A Near-Failed Treasury Auction

Issue 89

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🫶 If this email was forwarded to you, then you have awesome friends, click below to join!

👉 And you can always check out the archives to read more of The Informationist.

Today's Bullets:

Treasury Spotlight

Anatomy of an Auction

Market Reaction & Takeaways

Fed vs. Treasury

Inspirational Tweet:

Many of you saw this Tweet and my reaction to it and the US Treasury 30-year Bond auction this past week.

But a number of you still have questions and are wondering just how bad the auction reallywas, what it all means for markets and your portfolios.

Because these are vitally important questions, we are going to dig a little bit deeper than those Tweets and comments here.

But don't let the bond market lingo and concepts intimidate you. Because we're going to unpack all of it, nice and easy as always, today.

So, grab that cup of coffee, saddle up, and settle in for a Treasury Bond trail ride with The Informationist.

🧐 Treasury Spotlight

If you read last week's Informationist, you know that the US Treasury made a big announcement the same day that the Fed voted to keep rates steady.

Big news from the Fed, though widely expected.

But even bigger news from the Treasury.

Why?

Because the Treasury announced a schedule of borrowing of $776B for the 4th quarter of 2023, which was $76B less than the prior quarter of $852B.

Most importantly, the Treasury announced that they would be borrowing more on the short end of the curve versus the long end, releasing this set of auction sizes:

You can see that the total auctions add up to a few billion less than prior auction, and this was less than expected (read: feared) by the markets.

What do we gleam from all this?

First, the Treasury is trying to manage fears that there is a Treasury debt tsunami on the horizon by announcing smaller than expected auctions across the board.

Second, we can conclude that the Treasury is clearly listening to and concerned by the recent activity of investors, particularly on the longer maturity side of USTs.

The Bond Vigilantes.

I wrote all about bond vigilantes a few weeks ago, and for more context and a deeper dive on them, you can read that Informationist article right here:

TL;DR: investors are beginning to get worried that severe federal deficits will require massive debt funding from the Treasury, and this will in turn require high structural inflation to manage all that debt. These investors have been nicknamed Bond Vigilantes.

They are back.

And Janet Yellen and the Treasury is well aware of this.

However, we must also consider a few nuggets that we can gleam from the release, as well, to quote:

1) Primary dealers explicitly noted a high degree of uncertainty overall around deficit and growth forecasts, reinforcing Treasury’s need to maintain flexibility in their issuance strategy.

Translated: The Treasury itself admitted that the primary dealers (the banks that buy the debt and then pawn it off onto investors and institutions) are concerned about UST demand and being stuck with more of the auctions than they want to hold themselves. Remember that point, we will come back to it in a bit.

2) Treasury anticipates that one additional quarter of increases to coupon auction sizes will likely be needed beyond the increases announced today.

Translated: The Treasury expects to add to the amount they need to borrow this quarter, beyond these estimates. Duh.

3) Treasury continues to make significant progress on its plans to implement a regular buyback program in 2024.

Translated: The Treasury is almost ready to implement a quasi yield curve control plan in 2024. Regular, my a$$.

If you want to dig deeper into all this and the announcement from two weeks ago, The Informationist covered that, too, and you can find that here:

Bottom line. Remember that the US government is currently running $2T annual deficits, and that the Treasury will have little choice but to continue to issue more and more debt to cover this hole.

But we will explore that a bit more at the end of this newsletter.

We'll first turn to the disastrous bond auction from last week.

And do a bit of a bond autopsy.

🤮 Anatomy of an Auction

Man oh man, we heard a whole lot about the nearly busted 30-year US Treasury auction the past few days.

But before we get into that, if you have not yet done so, I suggest you to go read a thread I wrote last year that explains how Treasury auctions work and what to look for in them. It's super simple to understand, and it will make you smarter, I promise:

All set on the process and terminology?

OK, now let's peek at the results.

First, this was a 30-year Treasury Bond auction, the one you saw announced in the first part of this newsletter, for $24B.

