💡Are (Micro)Strategy's Preferred Stocks for You?

Issue 172

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

What Are Preferred Shares — and Why Perpetual?

What Are the Different MSTR Offerings?

What Type of Investor Are These For?

The Bottom Line (Portfolio Positioning)

Inspirational Tweet:

It seems Michael Saylor and Strategy are coming up with all kinds of creative ways to, er…create Bitcoin yield for investors. We keep seeing new offerings and new symbols every few months.

Particularly, the newest of them in the ‘perpetual preferred stock’ category.

But what are these new securities? What does perpetual preferred even mean? Are they more or less risky than common stock and do they trade like stocks do, too?

All good questions and ones we will tackle today.

But have no fear, we will do it nice and easy, as always.

So grab a big cup of coffee and settle into your favorite chair for a peek into the preferred stock world with this Sunday’s Informationist.

Partner spot

America's Most Secure Mobile Service

Really quickly and before we start, I cannot stress this enough. If you’re not protecting yourself from cyber attacks and SIM-swaps, you’re at serious personal risk these days. After seeing four of my colleagues go through the nightmare of SIM-swaps (someone literally taking control of your phone from afar)—identities stolen, bank accounts compromised, emails hijacked, social media held for ransom—I knew I was at risk, too.

So, I switched to a service called Efani, and it was super easy and seamless. It feels just like being with Verizon or AT&T, but I can rest easy knowing that my phone is ultra-secure. My colleagues learned the hard way, but now we’re all on Efani, and I couldn’t be happier. I honestly wouldn’t share this with you if I didn’t completely believe in the service myself. Whether you use Efani or something else, please don’t wait until it’s too late to protect yourself.

And if you choose Efani by using the link below, you get $99 OFF.

The Efani SAFE plan is a bespoke cybersecurity-focused mobile service protecting high-risk individuals against mobile hacks, providing best in class protection with 11-layers of proprietary authentication backed with $5M Insurance Coverage. Don’t wait. Protect yourself today.

😎 What Are Preferred Shares — and Why Perpetual?

I have had many comments from readers asking about these new Strategy offerings, and there’s plenty of confusion around them with investors.

Let’s start with the basics, shall we? Like what exactly is a preferred stock anyway?

Pretty simple actually, if you take a bond and merge it with a stock it would look like a preferred share.

See, preferred stock is a hybrid security that blends the fixed income characteristics of bonds with the simplicity of equity.

How so?

