💡 Are Bonds Riskier Than Bitcoin Now?

Issue 173

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today’s Bullets:

The Real Bond Story

Bond Volatility

Risk Adjusted Face-off: Bonds vs. Bitcoin

Portfolio Positioning

Inspirational Tweet:

Bonds.

For all our lives, we have been hearing how bonds—especially US Government bonds, aka US Treasuries—are the safest asset you can buy.

The portfolio ballast. The one asset that will hold its value, reduce volatility, and ensure at least something you own will deliver consistent returns.

The one asset that never fail you.

But the last few years have not been good to bonds. With insane inflation and repeated rate shocks, bonds have been volatile and uncertain.

Put simply, bonds have not done their stated job.

And now investors are beginning to ask the question that the US Treasury fears the most: Are bonds a risky investment now? 😱

And considering the returns it has delivered, could Bitcoin actually be a safer bet?

Good and important—if not unexpected—questions. And ones we will tackle, nice and easy as always, here today.

So, pour yourself a big cup of coffee, and settle into your favorite seat for a trip down the bond path with this Sunday’s Informationist.

🤨 The Real Bond Story

We like to keep things simple here, and we will do that again today.

So, let’s clear something up before we even start. The question we are asking is: are bonds a riskier portfolio asset than they appear to be?

And

Are they actually riskier than Bitcoin now?

To get to the bottom of those questions, we will need to dig into the return of bonds first. And to do that, we will start with the most well know Bond ETF, TLT.

TLT is the iShares 20+ Year Treasury Bond ETF, and it is one of the most widely held long-duration bond ETFs. In essence, it is an index that primarily holds US Treasury bonds with remaining maturities greater than 20 years.

As we noted above, bonds have had a rough period recently. In fact, returns for TLT have been downright dismal.

How bad?

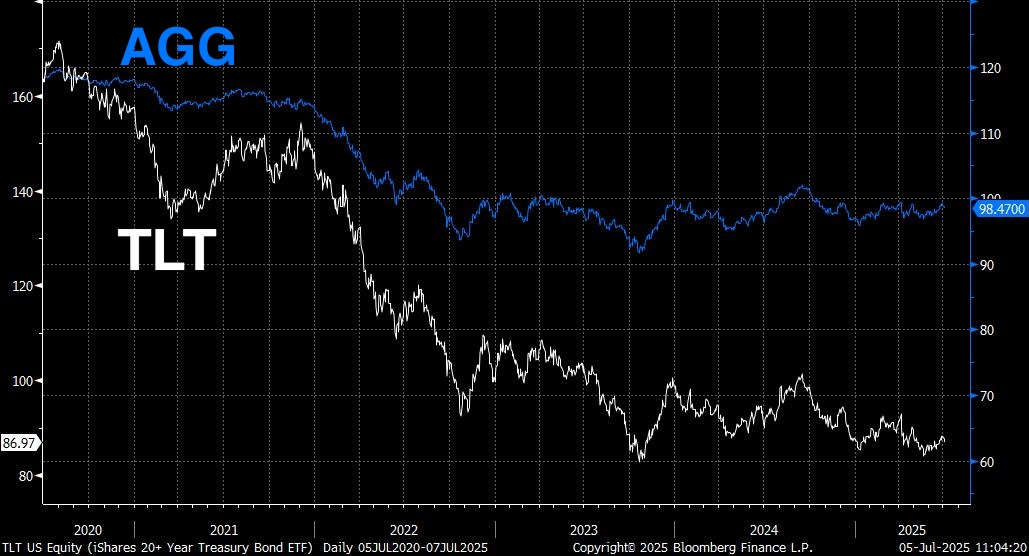

Here’s a chart of TLT returns for the past 5 years.

Ouch. That’s a 47% LOSS in 5-years.

Now you may be saying, because of its long duration holdings, TLT is highly sensitive to interest rate changes. And with rates being jacked up by the Fed and the market, TLT has suffered more than the average Treasury bond fund.

Good point.

So, let’s take a peek at a broader Treasury bond ETF, AGG.

The iShares Core US Aggregate Bond ETF (AGG) offers exposure to a broader slice of the US bond market, including Treasuries, investment-grade corporate bonds, mortgage-backed securities, and other government bonds.

AGG is less rate-sensitive than TLT because it includes shorter maturities and more credit risk.

But make no mistake, AGG still hasn’t escaped the carnage.

Take a peek.

Over the last 5 years, AGG is down 16%.

Wait, wait, wait, you say.

Don’t these ETFs pay yields in the form of nice fat dividends? These charts only show the performance of the bond without the yield.

Great point.

