Are Fed Swap Lines Really Foreign Bank Lifelines?

Issue 83 (Repost from CK Archive )

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today's Bullets:

What are Fed Swap Lines?

The History of Swap Lines

The Real Reason for Swap Lines

Bracing for Impact

Inspirational Tweet(s):

And Luke’s reply:

Swap Lines.

They sound like a super fancy, super complicated and intricate piece of Fed and Central Bank plumbing.

But what the heck are they? What do they actually do?

And most importantly, are they really just a form of ‘QE by another name’, as Luke Groman suggests above?

Super important questions that we will answer super simply today. So, have no fear and let’s get to it, shall we? Grab that cup of coffee and saddle up for a super Sunday with The Informationist.

🧐 What are Fed Swap Lines?

First things first, what the heck is a swap, anyway?

You may have first heard the term Credit Default Swap (CDS) back in 2008 or 2009, when the entire housing market imploded. I wrote all about CDS in a newsletter a while ago, and if you want to dig further into that, you can right here:

TL;DR, for today’s purposes: A swap is a contract between two parties (like a legal document) that agrees to swap one risk for another. Simple as that. I’ve traded many swaps in my career, sometimes swapping a variable interest rate bond for one with a fixed interest rate, or more typically in foreign exchange (FX), trading the risk of the fluctuations of one currency for another.

And that’s exactly what we’re talking about here.

Kind of.

Fed Swap Lines are also known as Central Bank Liquidity Swaps.

These are agreements between the Federal Reserve and foreign central banks, where the Fed provides US dollars to a foreign central bank in return for the foreign currency. The central bank borrowing the US dollars then pays the Fed interest on the principal of the total swap until it is closed and they swap the currencies back to each other At that pre-determined exchange rate.

A swap line is just like an open pipeline, where the agreement is in place and the foreign central bank can just move in and out of the swap, as needed, for the amount and time frame needed.

Why oh why would they need this?

I thought you’d never ask.

The stated reason from the Fed itself reads: to improve liquidity in dollar funding markets, during times of market stress, both in the U.S. and abroad.

Let’s unpack that, shall we?

’To improve liquidity in dollar funding markets’ just implies that there are times when it is difficult to obtain US dollars. That there aren’t enough dollars to go around.

Interesting. We will revisit that in a moment.

And ‘during times of market stress, both in the U.S. and abroad’, well this points to market disruptions, like say, the Great Financial Crisis or Covid lockdowns.

But the bottom line, the US needs all foreign countries to be able to access US dollars at all times, whether markets are stressed or in distress or not.

And so, no surprise, after the Great Financial Crisis did indeed require dollar liquidity, numerous Fed swap lines were made standing arrangements in 2013.

But these swaps existed long, long before this.

Let me explain.

🤓 The History of Swap Lines

The year is 1994, and I was working as a clerk on the floor of the New York Stock Exchange.

I was about as green as a 7-Eleven banana.

Anyway,

I was working for the trading arm of SG Warburg, a UK investment bank, and I was trading ADR arbitrage—a strategy where you buy and sell foreign securities that are listed on the NYSE.

You see where this is going.

Right. I was working in the booth that was closest to the posts of a number of Mexican companies, like Cemex, Telmex and Banco Santander, and so I was trading them for the big boys upstairs.

Everything was going swimmingly, the 24-year old kid had it all under control, until I didn’t.

In a matter of minutes, the names I was trading, the Mexican ADRs, were literally melting down. Spreads blew out against me, no bids, I couldn’t make a single trade for my bosses.

Remember, this is before they had all the circuit breakers and down limits that they do today.

Let ‘em plummet, find a bottom, they’d say.

And plummet they did.

Bottom, they didn’t.

Because the Mexican central bank had just shocked the financial world by devaluing the Mexican peso, triggering an all-out financial crisis. Capital fled from Mexico, crushing assets, causing severe economic contraction, and sparking contagion across Latin America.

They called it The Tequila Crisis, saying the lingering and ongoing impact was like a “tequila hangover.”