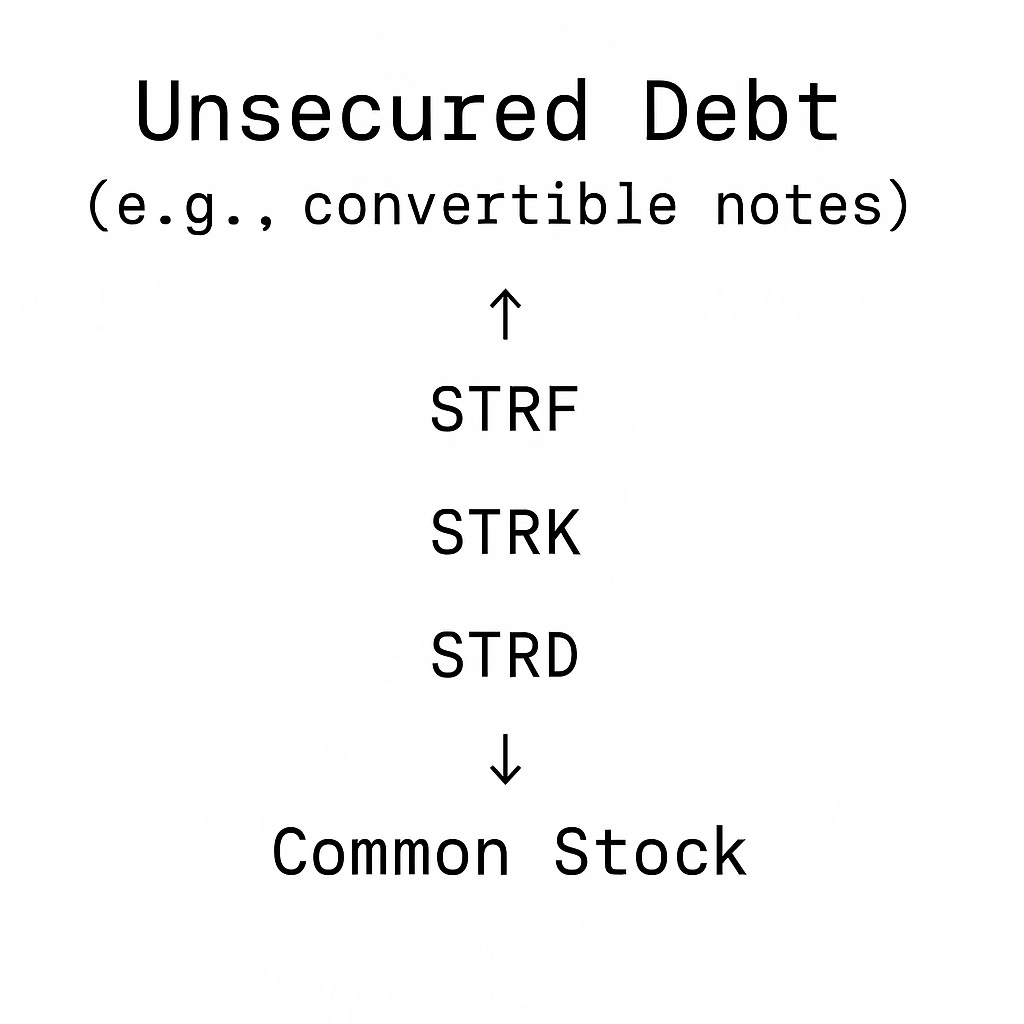

First, preferred shares typically pay a fixed dividend—often quarterly—and sit above common stock but below debt in the capital stack. That means they offer income with more downside protection than common shares, but more risk than bonds.

But, unlike common stock, preferreds don’t usually come with voting rights. And unlike bonds, they don’t come with a legal obligation for the company to make payments.

In other words, dividends can be suspended in tough times without triggering default—but they must be paid before any dividends go to common shareholders.

Where Preferreds Sit in the Capital Stack

Think of the corporate capital stack as an ****airplane—and investors as passengers seated by priority. Now let’s say that the company is going bankrupt—i.e., the airplane cabin is filling with and smoke—it may be on fire.

So, which passengers get out first?

It depends on where they sit in the Capital Stack:

Asset Backed Loans — These are the fancy people in first class, strapped in with parachutes and first out the door, as they get paid first in a bankruptcy and emerge likely unscathed.

Senior Secured Debt - This is business class, holding loans backed by collateral (like real estate or receivables) Recovery rates are typically high. If there are no asset backed loans ahead of them, they are golden.

Unsecured Bonds / Mezzanine Debt — Economy Plus class. No collateral, but still have legal claim. They’re next out the door—usually bruised, but breathing.

Preferred Stock — Exit row in economy. Technically ahead of the crowd, but with no guarantee of getting out if the fire spreads.

Common Stock — Seated in the back of the plane, already coughing from smoke. If anything is left after everyone else is paid, they might get it. But they usually don’t.

In this way, preferreds strike a balance: they don’t offer the upside potential of common stock, but they do offer predictable income and a higher claim on assets—which is exactly what income-focused investors care about.

Yields and Tradeoffs

Because they rank below debt and don’t mature like bonds, preferreds compensate investors with higher yields. In today’s market:

Investment-grade bonds: ~3–5%

Traditional preferreds: ~5–7%

Perpetual or riskier preferreds: 8–10%+

These instruments are common in sectors like financials, utilities, and real estate—industries that need capital but want to avoid diluting equity or over-leveraging their books.

Some examples:

Bank of America Series L Preferred – ~6.25% yield, perpetual, non-voting.

Public Storage PSA-O Preferred – ~5.75% yield, used by a REIT to raise capital.

Ford Motor F-A Preferred – ~6.50% yield from an industrial issuer.

A Short History of Preferred Stock

Preferred shares aren’t some modern financial invention. They date back to mid-19th century America, when railroad companies—the original capital-intensive startups—needed large capital injections to build infrastructure but didn’t want to give up control or take on too much debt.

One of the first major preferred issuers was the New York Central Railroad in the 1860s. These shares were often perpetual, paid consistent dividends, and attracted large investors like family trusts and early banks. Over time, preferreds became a standard tool for funding across more industries.