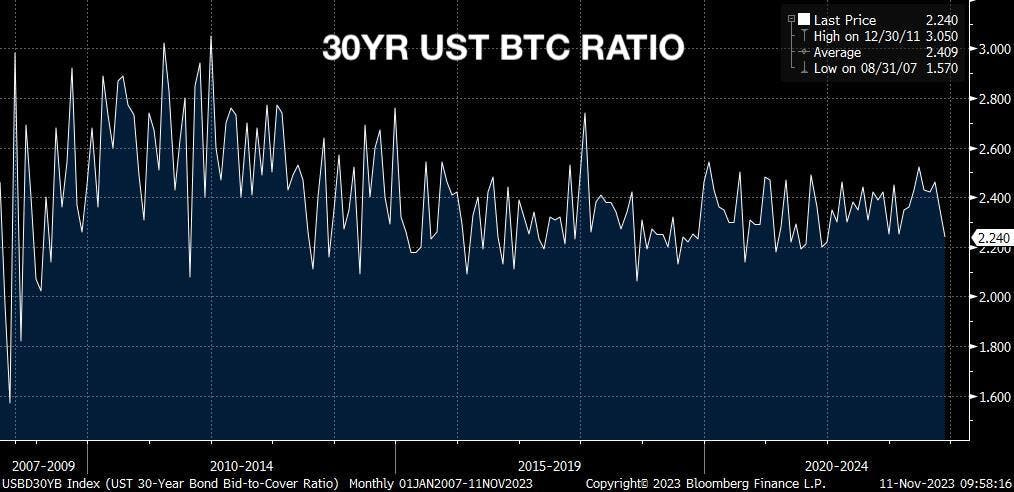

The first metric we'll look at is the Bid to Cover (BTC). This came in at 2.24.

Pretty bad. Maybe a C or C-, if this were a graded test.

For context, the BTC for these bonds typically comes in around 2.3 or 2.4.

This used to be up in the 2.5 to 2.6 range, but as you know, foreign demand for USTs has dropped in recent years, and so not as many buyers are available as there used to be.

As you can see here, BTC is trending lower and this last week was pretty awful.

If and when we get down to the 2.0 level, it's a full-on auction crisis.

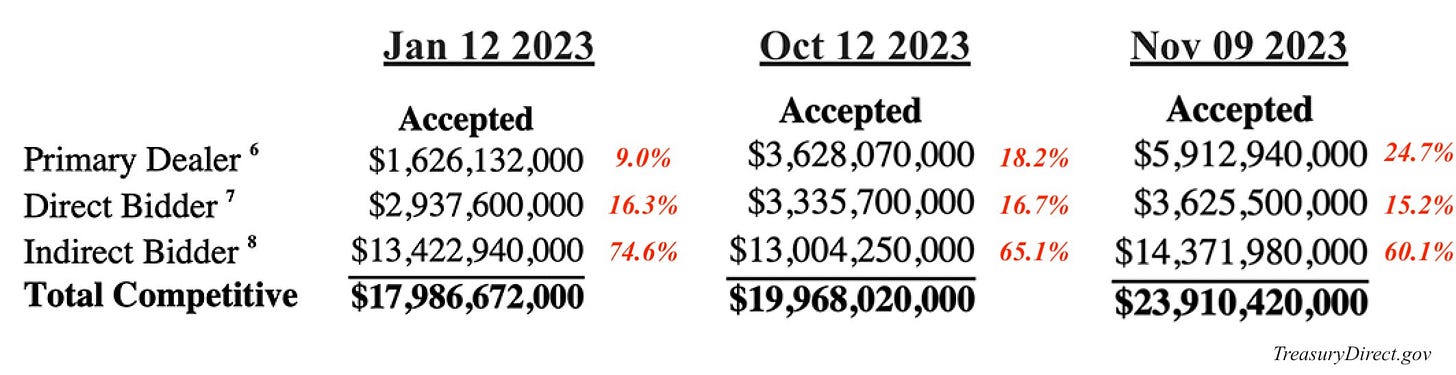

Speaking of foreign demand, this was also quite alarming. When looking at the results, Indirect Bidders (i.e., foreign buyers) only accounted for 60.1% of the auction. This was down from 65.1% just one month ago. 😮

Direct Bidders (institutions and individuals) failed to pick up the difference and only took 15.2%, leaving the Primary Dealers holding the bag on a whopping 24.7%.

WOW.

For a more holistic review, let's compare this auction to other auctions, shall we?

Here are some recent 30-year UST Auction Results:

What do we notice?

First, that's right, it seems these auctions are getting bigger and bigger, aren't they?

I mean, we started the year issuing $18B at auction, and this grew to $20B by October and $24B just one month later.

Second, we notice that Direct Bidders are taking less and less of each auction. This means that either hedge funds and institutions are growing wary of long-duration USTs or they are simply running out of cash to buy the stuff.

Third, take a peek at how Indirect Bidders slide from 75% down to 60% in less than a year.

Good God.

That evaporation of demand has left a gaping hole in the auctions. And who is the last line of defense to fill that hole? The one left holding the bag?

You got it.

The Primary Dealers. They were taking less than 10% of the issue back in January.

Now they're saddled with 25% of an issue that apparently nobody wants.

Remember the Treasury announcement from two weeks ago that stated, Primary dealers explicitly noted a high degree of uncertainty overall...?

Now we know why the dealers were so nevous.

But this still wasn't the worst of it.