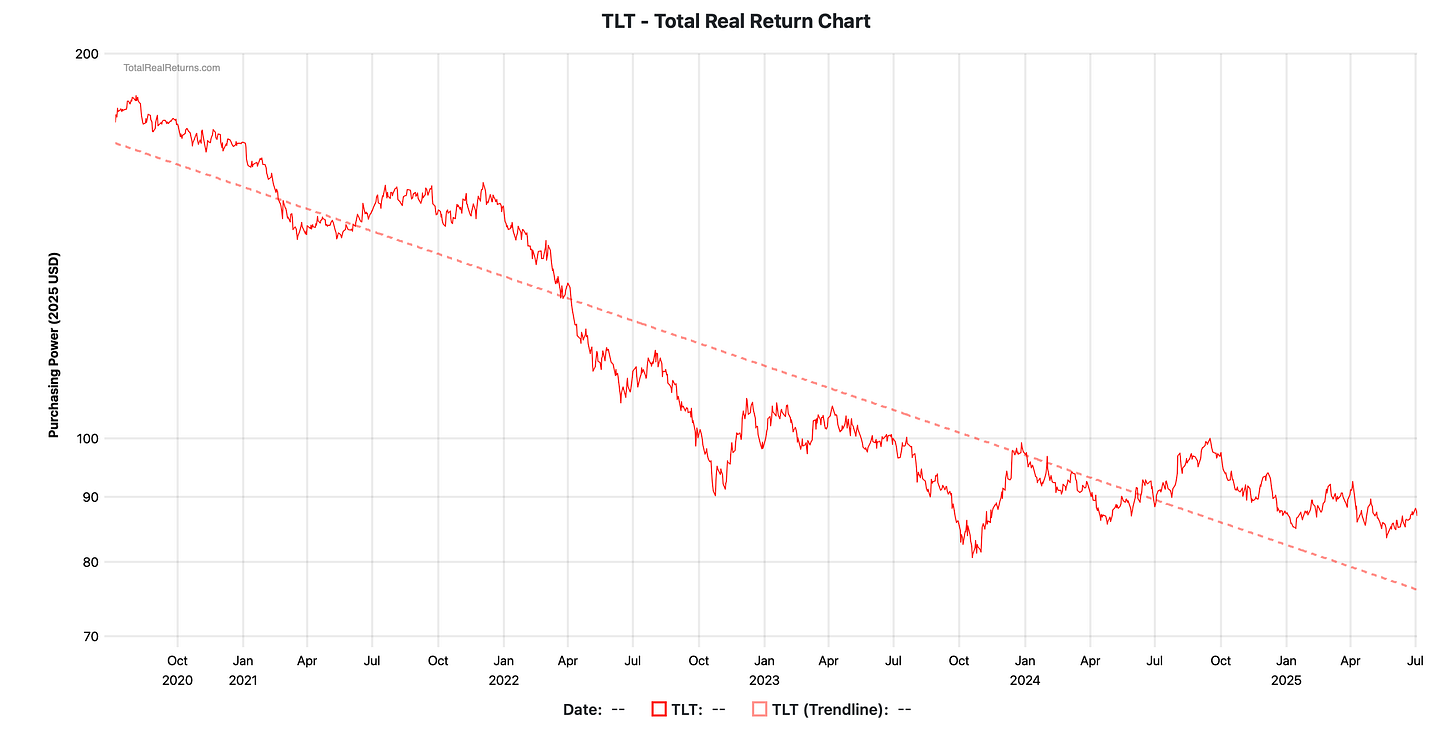

So let’s look at the total return that includes all these dividends—show the whole picture, so to speak.

Ouch. Still down 39% over the last five years.

But what about AGG? Surely that is much better.

And it is. But it also still lost over 4% in the last five years.

While not as dramatic as TLT, it's still a negative real return for the so-called safe diversified bond ETF.

What I mean is, when accounting for inflation (giving us the real return) we lose even more, as shown here in a chart by totalrealreturns.com.

OOF.

And AGG?

Better than TLT, but still awful.

Bottom line, even with reinvested dividends, these bond ETFs still suffered from deep negative real returns. What’s more is that the Bonds weren’t just volatile—they were riskier than they looked on the surface.

Let me explain.

🫣 Bond Volatility

Some of you may now be saying: these are bond ETFs and are just proxies for bonds and their returns, whereas if you bought a US Treasury and held it to maturity, all that would matter is the real yield (i.e., the bond’s yield minus inflation).

First, that would still show a deeply negative real return, as a 20 or 30-year US Treasury bought 5 years ago offered a yield of approximately 1 to 1.5%. With average annual inflation of over 4% in that time, you would have still lost ~3% annually.

Also, these returns were delivered alongside some serious volatility.

Remember, if we are going to measure bonds versus Bitcoin today, we have to include volatility as a component of the returns.

Why?

Because the higher the volatility, the higher the risk for the asset—as you never know when you may need liquidity. And if an asset is volatile, you may need that liquidity at the worst possible moment.

This has long been the mainstream argument against investing in Bitcoin.

So, how bad has bond volatility been?

Let’s go back to TLT and AGG and take a peek.