To this day, preferred shares remain popular with companies that want equity-like capital without giving up governance or facing refinancing risk.

Why “Perpetual”?

A perpetual preferred has no maturity date. The issuer never has to redeem it, and the investor theoretically collects dividends indefinitely—unless the company chooses to call it.

This structure presents trade-offs:

For companies: It’s a form of permanent capital. There’s no looming debt maturity, and dividends can be suspended in times of distress (especially if non-cumulative).

For investors: The absence of a maturity date increases interest rate risk and duration, since you can’t predict when your principal might be returned. In exchange, you typically receive a higher coupon.

A perpetual preferred is basically saying:

“We’ll pay you forever... unless we stop. And we’ll never pay you back your principal unless we feel like it.”

It’s this exact structure that Strategy is now using. By issuing perpetual preferreds, MSTR raises capital without taking on more debt or diluting equity. That capital is then used to buy Bitcoin—giving rise to something entirely new: a Bitcoin-backed income stream.

Let’s be clear: It’s not staking. It’s not leverage. It’s balance-sheet engineering. And it’s opening the door to what is now being called Bitcoin Yield.

So, let’s take a peek at the preferred offerings from Strategy, thus far, and how they are changing its balance sheet.

🤓 What Are the Different MSTR Offerings?

To put it simply, Strategy hasn’t just issued a bunch of preferred shares—it’s built a tiered capital stack with distinct offerings, each designed to attract different types of investors based on their risk appetite, yield requirements, and belief in Strategy’s Bitcoin-driven strategy.

Each preferred—STRK, STRF, and STRD—represents a deliberate engineering decision, using traditional capital markets to unlock the embedded yield of Bitcoin without ever liquidating it.

Let’s break them down, one by one, and then compare them side-by-side.