Until, of course, the US stepped in to ‘save the day.’

See, the US engineered a $50 billion bailout (sounds pitiful today, but this was big money in ‘94) with contributions from the US, the International Monetary Fund (IMF), and other entities.

But the key?

The U.S. provided a $20 billion short-term loan to stabilize Mexico's economy, to “restore investor confidence and prevent a broader financial contagion.”

Like across the border into the US.

And how did they physically do this?

You got it. They established Federal Reserve Swap Lines, whereby Mexico sent the US their now-crummy Mexican pesos in exchange for crisp and clean US dollars.

Like magic.

And so—now battle-tested and proven to work—in 2007, when the GFC was unfolding and dollars were once-again becoming ’scarce’, the Fed opened swap lines with the European Central Bank (ECB) and the Swiss National Bank.

In 2009, not enough liquidity yet and the crisis only growing, they opened a couple more with Bank of England (BoE) and Bank of Japan (BoJ).

In 2010, they added Canada.

And by October 2013, with the system clearly still not cured of its fiat disease, the Fed, ECB, Bank of Canada, BoE, BoJ and Swiss National Bank announced that their existing ’temporary’ liquidity swap arrangements would be converted to standing arrangements.

These arrangements would remain in place until further notice.

And in the 2020 lockdowns, the Fed added swap lines for Australia, Brazil, South Korea, Mexico (re-initiated), Singapore, Sweden, Norway, Denmark, and New Zealand.

And so, here we are.

How much was swapped at the peaks of the GFC and then Covid-lockdowns? Let’s peek, shall we?

Impressive.

About half a trillion USD during each crisis.

But we still haven’t gotten to the reason, the real reason why the US is so intent on being sure that everyone, their brother, their mother, and their uncle has access to US dollars.

Some of you may have guessed by now, and you would be correct, if you’re thinking…

Once again, it all comes down to the US Treasury.

More specifically, US Treasuries.

🤨 The Real Reason for Swap Lines

We are going to make this real simple.

Bottom line. The US Treasury needs orderly markets. Most importantly, the US Treasury needs orderly Treasury markets.

Let me explain.

The world operates, more or less, on a US dollar-based financial system. In other words, foreign banks need dollars to fund dollar-denominated activists, like import-exports or dollar denominated bank or corporate debt.

And so, when markets become stressed, dollar funding markets can seize up, raising the cost of obtaining dollars.

Remember, the world’s reserve asset is US Treasuries.

And in these times, foreign banks may turn to their central banks for dollars. But when the central bank cannot access the dollars cheaply, what do they do?

Exactly.

They sell US Treasuries.

This gives them US dollars in return that they can suffice demand for liquidity (they need them, their banks need them, their companies need them). And in some cases, this can become an all out rout on US bonds.

A major problem for the US Treasury, the entity that needs the most demand and liquidity for its bonds that it can possibly get.

And if you’ve heard me speak about the Debt Spiral, you know exactly why.