The worst part came in the form of a gigantic tail in the latest auction.

Remember, the tail is the difference between where bond yields trade pre-auction (when issued) versus at auction (i.e., expected price versus actual price).

These tails can sometimes be 2 or 3 basis points. Anything larger than that is an eye opener, and anything in the 4, 5, 6bp range is pretty much disastrous.

This auction's tail?

Five Point Three Basis Points.

5.3.

Holy Mother of God.

That is absolutely abysmal.

To put in context, this was the worst tailing auction that we have seen since 2011, when the S&P downgraded US credit rating from AAA to AA+.

My. Oh. My.

Suffice to say, that while this was not a failed auction, as that would mean a Bid to Cover ratio of less than the auction amount (i.e., less demand than the amount offered), it was breathtakingly bad and just short of catastrophic.

Hold on. Did you say Chinese malware?

A note. There have been rumblings and accusations in the media, suggesting that the less-than-stellar auction was a result of a malware attack on the Industrial and Commercial Bank of China (ICBC). One the largest banks in the world.

Apparently this attack forced ICBC to settle trades and transfers by USB sticks, physically running them back and forth from desk to desk and entity to entity.

Some are claiming that this disrupted participation in last week's Treasury auction, causingthe weakness.

I don't buy it.

First, the ICBC unit that deals with USTs only has ~$23B of assets, and so it is far too small to have had a material impact on the auction itself. There are thousands of participants in these auctions, and even if ICBC's bids were disrupted, they were likely nowhere near big enough to play a significant role last week.

And finally, when asked about the hack, Treasury Secretary Janet Yellen herself stated Friday that "we've not seen an impact on the Treasury market."

This may explain why Wall Street didn't buy it either, and the markets reacted so poorly to the auction.

How poorly?

😱 Market Reaction & Takeaways

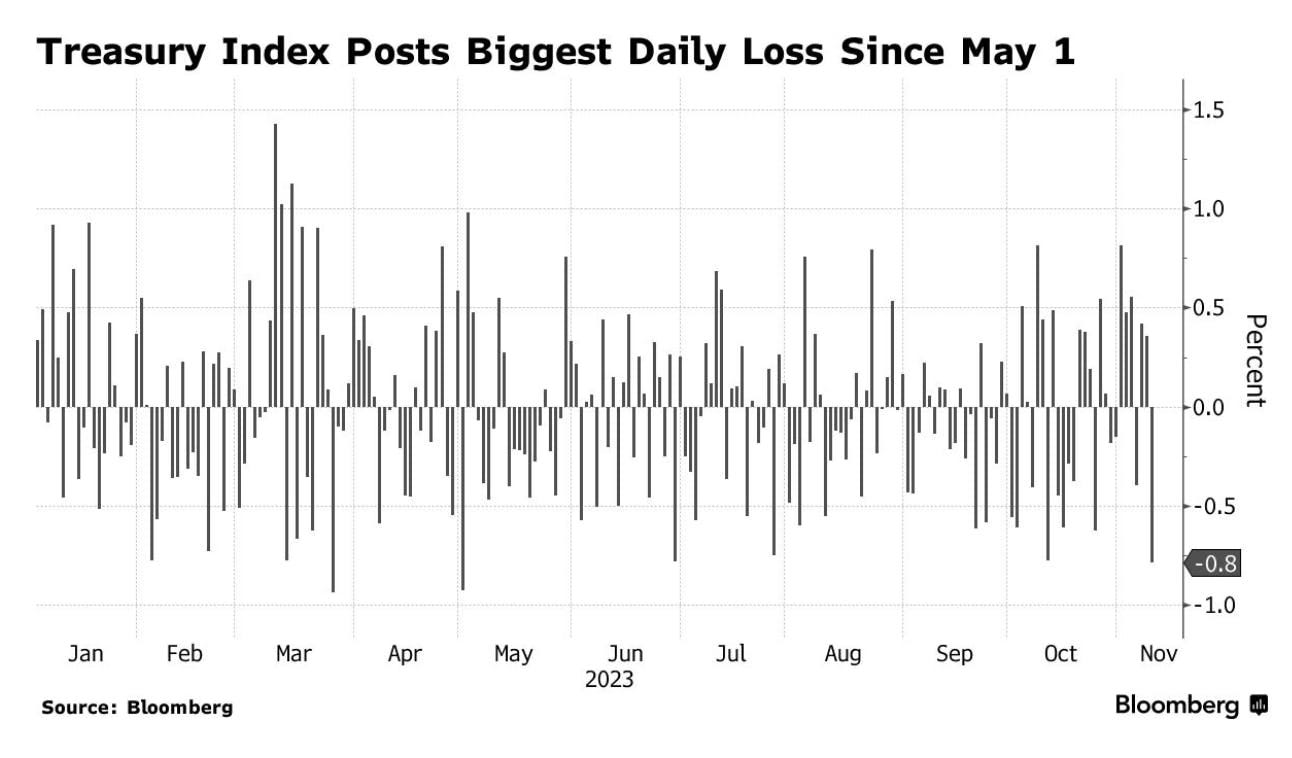

Let's put it this way, as results of the auction became public, the yields of the 30-year UST spiked from 4.62% to 4.82% in a matter of hours, most of that move coming in just a few minutes of trading.