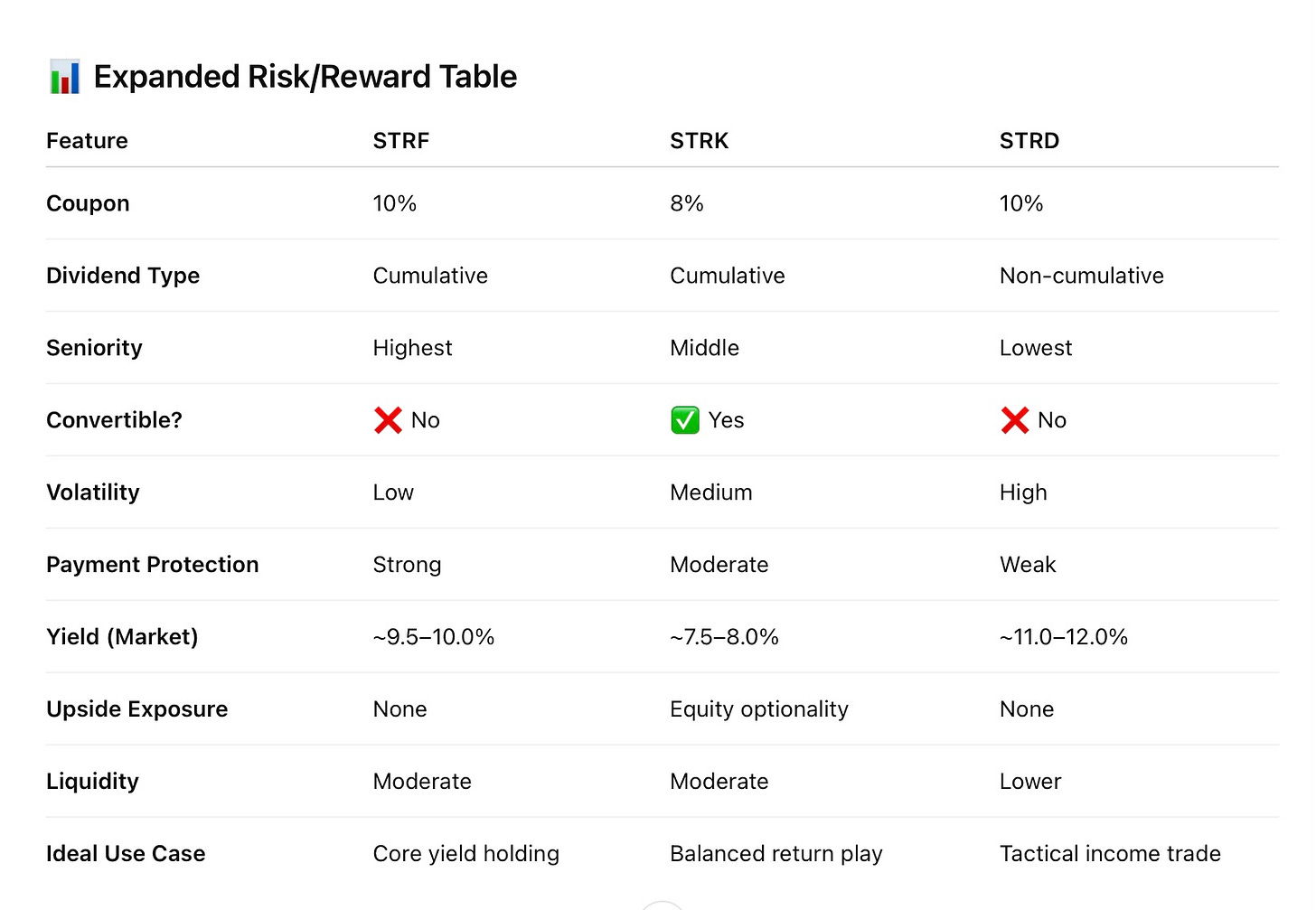

🟡 STRF – Series A “Strife” Preferred

Issued: March 2025

Coupon: 10% annually

Dividend Type: Cumulative

Seniority: Top of the preferred stack (senior to STRK and STRD)

Convertible: No

Call Feature: Yes, callable after 5 years

Market Yield: ~9.5–10.0%

ATM Program: $2.1B max capacity, issued over time

What It Is:

STRF is the institutional-grade preferred. With a high coupon and seniority over all other equity claims (except debt), STRF was clearly built for pensions, insurance funds, and income-focused allocators.

The dividends are cumulative, so even if they’re skipped, they accrue and must be paid before common dividends can resume. This provides a legal and reputational incentive for Strategy to maintain consistent payouts.

It’s essentially a bond proxy with better yield and more structural protection than STRD or STRK.

Who It’s For:

Institutions that can’t hold Bitcoin directly due to charter or custody limitations

Yield-focused investors seeking fixed income alternatives

Portfolio managers in multi-asset funds looking for non-equity, non-token yield

STRF is for those who want Bitcoin-adjacent exposure in a traditional wrapper—with the least amount of structural risk among the three.

🟠 STRK – Series A “Strike” Preferred

Issued: February 2025

Coupon: 8% annually

Dividend Type: Cumulative

Seniority: Middle tier

Convertible: Yes — into MSTR common shares at a premium

Call Feature: Yes, callable after 5 years

Market Yield: ~7.5–8.0%

Issue Size: ~$700M equivalent

What It Is:

STRK is the original issuance—Strategy’s first experiment in perpetual preferreds. Its purpose was twofold: raise capital at a fixed cost without issuing more common shares, and embed optional equity upside for investors through the convertibility feature.

If MSTR’s stock price rises above the conversion threshold, STRK becomes more valuable—allowing holders to participate in that appreciation while collecting a fixed 8% dividend in the meantime.

Who It’s For:

Income-focused investors with a moderate risk tolerance

Yield seekers who also want exposure to upside if MSTR stock booms

Investors who view STRK as a hedged long call on Bitcoin, with a cash-flow cushion

STRK is ideal for investors who want to sit between pure income and pure growth—it’s the hybrid product in the stack.

🔴 STRD – Series A “Stride” Preferred

Issued: June 2025

Coupon: 10% annually

Dividend Type: Non-cumulative

Seniority: Junior to both STRF and STRK

Convertible: No

Call Feature: Callable after 5 years

Market Yield: ~12% (trading below par)

Issue Size: ~$980M raised in upsized offering

What It Is:

STRD is the high-octane yield play—it offers the same headline coupon as STRF but with more risk.

Because the dividends are non-cumulative, Strategy can skip payments without having to repay them later. This is a meaningful downgrade in payment priority, and it places STRD firmly at the bottom of the capital stack—right above common equity.

The structure gives MSTR more flexibility in managing liquidity, especially if market conditions turn south. In return, investors receive a higher market yield—sometimes trading at a 10–15% discount to par.