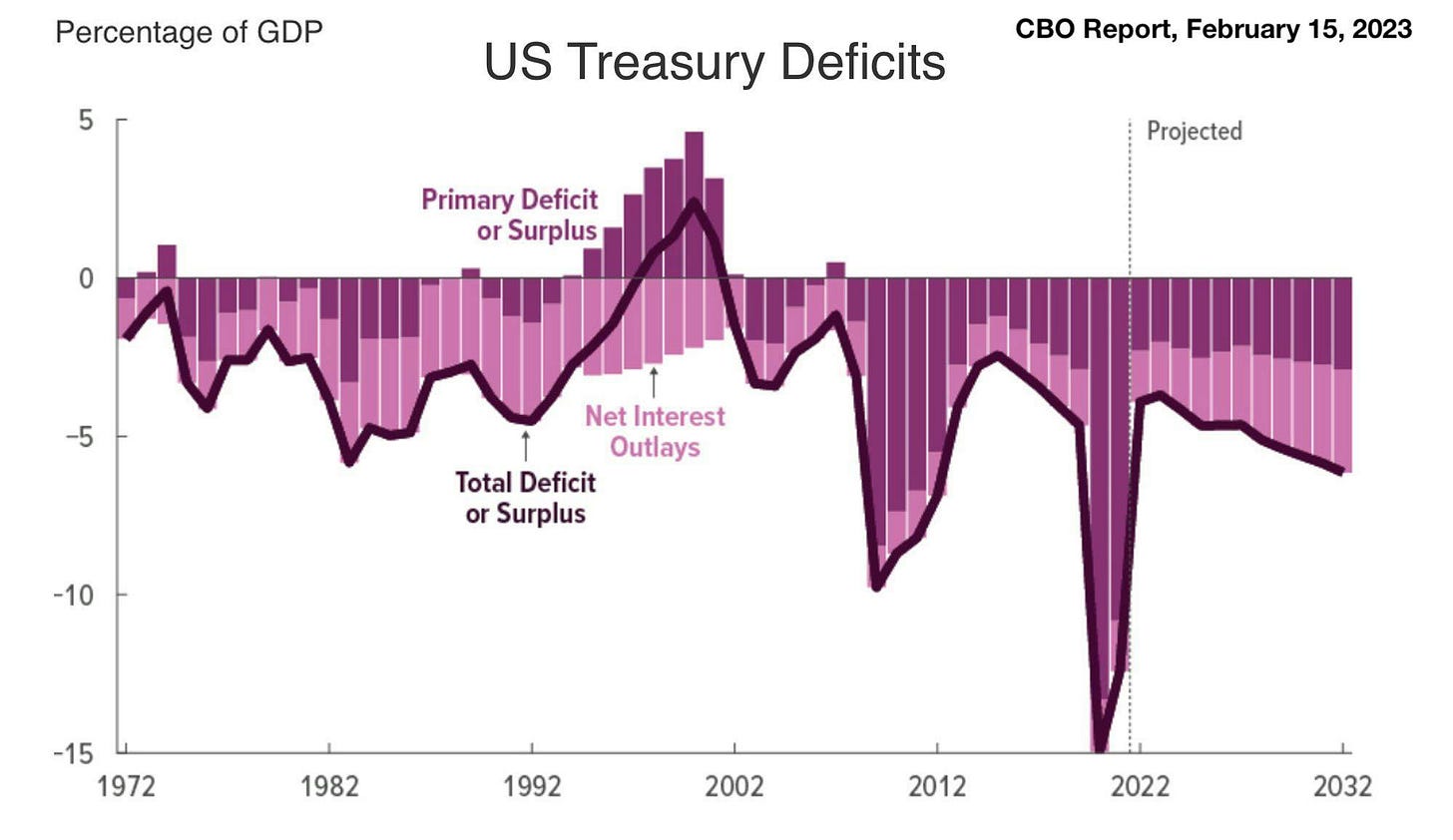

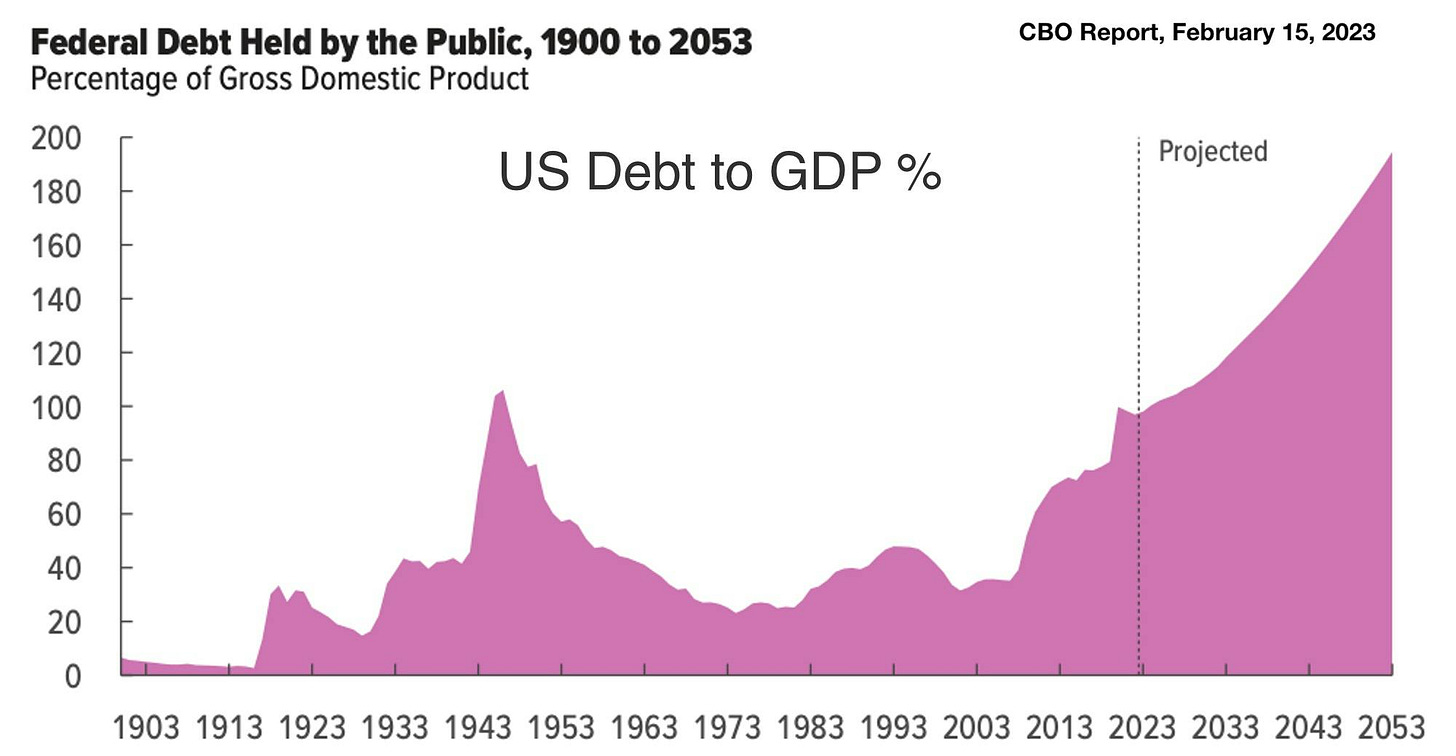

Because of this:

Which is leading to this:

In other words:

deficits → leads to more borrowing → leads to more interest payments → leads to larger deficits → leads to even more borrowing

Case in point: The US has issued $1.7T in USTs in just the last 16 weeks. 🤯

And with interest rates looking to remain structurally higher for the near and possibly long-term future, this situation is only going to get worse.

Much, much worse.

The dreaded Debt Spiral.

😮 Bracing for Impact

Bottom line: the Treasury (and hence the Fed) need the US Treasury market liquid. They need to be able to issue more debt to the market without competing with other countries trying to sell their own USTs to the market.

They cannot, will not, must not allow the market to become illiquid for them, their unending and bottomless need for borrowing.

The solution?

Open Fed Swap Lines to provide US dollars to foreign central banks in order to satisfy dollar demand and prevent a rout in US Treasuries.

Because, if the Treasury market becomes illiquid, if it becomes disorderly, if it threatens to lock up…it means the entire financial world—the global financial system—is on the brink of collapse.

So, when you hear the Fed is once again utilizing its swap lines, be aware. Be extremely aware.

It means that the credit event—the one that has large-scale contagion possibilities—is likely already upon us.

And it’s high time to brace for impact.

That’s it. I hope you feel a little bit smarter knowing about Fed Swap Lines and why they are so important to the US Treasury and, hence, global financial system.

If you enjoyed this newsletter and found it helpful, please share it with someone who you think will love it, too.

Talk soon,

James✌️