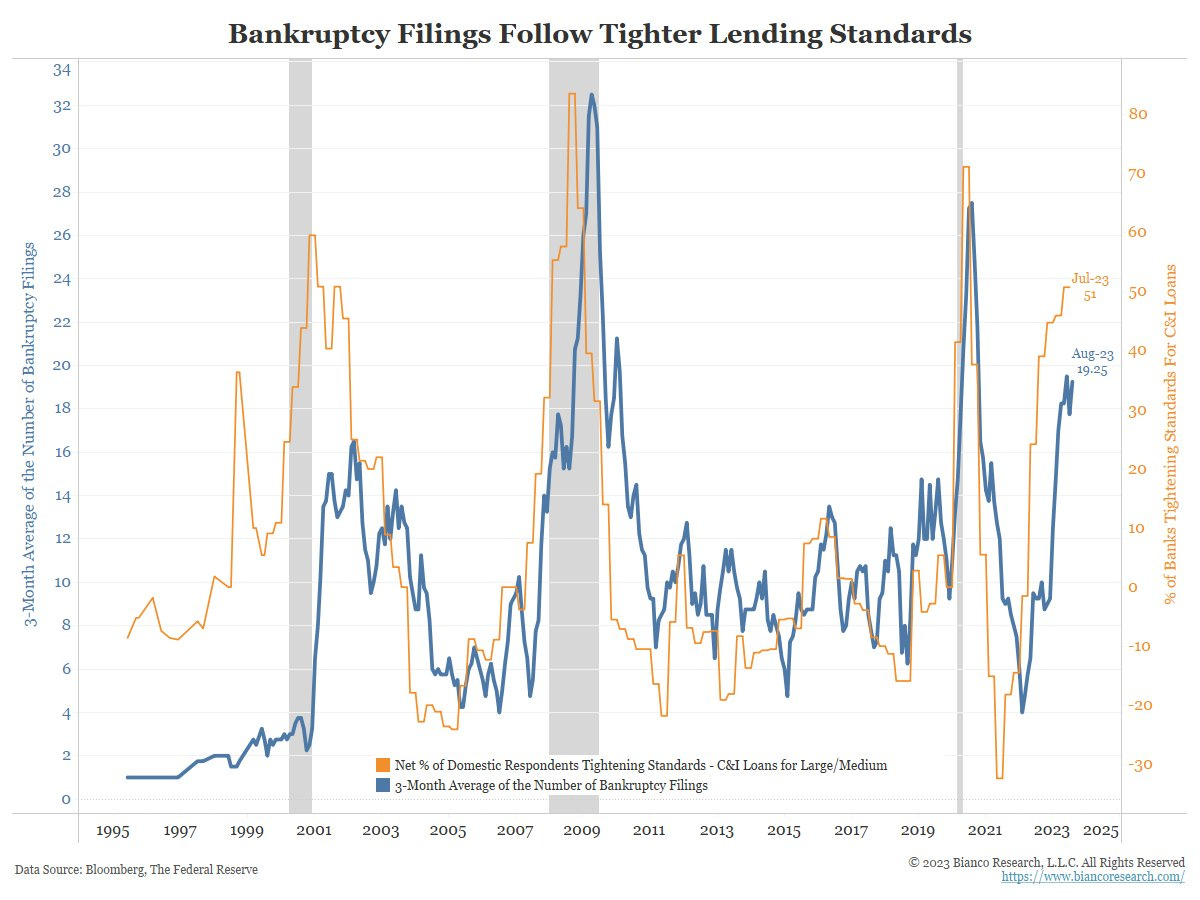

In the meantime, there’s an immediate affect from the fleeing deposits. Namely, as deposits leave banks, banks tighten lending even further.

Makes sense, as deposits leave, banks’ abilities to loan out money decreases.

And, as Jim Bianco’s team demonstrates, bankruptcies often follow tighter lending:

As we have been watching for and somewhat expecting around here, this could lead to an all-out, full-on credit crisis.

The dreaded credit event.

Now this is by no means a red alert. Yet.

But it is another warning sign that unforeseen and unexpected effects are emerging from the jacking up of interest rates on a highly levered economy.

So, as investors, what can we do about it?

🤓 Portfolio Positioning

It seems to reason that holding a higher allocation to cash at this time would be prudent. At least that is how I am playing it.

First. I make sure all my bank deposits are fully FDIC insured.

Second, I make sure any deposits above and beyond FDIC limits are at a GSIB-protected bank. (If you are wondering what I mean by that, I wrote all about GSIB banks here:)

But here’s the thing. Bank deposits are basically cash on the sidelines. And if it’s stashed in a checking or savings account, it’s pretty much idle. Just sitting there, rotting away by way of the inflation termites.

To my point, be sure that your deposits are not earning yield like this:

This goes into the, ‘Are you F%^&$! kidding me?’ category.

But that’s not you.

You are in the know and will be sure to get the yield you deserve. The yield you need to keep up with the very inflation that has caused these higher rates. There are much better cash alternatives, such as:

Money Markets

Short Term Treasuries - T-Bills

High Yielding CD’s

Because over in the Fed-Funds-rate-driven US Treasury yield land, you can get:

Much better, yes?

There are a few ways you can have access to these yields, as we’ve discussed:

Buying USTs in the open market on your brokerage, like Fidelity or Schwab

Buying USTs in the open market through your bank (not all banks offer this)

Buying USTs in an official auction through TreasuryDirect

An easier option, if you are just looking for higher yields and want more liquidity, is to join in on the money market fun. After all, yields on money market accounts at large institutions like Fidelity and Schwab are currently yielding more than 5%.

And finally, my least favorite option (but viable, still) is a CD (Certificate of Deposit).

Even at Wells Fargo, you can get north of 4% on those (though with some requirements and limitations):

So, I suggest you shop around and check all your options there (and the fine print—this is where they get you on CDs), as these are locked in for a term (you have to pay a penalty to cash in) and there are better rates at places like Schwab, for instance.

But the bottom line is, pretty much anything is faaaaar better than just stashing your hard-earned cash in purchase-power-melting checking or savings accounts.

After all, for the first time in a long time, there’s yield to be made on cash, and I suggest you go get it.

That’s it. I hope you feel a little bit smarter knowing about deposits and are ready to start incorporating money markets or USTs into your own investing. Before leaving, feel free to respond to this newsletter with questions or future topics of interest.

And don’t forget to leave a comment or answer a comment in our awesome 🧠 Informationist community below!

Talk soon,

James✌️

At a Schwab brokerage account, your settlement account earns just 0.4% interest, compared to over 5% at Fidelity and Vanguard. To earn more at Schwab, your have to move funds to a money market mutual fund. the rate there is better but if you want to make a trade, you have to wait overnight to get your funds. Does Schwab really deserve to be mentioned as a go-to brokerage for those seeking a decent rate on their cash?

Earlier this year, I moved all my bank cash to a high-yield savings (4.5% APY - FDIC insured). I've considered moving it to other accounts, but don't want to deal with the setup and credit hit. Moving to treasury direct is tempting to get that extra 120bp...especially for a 4-6 month bill.