Who It’s For:

Aggressive income investors

Yield-focused funds seeking double-digit fixed income alternatives

Traders betting on Strategy’s long-term solvency and BTC strength

This is a speculative trade: higher reward, higher risk, and not attractive to investors who rely on consistent income. STRD offers yield, but no safety net.

MSTR Capital Stack (Simplified)

Each layer of the stack reflects a different balance of risk, yield, and protection. All are supported—explicitly or implicitly—by Strategy’s growing Bitcoin holdings.

What Makes These Different From Traditional Preferreds?

Typical preferred shares issued by banks or REITs are backed by revenue-generating assets—mortgages, rents, deposits.

Strategy’s preferreds are backed by Bitcoin.

Why that matters:

BTC is volatile and non-yielding, but highly liquid and globally recognized.

MSTR’s strategy assumes BTC will outperform the cost of capital over the long term.

Instead of lending or staking BTC, Strategy issues preferred shares to buy more of it.

This turns their balance sheet into a Bitcoin monetization engine—and the preferred shares into yield instruments derived from sound money reserves.

And here is how they have each performed with MSTR’s volatility, strictly tied to Bitcoin now.

As you can see, STRD is trading well below par now, meaning the yield is higher than the stated coupon of 10% (closer to 13%). Both STRK and STRF are trading above par, meaning they are offering a yield below the coupon (7.6% and 9.5%).

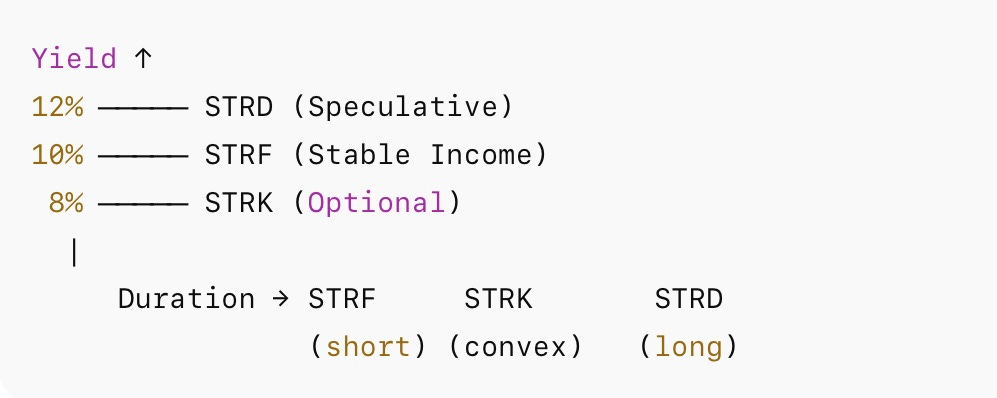

A word on duration.

Duration & Yield Curve Dynamics

If you’ve ever heard a bond manager talk about “duration,” you know it’s often used as a proxy for interest rate sensitivity or effective time exposure. But with perpetual preferreds, duration means something a little different:

Duration is the amount of time it takes to get your money back—through income or redemption.

The longer the duration, the more sensitive a security is to rising interest rates and changes in market sentiment. The shorter the duration, the more stable the pricing—but typically, the lower the yield.

Why Duration Matters for Perpetual Preferreds

Unlike bonds, which have a defined maturity date and return your principal at the end, perpetual preferreds never mature. This means investors are expecting a steady stream of dividends indefinitely—and the market will continue valuing those payments based on prevailing interest rates and risk premiums.

This boils down to:

Interest Rate Sensitivity

If rates rise, new income products offer higher yields—so the value of your fixed dividend stream falls.

Call Risk (or Lack Thereof)

If the issuer can call the shares but doesn’t, you’re stuck holding a fixed-rate product during rising rate environments.

Optionality and Structural Protections

Cumulative dividends, conversion rights, and seniority all change how “safe” the yield feels—and thus how long investors expect to hold it.

How do they stack up against each other in duration, then?

🟡 STRF – Shortest Duration, Bond-Like

Coupon: 10%

Dividend Type: Cumulative

Seniority: Highest

Market Behavior: Investment-grade fixed-income proxy

Duration Profile: Short — consistent income, higher protection, and top of the stack.

