Let's Talk About GDP...

Issue XXV

✌️ Welcome to the latest issue of The Informationist, the newsletter that makes you smarter in just a few minutes each week.

🙌 The Informationist takes one current event or complicated concept and simplifies it for you in bullet points and easy to understand text.

🧠 Sound smart? Feed your brain with weekly issues sent directly to your inbox:

Today’s Bullets:

What is GDP?

How is it calculated?

How accurate is it?

Why is it so important?

Inspirational Tweet:

Sven here, the NorthmanTrader—an extraordinary resource for investment knowledge and macro-economic outlook—points out that, once again, the Fed has completely missed to target when estimating economic indicators. GDP is not only on target to fall short of the 4% estimate, but it is actually negative 2.5% through the first two quarters of 2022.

But what exactly does that mean, and why does it matter?

Let’s go ahead and peel that onion back, shall we?

💰 What is GDP?

First, GDP stands for Gross Domestic Product and is the total value of all goods and services produced by a country in a stated time period. Annual and quarterly GDP estimates are closely monitored by economists, investors, and central banks alike, and these serve as a primary indicator of a country’s economic health.

GDP can be calculated as nominal, a simple period to period percentage change, or real, where this change takes into account the rate of inflation. Real GDP is what I quoted above, and is the number that actually matters when determining any accurate measure of activity. Most importantly, how is it changing from period to period?

But how exactly is GDP calculated, and why is it so important?

🔢 How is it calculated?

Most nations publish GDP figures monthly and quarterly, and in the U.S., the Bureau of Economic Analysis (BEA) publishes preliminary quarterly GDP four weeks after each quarter ends, and a final release three months after the quarter ends.

GDP can be calculated in three different ways, each of which should…theoretically…produce the same result:

the expenditure (or spending) approach,

the production (or output) approach,

and the income approach.

Expenditure Approach

The expenditure (spending) approach, calculates spending by the three main groups that make up an economy: consumers, government, and business. It then nets out imports from exports and adds this to the number, giving us the formula:

GDP = C + G + I + NX

Where

C = consumer activity

G = government spending

I = business investment

NX = net exports

To give you an idea what may actually go into this equation, C (consumer activity) can include anything from buying groceries to car washes, and this accounts for about two-thirds of US GDP.

G (government spending) can include anything from infrastructure, like roads and bridges, to tanks to Congress’s (and any other government entity) payroll.

I (business investment) encompasses private sector expenses for business activity, like machinery and salaries of employees.

NX (net exports) subtracts total exports from total imports (NX = Exports - Imports). This means all goods and services that a country makes which are exported to other countries, minus all of the imports that are purchased by domestic consumers.

Production Approach

The production (output) approach is basically the reverse of the expenditure (spending) approach in that it takes the total value of economic output and then deducts the cost of intermediate goods that are used in the process (e.g.,materials and services). So, as the expenditure approach projects forward from costs, the production approach looks backward from completed economic activity.

Gross Output = Total Value of Output – Value of Intermediate Consumption

Income Approach

Less practical but considered more accurate, the income approach calculates the income earned by all aspects of an economy, including the wages paid to workers, rent earned on land, interest earnings, and corporate profits. Additional accuracy comes from adjustments for items otherwise not considered in production, i.e., taxes and depreciation. All of this added together constitutes a country’s income.

The income approach is often calculated alongside the expenditure approach as a checks and balance and measure of accuracy.

Speaking of accuracy, how close is the GDP calculation to the true output of a country?

🧐 How accurate is it?

As complicated as it can be for major countries and complex economies, GDP calculations, in theory, should be an accurate representation of a nation’s economic activity. That said, the estimates published are often significantly revised once the final calculations are available.

Why is this?

A few primary reasons: compiling complex and extensive data quickly will increase the likelihood of mistakes, and the data itself is often partial or projected based on trends. As more data becomes available, more revisions are likely to occur. Also, the offices compiling the statistics continually review and revise their methodology in order to take into account new sources or concepts.

All this added together can produce massive adjustments to the final numbers and make the initial estimates all but unusable. And this is for well funded and developed economies, like the US. Many smaller countries have underfunded statistics offices, and some smaller nations have significant economic activity that goes completely unrecorded, in the form of underground economies.

In any case, if the only GDP number that really matters is the final one, and that’s numerous months old by the time it is published, why do we care so much about GDP anyway?

🏛 Why is it so important?

First, and foremost, with the monetary system as is, central bankers rely on a number of economic indicators to make major policy decisions which can affect virtually every single person living and operating within that economy.

Timely or not, GDP is a critical key indicator for the Fed and central bankers. Also, companies rely on many of the same indicators to decide on hiring and investment for their businesses. Consumers look at GDP and inflation measures and their confidence levels affect their spending, which then affects those same numbers.

An economic feedback loop.