That's a 4.3% move.

Let me remind you.

This is a US Treasury Bond.

The global reserve asset.

The (supposedly) most risk-free, most pure, most perfect security on the planet.

And on Thursday, it traded like a tech or meme stock.

Insanity.

Measuring price action across the entire spectrum of Treasuries was no better.

Double ouch.

A couple of other metrics we can look at are the MOVE and Bloomberg Treasury Bond Liquidity Indices. In both measures, higher numbers mean higher volatility, mean worsening market conditions.

Well. It seems we've slipped back to levels that we haven't seen since 2010 and the Great Financial Crisis.

Put simply, not good.

There's little doubt that investors are spooked from the terrible auction and wondering just how far out on the maturity curve they're willing to go to capture yield.

🤨 Fed vs. Treasury

So, what are the takeaways from all of this? What should we be thinking about, and how should we be positioning ourselves for the near and long-term future?

Takeaway one, I believe the Fed will have to tread lightly and not compete with Treasury in trying to execute any QT. Will they continue to allow bonds to to mature off their books? Likely.

But I cannot see them entering the market here to actively sell any Treasuries. They simply cannot compete with the Treasury for liquidity in the market.

Investors announced that loud and clear last week at that auction.

Second takeaway, I expect the Treasury to continue to lean hard on the short end of the curve, issuing as much short-term paper (T-Bills) as possible.

They will do this until the remainder of the Reverse Repo Facility is drained, as this money is eligible to buy T-Bills but not longer maturity bonds. And they have already tapped the RRF for a cool $1.4T.

Third takeaway is that I fully expect the Treasury to hustle and get that bond buyback program up and running ASAP. They will pick and choose certain bonds and maturities to buy from dealers and banks in order to ensure sufficient liquidity in the Treasury market.

Yeah, well, if you weren't issuing so many damned bonds, literally flooding the street with them, perhaps there wouldn't be such a growing liquidity problem in the first place.

I digress.

The point is, this is none other than a stealth form of QE or Quantitative Easing.

So, while the Fed is letting USTs roll off their books, the Treasury is out there buying bonds from banks.

Can you say banana republic?

Second digression, and back to center.

Possibly a final takeaway from all this is that the Treasury has really boxed the Fed into a tight little corner. Painted them right in there.

Because the Fed is now on a tightrope.

See, if the Fed signals pause or pivot, the equity markets run, and this exacerbates asset inflation, something they are desperate to avoid.

If the Fed signals or moves rates higher, well this then hurts USTs, exacerbates the borrowing problem, and Treasuries collapse under the weight of demand for term premium.

In fact, in a recent report by the Treasury Borrowing Advisory Committee, they found that structural demand for duration risk (holding longer term USTs) has decreased, and the rise in Treasury yields can be attributed to “term premium” rather than to expectations of higher future policy rates.

Ah, the Bond Vigilantes have ben recognized.

Remember:

higher UST rates → creates larger deficits → leads to more debt → then long duration yields spiking → even larger deficits → eventually a debt tsunami

The Fed simply cannot and will not win here.

I expect the Fed to walk the tightrope verbally and hold rates too high for just a little too long.

I expect the economy to continue to show signs of stress and slowdown.

And with the Fed holding rates too high for too long and the Treasury actively managing rates lower on the long end of the maturity curve, I expect the yield curve to fully un-invert in the next few months.

Longer maturities will fall below those of shorter maturities.

And so, counterintuitively, because of the nature of impact to the price of bonds, I am positioned to take advantage of this in my portfolios.

I am also positioned to benefit from a flight to hard assets and monies, like Bitcoin, gold and other anti-inflationary assets.

But this can all change in an instant.

And so I'm watching the temperature of the Treasury markets like a hawk.

Because right now, they are looking anything but healthy.

That said, I sleep well at night, knowing my portfolio is well diversified and I have a solid plan to keep my family's financial future secure. My sincere hope is that you do, too.

That’s it. I hope you feel a little bit smarter knowing about Treasuries and auctions and how they can impact your investing and portfolio.

If you enjoyed this newsletter and found it helpful, please share it with someone who you think will love it, too!

Talk soon,

James✌️