STRF acts like a bond. Even if MSTR faced a liquidity crunch, skipped dividends would accrue and must be paid before any common dividends. Its yield is high, but its volatility is lower, and price behavior is relatively stable.

This is the short end of the curve, appealing to traditional fixed-income buyers.

🟠 STRK – Medium Duration, Optionality Curve

Coupon: 8%

Dividend Type: Cumulative

Convertible? Yes

Seniority: Middle

Market Behavior: Bond-equity hybrid

Duration Profile: Nonlinear / Optional

STRK is unique: it behaves like a long-duration preferred unless Strategy’s stock price rises sharply—at which point it starts acting like a convertible bond.

If MSTR trades far above the conversion price, investors may convert or expect a call—which shortens duration.

If MSTR stays below the conversion threshold, STRK functions like a traditional preferred, but with slightly lower yield and less protection than STRF.

*Note - For the bond experts out there, they understand that STRK’s optionality makes it the convexity play in the stack—duration shortens in bull markets and stretches in bear markets.

🔴 STRD – Long Duration, Maximum Yield

Coupon: 10%

Dividend Type: Non-cumulative

Seniority: Lowest

Market Behavior: High-yield bond substitute

Duration Profile: Very Long — no conversion rights, and issuer has full control to skip dividends without accrual.

STRD’s lack of dividend protections means investors demand a steep discount to par—reflected in yields around 12%. Its long duration reflects uncertainty about future payments and the lack of mechanisms to recover skipped dividends.

It’s the far-right edge of Strategy’s yield curve—maximum return, maximum risk.

In essence, though, what you’re seeing is a risk-adjusted pricing curve of Strategy’s capital structure.

Investors demand higher returns for taking on more structural risk and more uncertainty in future income streams.

Each instrument reflects a different market perception of MicroStrategy’s long-term solvency and the viability of using Bitcoin as a reserve asset to support company’s claims.

Which brings us to the ultimate question: what is the risk/reward of each preferred for investors?

To answer this, let’s walk through how they behave under stress, how they behave in euphoria, and where they might sit in a broader investment strategy.

Risk vs. Reward: The Tradeoffs Behind MSTR’s Capital Stack

🟡 STRF – The “Sleep-at-Night” Income Investment

Best For: Income-focused allocators, pensions, insurance portfolios, RIAs managing conservative capital

Risk Level: LOW

Dividend Type: Cumulative

Seniority: Highest among preferreds

Market Behavior: Relatively stable, bond-like, tightly priced

Key Advantage: Highest payment priority + missed dividends accrue

Tradeoff: No equity upside or convertibility

STRF is MicroStrategy’s safe money. It exists to offer institutional investors a clean, high-yield product backed by BTC economics—without the direct exposure or volatility.

In many ways, STRF is a bond in disguise. And if you believe Strategy’s Bitcoin treasury creates long-term solvency, STRF becomes one of the most attractive yield vehicles in public markets.

🟠 STRK – The Balanced, Optionality-Driven Hybrid

Best For: Investors looking for yield + upside, crossover credit/equity funds, family offices

Risk Level: MEDIUM

Dividend Type: Cumulative

Seniority: Middle

Convertible? Yes

Market Behavior: Hybrid pricing; reacts to MSTR equity performance

Key Advantage: Income + equity upside

Tradeoff: Lower yield than STRF, less structural protection

STRK is the bridge between debt and equity. It appeals to investors who don’t want to own MSTR common—but want the right to if the trade goes well.

It’s especially appealing in bullish BTC environments. If Strategy rallies, STRK’s optionality value increases, creating a convex return profile. If it doesn’t, you still clip 8%.

STRK is a total-return vehicle, not just a yield product. It’s the thinking investor’s way to speculate responsibly.

🔴 STRD – The Speculator’s Yield

Best For: Yield-maximizing traders, hedge funds, capital-intensive strategies with risk buffers

Risk Level: HIGH

Dividend Type: Non-cumulative

Seniority: Lowest

Convertible? ❌ No

Market Behavior: Priced at steep discount to par; volatile

Key Advantage: Highest nominal and effective yield

Tradeoff: No recourse if dividends are suspended

STRD is the wild card—10% coupon in name only. The actual yield is now ~12% because the security trades well below par, reflecting investor concern over dividend reliability.