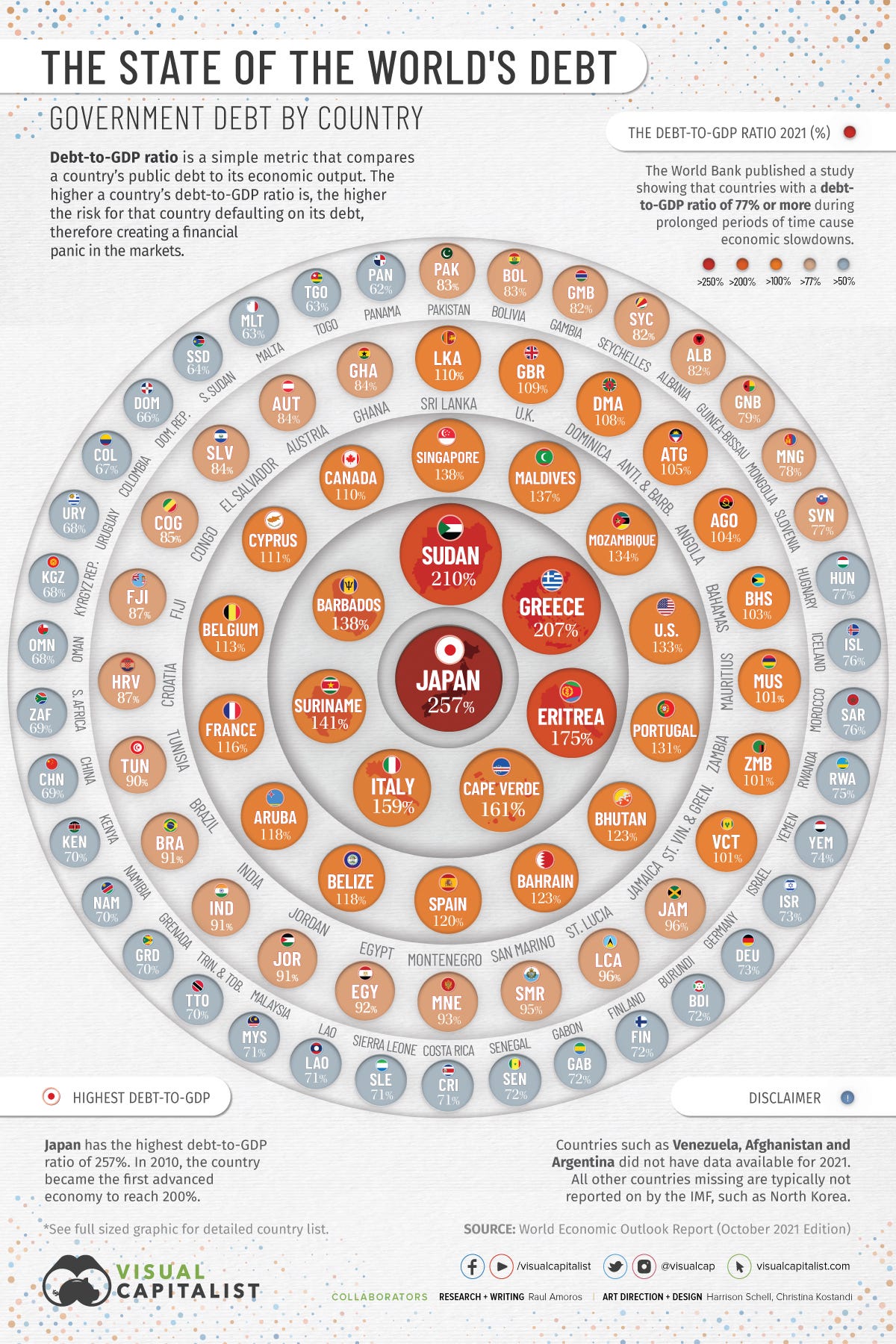

And finally, investors look at GDP numbers to determine whether they should buy a nation’s sovereign debt. If a nation has a high debt to GDP ratio, this could indicate a looming debt crisis for them. Remember, GDP is basically a nation’s revenue.

If a nation has too much debt, like Japan, Greece, and Sudan in the above graphic, their growth in revenue may not be able to keep up with their ballooning debt. At some point, global confidence in that country falls enough, it becomes harder and more expensive to borrow money (issue more debt), payments are missed on outstanding debt, the currency devalues, and a debt spiral begins.

The country goes into credit crisis: it defaults on its bonds, the currency collapses, and the economy is destroyed.

So, as imperfect as it is, GDP is an incredibly important measure of health of any nation or economy. Unpacking the underlying data and causes for any movement or changes can give governments, their agencies, companies, and investors the clues they need to make decisions that will ultimately affect the forward economy greatly.

That’s it. I hope you feel a little bit smarter knowing about GDP, the methodologies used to calculate it, and its importance as an indicator of health of a nation’s economy.

Before leaving, feel free to respond to this newsletter with questions or future topics of interest. And if you want daily financial insights and commentary, you can always find me on Twitter!

✌️Talk soon,

James