If MSTR keeps paying, STRD looks like a steal. If it misses a single payment, STRD can sell off hard, and those skipped payments are lost forever.

This is a trade, not a hold. Investors will use it when BTC is surging, Strategy is flush, and they want to ride the yield train without staying on it too long.

Expanded Risk/Reward Table

Portfolio Framing

Here’s how you think about it from an allocator’s perspective:

Use STRF like a bond with a Bitcoin-flavored twist. A core yield sleeve for traditional income portfolios.

Use STRK in the “alternative yield” or total return bucket. Think of it as credit with embedded calls.

Use STRD in a tactical sleeve—when market conditions are strong, and you’re comfortable with potential dividend suspensions.

Or you can even blend them to create the exact risk/reward you are looking to add to your portfolio. That’s exactly what institutional investors will often do.

On that…

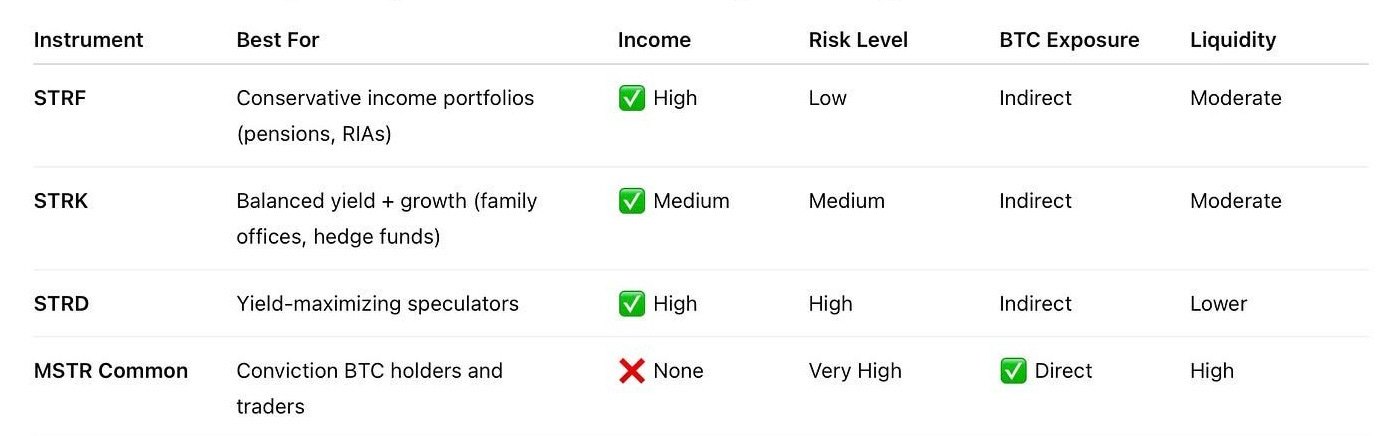

🧐 What Type of Investor Are These For?

Strategy’s capital stack is now a menu of Bitcoin-adjacent strategies—offering everyone from conservative income-seekers to aggressive speculators a way to gain exposure to BTC without directly holding the asset.

But these instruments aren’t one-size-fits-all. They’re structurally different, behaviorally distinct, and targeted at different segments of the investor landscape.

Let’s walk through who each preferred (and the common stock) is truly designed for—and why.

STRF – The Institutional Income Vehicle

Who it’s for:

Pension funds

Insurance companies

RIAs managing high-net-worth clients

Multi-asset allocators with yield mandates

Investors prohibited from holding crypto or Bitcoin

Why it fits:

Senior-most security in the capital stack

Cumulative dividends provide strong protection

Structured as traditional perpetual preferred stock—no blockchain, no tokens, no custody issues

Trades through standard brokerage platforms with quarterly dividend flows

STRF is the cleanest way for a conservative investor to get Bitcoin-driven yield without owning actual Bitcoin. It fits comfortably into a fixed-income sleeve and offers 2–3x the yield of investment grade bonds with relatively modest volatility (compared to MSTR equity).

STRK – The Hybrid for Growth-Minded Income Investors

Who it’s for:

Family offices

Long/short equity managers

Total return and alternative income funds

Yield-seeking investors who want some upside optionality

Bitcoin-curious traditional investors who want a “safer” proxy

Why it fits:

Provides a reliable 8% yield with cumulative protection

Offers equity upside via conversion to MSTR common

Sits in the middle of the stack—less protected than STRF, but with more potential reward

Behaves like a convertible bond with yield attached

STRK is for the allocator who believes in Bitcoin long term, respects Strategy’s strategy, but doesn’t want to commit to volatile common stock just yet.

It’s an attractive tool for a risk-managed bet on MSTR with consistent income as the buffer.

STRD – The Speculative Yield Machine

Who it’s for:

Tactical credit investors

Hedge funds and risk-parity traders

High-yield seekers with portfolio buffers

Bitcoin bulls willing to take structural risk

Opportunistic investors who actively manage positions

Why it fits:

Offers the highest yield (nominal and market) of the stack

Non-cumulative means no obligation if things go sideways

Highly sensitive to MSTR’s liquidity, reputation, and market conditions

Can outperform dramatically during risk-on rallies in BTC and MSTR equity

STRD is not for retirement portfolios or conservative income strategies. It’s a levered bet on Strategy’s continued solvency and Bitcoin appreciation, disguised as a high-yield preferred.

MSTR Common Stock – The Conviction Trade

Who it’s for:

Long-term Bitcoin maximalists

Public equity managers with macro conviction

Retail traders with high risk tolerance

Institutions with equity mandates and BTC exposure goals

Why it fits:

Offers direct exposure to MicroStrategy’s Bitcoin holdings

Trades with 2–3x beta to BTC in both directions

No income, no downside protection—pure upside volatility

Highly liquid and widely held by ETFs, funds, and macro traders

MSTR equity is not about income—it’s about conviction. It’s for investors who believe that Strategy’s BTC strategy will outperform every other asset class in the next 10 years. It can double in a year—or halve in a month.

🤩 The Bottom Line (Portfolio Positioning)

As of this week, Strategy holds 592,345 BTC—worth an estimated $63 billion. That holding makes it the largest corporate Bitcoin treasury in the world, by far.

But what makes MicroStrategy truly unique is how it’s turned that Bitcoin position into a multi-tiered capital structure—a kind of Bitcoin-powered yield curve that offers something for nearly every type of investor.

These are not just “preferreds,” they are yield-bearing proxies for Bitcoin exposure—built using the architecture of traditional finance, but powered by a monetary asset with high volatility, no counterparty risk, and no dilution.

Capital Stack = Portfolio Stack

Think of MSTR’s offerings as components of a modern income + growth strategy:

Each serves a different function in a portfolio, depending on your goals:

Want reliable income backed by BTC’s balance sheet? → STRF

Want income with potential for upside participation? → STRK

Want to swing for double-digit yield? → STRD

Want direct leverage to BTC price action? → MSTR common stock

Final Strategy Takeaway

The brilliance of Strategy’s approach is that it’s not selling Bitcoin—it’s collateralizing it. And instead of issuing debt or offering staking products like typical crypto platforms, it’s using the tools of Wall Street and the long-term strength of Bitcoin to build real financial products for traditional allocators.

That makes MSTR preferreds one of the few ways institutions can access Bitcoin’s upside—or monetize their belief in its long-term value—without buying the asset itself.

Strategy is quietly building the Bitcoin yield curve—one that’s:

Powered by BTC reserves

Structured like fixed income

Traded through familiar brokers

And offering yields that rival junk bonds—with arguably less systemic risk

In other words, Strategy preferred investors don’t need to hold Bitcoin directly to benefit from its monetary properties.

MicroStrategy has created a financial bridge:

From Bitcoin to cash flow.

From conviction to consistency.

From volatility to structured income.

Whether you’re stacking sats, stacking yield, or simply looking for better fixed income alternatives…

The modern Bitcoin yield curve is officially here.

The only questions are if and/or how Strategy’s various offerings fit into your own portfolio.

That’s it. I hope you feel a little bit smarter knowing about preferreds in general and how Strategy is using them to offer different risk/reward options for all types of investors.

If you enjoyed this free version of The Informationist and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️

Excellent overview. I had to fire my "financial advisor" over his refusal to purchase STRK due to his "belief" that BTC was eventually heading to zero. I'm still mad about it as I wanted to buy it at under par and eventually bought it above par...

Great article as always James! Q--Where does Strategy derive the funds necessary to pay the dividends? Is it solely through continuing operation of its underlying cyber-security business?